An economics, investment, trading and policy blog with a focus on Modern Monetary Theory (MMT). We seek the truth, avoid the mainstream and are virulently anti-neoliberalism.

Pages

▼

Pages

▼

Monday, October 31, 2011

Here we go again. Corzine blows up MF Global and walks away with $12 million

How many times do we have to see another sickening replay of this all-too-pervasive Wall Street scam?

Jon Corzine, "Master of the Universe," former NJ Governor and before that, Co-Chair of Goldman Sachs, puts MF Global into bankruptcy becuase of one, highly risky, bet-the-farm trade that he should have known wouldn't work.

Now there will be thousands out of work and what happens to him? He walks away with a $12 million "golden parachute."

And people wonder why the Occupy Wall Street protesters are upset? Seriously??

Read here.

Saturday, October 29, 2011

ABSURD: EFSF Considers Issuing CNY-Denominated Bonds

Just copied the headline (couldn't improve on it) from Business Insider here.

This just gets harder to understand. The European policy leaders are apparently investigating a course of establishing liabilities in the Chinese currency instead of their own currency.

Friday, October 28, 2011

S&P puts its stupidity on display once again

Over the past few years we've seen numerous examples of S&P stupidity, from the toxic assets rated AAA (although that might have just plain, fraud not stupidity) to the downgrade of the US credit rating even though there is ZERO risk of a US default because it's a currency issuer, to this...a statement by S&P on Europe's EFSF fund:

| ""In our opinion, there is an "almost certain" likelihood that the EFSF's 'AAA' rated member governments would provide timely and sufficient extraordinary support to the EFSF if needed." |

And who might that support come from? France? Germany? Those nations are all credit sensitive themselves and are, therefore, constrained due to the fact that none of them are currency issuers.

By establishing the EFSF as the mechanism by which the situation gets "resolved" and precluding ECB support, they have all gone into "Ponzi," a fact you'd think S&P would recognize. But then again, S&P doesn't think it just issues proclamations based on ignorance.

Personal savings fall 32% since June as a consequence of the debt ceiling debacle

The personal savings rate fell to the lowest level in four years and it's no surprise why: gov't spending fell off sharply during the whole debt ceiling debacle. Since gov't deficits add to private sector income and savings, then savings will understandably fall as the deficit shrinks. If savings get low enough, it could cause a very sharp economic downturn as households reduce consumption in order to raise their savings. At the economy's peak in 2007, the savings rate hit 1.7%.

Thursday, October 27, 2011

Monetarists Surface at the Vatican

Is no place sacred from Monetarist dogma? Short article from Reuters via CNBC here.

The Vatican Department of Justice and Peace released a report this week that weighs in on some the issues around the recent and current global economic crises, and what this body believes is a current institutional and political structure that is inadequate to deal effectively and fairly with them.

It said the International Monetary Fund (IMF) no longer had the power or ability to stabilize world finance by regulating overall money supply and it was no longer able to watch "over the amount of credit risk taken on by the system."Ignoring what I believe to be an error in their ideas about what the purpose of the IMF is; here it is revealed that monetarist dogma has indeed infiltrated the Vatican.

The article generally indicates that at least this body within the Vatican advocates for more globalization and global coordination of world finance; establishment of a "supranational authority"; but yet credits this body with the following position:

It condemned what it called "the idolatry of the market" as well as a "neo-liberal thinking" that it said looked exclusively at technical solutions to economic problems.

Perhaps something is being lost in the translation from Reuters here. But if I take the article at face value, I can't help but think that these policy analysts at the Vatican are in way over their heads on these issues about global macro economics and how they relate to 'justice and peace'.

BEA Advance GDP for 3rd Qtr + 2.5%

BEA with an advance GDP this morning, link here.

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.5 percent in the third quarter of 2011, (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 1.3 percent.

Wednesday, October 26, 2011

When it comes to economic policy the Democrats are their own worst enemy

I wish someone of influence within the Democratic Party would learn some MMT. Unless that happens, their economic ideas are doomed.

Here's an example of the proposed "stimulus" being put forth by Democratic members of the Supercommittee:

| Supercommittee Dems push for stimulus to be part of deficit deal By Erik Wasson - 10/26/11 11:49 AM ET Democrats on the congressional supercommittee this week presented Republicans with a plan to cut the deficit that included billions of dollars in stimulus spending, aides told The Hill. In a private session of the deficit panel on Tuesday, Sen. Max Baucus (D-Mont.), chairman of the Senate Finance Committee, proposed trillions of dollars in tax increases that would partially cover stimulus spending for the economy, aides said. |

The tax hike thing is just not going to pass. They should stop, already.

Or, they should call it what it really is: income redistribution. They should just come right out and say, "We want to redistribute income. That is our plan."

But for heavens sake, stop calling it a stimulus.

The don't do this because they are ignorant about how our monetary system functions. So are the Republicans, by the way, but at least the Republicans don't lie about their intentions. They pretty much come right out and say they want to give everything to the rich because the rich are "the job creators." We know that's a bunch of BS, but it's a sound bite that they've managed to make work.

This thing will never work. You have one party that is openly and unabashedly creating a policy conduit by which all of the nation's wealth is funneled up to an elite class of plutocrats, and then you have the bumbling Democrats who talk of "fairness" and greater equality, but then act like we've but a few crumbs left and we must struggle and strive and sacrifice in order to find a better way to divy those crumbs up among the citizenry.

It's truly pathetic. Both parties are to blame, but mostly I blame the Democrats. The party's leadership and its "intellectuals" are a bunch of snobby elitists who went to places like Harvard, Yale and Princeton who'll fight you tooth and nail so that that their misguided dogma rules the way they think and act.

It's hopeless.

Obama sending US troops to Uganda now!

No joke. Here's the story:

| "US President Barack Obama has said he is sending about 100 US soldiers to Uganda to help regional forces battle the notorious Lord's Resistance Army." Read article here. |

I guess that's why defense spending has stopped going down. That's one way to keep aggregate demand and income supported.

Record inventory level suggests recession risk is high

From today's Commerce Department release on durable goods orders:

| "Inventories of manufactured durable goods in September, up twenty one consecutive months, increased $0.4 billion or 0.1 percent to $365.6 billion. This was at the highest level since the series was first published on a NAICS basis in 1992 and followed a 0.9 percent August increase." |

And here's how it looks:

The police state is here! Law enforcement now the "hired guns" of the plutocrats

You can see here police in Oakland using tear gas, shock grenades and other heavy handed tactics to break up the Occupy Oakland demonstration. Once again, peaceful demonstrators exercising their Constitutional right are beat down by the police state. Who are the police protecting? Property's is not being damaged or destroyed, no one is being threatened, so we can only assume conclude that law enforcement in the US has becomme the "hired gun" of the plutocracy. Democracy itself is threatened.

Ciao Italia!

The focus of the current European economic debacle seems to be starting to shift from Greece to Italy. Today is also supposed to be a big day for policy as far as today is a "deadline" for the European leaders to come up with some sort of longer term solution to their current problems with getting sovereign debt issued at reasonable interest rates. (TIP: They won't)

So apparently, even though the incoming ECB President is himself an Italian, he is just as ready to advocate a hard line on austerity for Italy as any other ECB moron that could have taken over the ECB Presidency.

Arrivederci !

Here is an article that provides an overview of the current situation at the ECB and Italy.

Incoming European Central Bank President Mario Draghi called for “immediate implementation” of the euro area’s rescue fund, warning that it’s up to nations to ultimately solve the sovereign-debt crisis. (Ed: True enough!)

Bank of Italy Governor Draghi, who takes over as ECB President on Nov. 1, also said that he sees “significant” downside risks to economic growth in the euro region as industrial output expands at a “very moderate pace.”

Draghi also called on Italian Prime Minister Silvio Berlusconi’s government to immediately implement austerity measures and carry out a planned review of public spending.

So apparently, even though the incoming ECB President is himself an Italian, he is just as ready to advocate a hard line on austerity for Italy as any other ECB moron that could have taken over the ECB Presidency.

Italy is looking like the next domino to fall in this European fiscal fiasco that Warren Mosler opined this week may ultimately ripple through Europe and ironically lead straight on ultimately to the mother country of all austerity advocacy, Germany, as in reality, none of the Countries in the EMU (including Germany) are currency issuers; they have all surrendered their monetary authority to the EU/ECB; which is sadly infested with persons who advocate for smaller fiscal deficits.

Tuesday, October 25, 2011

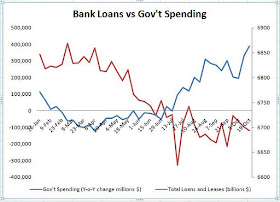

Bank loans surge as government spending slows

Followers of MMT understand that government deficits add to non-government (private sector) income and savings. That means high and rising deficits tends to cool credit demand because private sector balance sheets are getting healthier.

On the other hand, a slowdown in deficit spending tends to do the opposite: it DRAINS income and savings thus causing credit demand to rise in order to compensate for that loss in income and savings.

The chart below is quite eye-opening. It shows a very strong correlation between government spending and private credit creation. Bank loans have begun to grow since the slowdown in net government spending that started back in March-April of this year. And when net government spending went negative year-over-year in July, bank lending absolutely took off.

The private sector is now tapping credit as the government begins to step out of the economy. Unfortunately, this will not be a repeat of 2004 - 2007, where we had a credit boom, because credit conditions are, generally, much tighter now. And with unemployment high, the ability to get credit and service that credit is poor, so this credit cycle can collapse very quickly.

Monday, October 24, 2011

Time to re-read the Declaration of Independence and recall its noble ideals

Time to revisit the Declaration of Independence:

| We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.--That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, --That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness. Prudence, indeed, will dictate that Governments long established should not be changed for light and transient causes; and accordingly all experience hath shewn, that mankind are more disposed to suffer, while evils are sufferable, than to right themselves by abolishing the forms to which they are accustomed. But when a long train of abuses and usurpations, pursuing invariably the same Object evinces a design to reduce them under absolute Despotism, it is their right, it is their duty, to throw off such Government, and to provide new Guards for their future security. |

These ideals have been forgotten.

Economic rent and rent-seeking

Have you ever heard of the term “economic rent”? No? That’s probably because of the greatest political coup in the history of our republic. In politics, true power comes – not from your argument – but from the ability to steer the conversation to what you want to talk about and away from what you don’t want to talk about. The true elites in our society have continued “winning” the political debate by removing a very important concept from the political conversation.I admit, reading the term, “economic rent” can cause eyes to glaze over quickly. A more accurate description is “unearned income”. It is people and companies who make money by doing zero work and risk little or none of their own assets....

Read the rest at Daily Kos, Time to resurrect an old idea: Economic Rent by Madddog

Looks like Maddog has been reading Henry George and Michael Hudson. Judging from the comments, he's gotten some progressives fired up about it.

Update: see also Simon Patten on Public Infrastructure and Economic Rent Capture by Michael Hudson

(h/t GLH in comments)

Warren Mosler in Zuccotti Park on Saturday

Warren Mosler, one of the founders of MMT, will be in Zuccotti Park, NYC, on Saturday, Oct 29 at 1pm. He'll be at the Northeast corner of the park. Anyone who wants to drop by is welcome.

Vacation Time

I'm getting ready to go on vacation for about two weeks, so my posting will be intermittent for a while.

Tom

Ray Dalio making same mistake as Bill Gross?

CHARLIE ROSE: --So you have the same opinion that Standard & Poor`s had when they reduced --RAY DALIO: Essentially.CHARLIE ROSE: -- America`s credit rating.RAY DALIO: Essentially. So I think -- and by the way I think it`s very important to understand that the government debt is the terrible challenging issue that we should talk about maybe but also more important is the private sector debt. So that resolving the public sector debt does not resolve the problem.That individuals face the same problem meaning that they`re overly indebted and because they`re overly indebted and spend a lot of their consumption through borrowing and they had a -- it was like if you borrow you have a party and everything`s good and you have a prosperity and you -- you have your party, you hire the caterers, they`re employed and everybody`s happy.So that there`s a private sector debt issue at the same time as the public sector debt. They`re both. So if you resolve the budget deficit, you do not resolve the private sector debt issue. Both of those things mean we`re both overly indebted. We cannot -- the amount that we owe and have promised in its various forms can`t be paid.

Video and transcript at Zero Hedge, Dalio: "There Are No More Tools In The Tool Kit" - Complete Charlie Rose Transcript With The Head Of The World's Biggest Hedge Fund

Sunday, October 23, 2011

David Graeber explains Occupy Wall Street

Yves Smith put this up at Naked Capitalism a couple of days ago. If you didn't see it or forgot to get to it (as I did until now), here it is.

EU leaders agree to revise treaty

European Union leaders have agreed to change the bloc's treaty if necessary in the interests of economic convergence and discipline, Herman Van Rompuy, the EU president, has said.Speaking after EU leaders held crunch talks in Brussels to nail down a solution to the worst economic crisis in its history, Van Rompuy said: "We decided to explore the possibility of limited treaty change."The aim is deepening our economic convergence and strengthening economic discipline. Limited means not a general overhaul of the institutional architecture."We also said that we would need the agreement of all the 27 [member states] before we can decide on a treaty change."The most important thing is not to change the treaty, the most important thing is to strengthen economic convergence."

EU ready to revise treaty to stem euro crisis at Al Jazeera

No indication that they actually get it yet though.

French President Nicolas Sarkozy backed down on Sunday in the face of implacable German opposition to demands to use unlimited European Central Bank (ECB) funds to fight the eurozone's deepening crisis.

Tim Duy on a double-dip

A major credit event in Europe looks inevitable. Would a European meltdown endanger the US recovery? We are looking at two channels, trade and financial. I tend to discount the trade channel. As a general rule, I think the propagation of such shocks is too weak to alter the fundamental cyclical forces underlying the US economy. The potential for financial shocks, however, keeps me up at night - this is the key to the US recession story. There is a nontrivial chance that credit event in Europe triggers a credit event in the US.

Read the whole post, On That Double-Dip at Tim Duy's Fed Watch

This has been my thinking for some time. Real economy is recovering — very slowly, but the financial system is still badly impaired. Any significant shock can tip things over the cliff, and the deteriorating situation in Euroland looks like another Credit Anstalt moment just waiting to happen. My money is on another shock, followed by the second leg down in Great Depression II. The crisis in Euroland could provoke it, but there are a number of other things hanging by a thread ready to break, too.

Steve Keen on Occupy Wall Street in the Land of Oz

I was disgusted to learn this morning that Sydney had joined Melbourne in being one of the very few cities around the world to evict the Occupy protesters. I’m glad at least that I got a chance to speak at yesterday’s rally, before the police action at 5am this morning.

Read the rest at Steve Keen's DebtWatch, Australia: beautiful one day, police state the next

Occupy Sydney rally, including Steve's talk

Air car is not all hot air — Tata to release in '12

Tata Motors Mini CAT Air Car to debut in 2012 by Brett Davis at Car Advice

Tata says the Air Car stores enough compressed air to offer around 300km worth of motoring. Users will then be able to re-gas the car at certain filling stations that are equipped with special tanks of compressed air, in around three to four minutes for around $2. It will also come with its own generator pack which can be used at home capable of re-gassing the tanks in around four hours.... Tata is aiming to release the Mini CAT Air Car in India next year with prices starting at around $12,700.

(h/t Yves Smith at Naked Capitalism)

Telegraph — Move it or get off the pot

With Europe on the brink of a disaster, the euro must be reconstituted as an entity based on economic reality, not ideological folly.****The detail of the disputes over bank bail-outs and the scale of the European rescue fund is tortuous and convoluted. But the underlying problem is simple enough. Europe’s political elites know that for the euro to survive in its present form, it must move – with speed – towards full fiscal and political integration. Yet national leaders, and the voters they answer to, are as yet unwilling to accept the loss of sovereignty, and indeed the shared liabilities, that such a revolution demands.****The question now is how best to minimise the damage, so that the single currency does not take the world economy down with it – and reconstitute the euro as an entity based on economic reality, not ideological folly.

Read the whole editorial at The Telegraph, The single currency is close to collapse

See also, Most Greek bailout money has gone to pay off bondholders by Howard Schneider at The Washington Post.

More than half of the money lent to Greece so far by the International Monetary Fund and European nations has gone to repay bondholders, a transfer of billions of dollars from taxpayers around the world to European banks and pension funds that invested in the troubled Mediterranean nation.

(h/t Edward Harrison at Credit Writedowns)

Four Things Occupy Wall Street Should Know About the Federal Reserve

There are many legitimate reasons to critique the Fed, but the “End the Fed” movement isn’t interested in reform.1. “Ending the Fed” is a Terrible Idea2. The Gold Standard is an Awful Idea3. The Good and Bad of Modest Inflation4. Don’t End the Fed, Make it Accountable to the Needs of the 99 Percent

Read the whole post at AlterNet, Four Things Occupy Wall Street Should Know About the Federal Reserve by Jake Blumgart

A bit of out of paradigm but generally on the right track.

Video: Buffalo Exhibit More Righteousness than Human Economic Policy Leaders

This video has been out there for a few years and perhaps many here have already seen it. But to follow up on my recent post of an article that compared the popular interpretation of Adam Smith's economic concept of "The Invisible Hand" and naturalist Charles Darwin's "Natural Selection", here is a moving YouTube video documenting the mature leadership within a herd of African Buffalo coming to the aid and assistance of a youngster that has at first, apparently happened into it's destruction via the jaws of a group of four footed predators and giant reptiles.

After the initial surprise ambush and attack, the buffalo leadership quickly re-groups the herd and goes back in to "kick ass" (literally!). The buffalo, at somewhat risk to their own individual safety, work to separate their youth from the predators and then shepherd the calf back into the safety of the center of the herd.

'Survival of the fittest'? or righteous leadership facilitating successful group coordination to preserve a disadvantaged fellow member of their species?

Saturday, October 22, 2011

Stimulus Money Used to Employ Foreign Guest Workers

Congressman Peter DeFazio smelled a rat and boy did he find one. A host of Oregon forest thinning and clearing jobs, created by the American Recovery Act and funded by taxpayer dollars, went to foreigners, brought over on H-2B guest worker visas, instead of unemployed Americans. DeFazio fought and obtained funding for those forest projects and jobs in the 2009 Stimulus bill. DeFazio assumed with so many unemployed and desperate U.S. Citizens in his state, of course those jobs would go to them. He was wrong.

A local newspaper in Bend Oregon, actually did their job and started investigating how forest thinning work was going to foreigners instead of unemployed loggers in the area. Defazio read the newspaper.

In 2010, the Forest Service awarded Stimulus Recovery Act contracts to four employers totaling$7,140,782 for forestry work in Oregon. These four employers in turn hired 254 foreign guest workers. This is when unemployment in Oregon was hitting 15% in rural areas and loggers were hard hit.

Believe this or not, even with taxpayer dollars, supposedly to create jobs, employers are not required to recruit U.S. workers. That's right, you can be unemployed, pay taxes which in turn import foreign workers and deny Americans employment. Below is a local KATU news segment where one logger tells KATU the real unemployment rate in forestry work was over 40%.

Read the rest: Stimulus Money Used to Employ Foreign Guest Workers Instead of Americans at Economic Populist.

This is a real blood boiler.

Effect of policy uncertainty

Policymakers’ choices dominate headlines in the global crisis. This column distinguishes between economic uncertainty and economic policy uncertainty, constructs an index to measure policy-related uncertainty, and argues that improving policy uncertainty would create millions of US jobs.

Policy uncertainty and the stalled recovery by Scott Baker, Nicholas Bloom, and Steven J. Davis at vox.eu

Interesting post on political divisiveness in the US being a contributing cause of the economic uncertainty that is creating a drag on the economy by increasing propensity to save rather than consume or invest.

Rick Bookstaber on Occupy Wall Street, Social Unrest, and Income Inequality

We are seeing the specter of instability in the growing protests of income inequality, economic distress of the middle class, and economic and political power of the very wealthy. There is Occupy Wall Street in the U.S., and similar protests ranging across the globe. In parts of Europe there is rioting in the streets, in parts of China protests have turned deadly.

Rick Bookstaber on Occupy Wall Street, Social Unrest, and Income Inequality

If you are not familiar with him, Rick Bookstaber is a very intelligent and erudite person with an extremely impressive background in both finance and marital arts (Brazilian (Gracie) Jiu Jitsu). He blogs somewhat occasionally at RickBookstaber.com.

Edward Harrison on government, regulation and free markets

I want to talk about why people blame government for the state of the economy more than Wall Street and what I think the remedies are. This will be a long post. So feel free to bookmark it to read it and the links when you have a moment.

On government, regulation, over-regulation and free markets by Edward Harrison at Credit Writedowns.

A sociologist looks at Occupy Wall Street in light of past social protests

Matt Bieber interviews sociologist Todd Gitlin about Occupy Wall Street in comparison with previous social movement in the US.

Todd Gitlin is a professor of journalism and sociology and chair of the Ph. D. program in Communications at Columbia University. In 1963-64, Gitlin served as the third president of Students for a Democratic Society. Later, he helped organize the first national demonstration against the Vietnam War and the first American demonstrations against corporate aid to the apartheid regime in South Africa. Gitlin is the author of fourteen books and has written for a wide range of periodicals.

Matt Bieber studies politics, religion, and public discourse at Harvard's Kennedy and Divinity schools.

(h/t Truthdig)

Rob Parenteau — Failure of "expansionary fiscal consolidation" admitted

Short and to the point. MMT economists got this right as their warning boing back several years go to show.

Leaked Greek bailout document: Expansionary fiscal consolidation has failed by Rob Parenteau at Credit Writedowns.

(h/t Edward Harrison at Credit Writedowns)

Friday, October 21, 2011

What if we paid off the national debt?

NPR releases secret report prepared during the Clinton administration about paying off the national debt with the surplus it had accumulated.

Nixed. Why? They concluded that too little debt was a problem.

Full report in PDF, Life After Debt

What If We Paid Off The Debt? The Secret Government Report (with audio) by by David Kestenbaum at NPR

The US only paid down the national debt once, under President Andrew Jackson. It was followed by a depression.

See also L. Randall Wray, The Federal Budget is NOT like a Household Budget – Here’s Why

Bruce Judson asks who the real capitalists are

You are a visitor from a foreign country or an alien world with no knowledge of Wall Street or capitalism. Then the principles of capitalism are explained to you and you are asked to identify the capitalists in this confrontation: the people in the buildings or the people congregating on the street. Which would you choose?

Read the whole post, The Kids Camping on Wall Street Are The Capitalists, Not the People in the Buildings, by Bruce Judson at New Deal 2.0

Bruce Judson is Entrepreneur-in-Residence at the Yale Entrepreneurial Institute and a former Senior Faculty Fellow at the Yale School of Management.

Charles Darwin the Economist

Article at LA Times by Robert H Frank here. Excerpt: Frank is perhaps implying that he believes that to Adam Smith, in reality it was often "form over substance" in the "free markets". It is an interesting short article that also touches on the tug of war between individual and group interests that we have discussed before here at MNE.

With good reason, most contemporary economists regard Adam Smith as the founder of their discipline. But I would instead accord that honor to Charles Darwin, the pioneering naturalist.....

Smith did not claim that markets always channel greed in socially productive ways. For him, the remarkable thing was that they often appeared to. Although his account of how that happens lacks the generality that many of his most enthusiastic modern disciples ascribe to it...

Investigative report exposes the deficit hawks

Groups like the CRFB and the Concord Coalition, founded by former Congress members in the 1980s and ’90s, have long presented themselves as nonpartisan, penny-pinching critics of wasteful government spending, when really they are anti-government, pro-corporate ideologues whose boards are filled with K Street lobbyists and financial executives. The goal of much of the austerity class is to see government funds redirected to the private sector. (Their ideology, which accepts the accumulation of private debt but opposes government debt, explains why the austerity class ignored the massive housing and credit bubble, which more than any single factor contributed to an explosion of debt worldwide.)(emphasis added)

Read the whole article How the Austerity Class Rules Washington by Ari Berman at The Nation

It's the economic rent, stupid.

Berman has a one-two punch in this issue. See also Occupy Wall Street Hits K Street by Ari Berman at The Nation

If you want to understand how the top 1 percent have accumulated such power in American politics, look no further than Washington’s K Street lobbying corridor. Wall Street has long been the dominant player in the capital. “The banks,” Senator Dick Durbin said in 2009, “are still the most powerful lobby on Capitol Hill. And they frankly own the place.”The financial sector has spent more money on campaign contributions and lobbying than any other sector of the economy—$4.6 billion on lobbying since 1998, according to Open Secrets. This year, commercial banks andsecurities and investment firms have spent over $82 million on lobbying, employing over 1,000 lobbyists.Given these facts, it makes sense that the Occupy Wall Street movement has spread to K Street. Since October 1, demonstrators have gathered in MacPherson Square, their numbers and visibility growing in recent days....

A lot of this post is about Harvard professor Larry Lessig, "one of the pre-eminent advocates of true campaign finance reform."

“Forget the 99 percent,” Lessig said yesterday. “We are the 99.95 percent of people who have never maxed out in a Congressional election campaign by giving the maximum amount. It is .05 percent of America who have given $2500 in the last election to a Congressional candidate, .05 percent, and Congress listens to them.”

Replay of Chicago 1968 brewing?

This doesn't just border on the absurd; it dashes across the line.

It's happening in Oz, too. Melbourne police pile on.

This is really coming across as the public security forces being used as a front for the bankers. I don't know what the authorities ordering this are thinking, but if they think that are going to make this just go away, they are going to be disappointed. Using state violence to suppress dissent just acts against their interests, as escalating events around the world are proving.

If this is their attempt to inspire "confidence," they are doing just the opposite.

Thursday, October 20, 2011

Nice MMT-related post

Warren Mosler calls attention to The Problem With The Deficit? It’s Not Big Enough by Ben Strubel as a "well stated MMT based narrative." If you didn't catch it already at Warren's here, definitely take a look at it. MMT is getting out there.

Sen. Bernie Sanders names MMT advisers

Bill Black, James K. Galbraith, and Stephanie Kelton — three in a group of ten, with several others having exposure to MMT. Not bad.

(h/t Warren Mosler)

Digital Revolution—Smartphones and tablet computers drive online commerce

Online auction and financial transactions powerhouse eBay said Wednesday that profit in the recently ended quarter climbed as commerce shifts to smartphones and tablet computers.The Silicon Valley company reported that its net income in the quarter ending September 30 rose to $490.5 million as revenue leapt 32 percent to $3 billion.“Our company reported another strong quarter, with eBay, PayPal and GSI each performing well,” said eBay chief executive John Donahoe.“Mobile commerce continues to accelerate as consumers change the way they shop and pay.”

Agence France-Presse via Raw Story reports eBay profit rises as shoppers turn to smartphones

Digital gaining ground.

WTF — Louisiana bans using cash in sales of second-hand goods

In a new law that could put every trading post, Goodwill, flea market, garage sale and Craigslist merchant in the state of Louisiana out of business, a bipartisan group of elected representatives has opted to ban all cash payments for the buying and selling of used goods.Though House Bill 195 was intended to make it easier to track the sales of stolen goods by giving police a paper trail to follow, the unintended consequences could be much more widespread. Namely, the law requires second-hand sales be made paid for with credit cards, paper checks, electronic transfer or money orders. Cash is prohibited.It was signed into law on July 1, but flew so far under the radar that practically nobody in the media noticed until this week, when Louisiana’s KLFY Eyewitness News 10 put a spotlight on the new rules and their likely impacts on local business.The law also requires second-hand sellers to obtain personal information about each buyer — information like names, addresses, driver’s license number and even, if applicable, their license plate number — and turn it over to state officials.

Read the full post (text of law also available) at Raw Story, Louisiana bans using cash in sales of second-hand goods

A friend of mine asked me about this this yesterday and I dismissed it as a ridiculous conspiracy theory. I was wrong apparently. Unbelievable!

Simon Johnson blames Wall Street on The Rachel Maddow Show

Visit msnbc.com for breaking news, world news, and news about the economy

Related: Patrick Bryne, CEO of Overstock.com, a Libertarian, talks to Cenk Ugyar at Current TV (video). He agrees that Wall Street's capture of government is the problem, not capitalism, and he supports the message that Occupy Wall Street is sending about this.

Smackdown—Bill Mitchell responds to criticism of MMT use of sectoral balance approach

From the comments at billy blog on You do not increase spending by cutting it

Bill,I’ve been following your blog, and MMT, for a little while now, and it’s fascinating stuff. I’m fairly green when it comes to economics, I’m ill-equipped to judge whether critiques of MMT are well-founded. I ran across the following critique of MMT (and you specifically) from a comment on your recent Harvard article.The website at which this criticism (and others) can be found is:http://www.zerohedge.com/contributed/mmt-and-munis.The (incredibly rude) criticism, as posted by Dan Duncan, is as follows:“Billy Mitchell…derives his justification from ‘The Fiscal Accounting Equation’. In this equation, he matches up ‘Sources of GDP’ = ‘Uses of GDP’. From there, he employs simple algebraic maniuplations to arrive at his ultimate conclusions…and the Holy Grail of MMT: http://moslereconomics.com/2010/04/30/tea-party-protest-sign/The only problem, of course, is that Billy Mitchell doesn’t understand simple math (or logic).The issue is not that Sources of GDP = Uses of GDP. Rather, it’s that Sources of GDP cause (or allow for) Uses of GDP. Once this is understood, his pathetic algebraic manipulations descend into a nightmare of recursive circular reference.Yes, once the books are closed, then Sources=Uses. But at this point, all you accomplish by moving the terms around is to make a statement about what already happened….You cannot, however, move the terms around to affect policy. It’s too late for that.Think of it this way: You own a business and run a household. Sales – CGS —>Mtg pymt+Groceries+Savings. Yes, at the end of the year, the LHS will = the RHS. But this does not mean we can move Savings over to the LHS of the equation and Sales over to the RHS. The Savings aspect was determined–in part–by Sales. We need to close the books, see what Sales actually were before we really know what the Savings were. Until the books are closed, Savings is really in a Schrodinger state of superposition.If a+b causes x+y, you cannot just move the terms around. It’s not that simple. Yet, this is exactly what Billy Mitchell and the other MMT Morons do, when they attempt to justify this abomination.Look at the Billy Mitchell explanation. I’m not making any of this up. It really is quite astonishing that MMT is taken seriously.”Dear Brian (at 2011/10/20 at 2:05)This person (Dan Duncan) clearly hasn’t read any of my work which repeatedly says that the sectoral balances of the National Accounts have to hold at each point in time (being relationships between flows) and it is national income movements which ensure that. The interesting thing is then what drives these national income movements and whether government action (discretionary) can influence the non-government aggregates.We know that non-government action influences the budget balance (via the automatic stabilisers). MMT also considers that government spending and taxation influences aggregate demand and hence aggregate output which influences private saving, imports and through accelerator effects private investment.http://bilbo.economicoutlook.net/blog/wp-admin/edit-comments.php#comments-formI don’t think the critic has read any of that work otherwise he wouldn’t take that angle of attack. We (myself or my other MMT Morons) clearly understand that behaviour has to drive the accounting. The sectoral balances provide a useful check to ensure that goals are compatible. I think MMT is safe from the likes of Dan Duncan.As an aside, the macroeconomics literature – mainstream or not – do not call the sectoral balances a “Fiscal Accounting Equation”. Using that terminology is not conventional and suggests that Dan Duncan is not very familiar with standard macroeconomics literary conventions. If you search Google for that term you will not yield anything about National Income accounting.best wishesbill

Steve Wynn blames his workers' falling salaries on deficits

You gotta love this! Another billionaire blaming his workers' pay cuts on deficits and the government. This is dumb even for a guy who peddles vice.

Here are his comments in a nutshell:

| "Deficits are killing us, our dollars are worthless, and the Democrats are bankrupting the country and vilifying anyone who's successful. So naturally, people are protesting." "I am watching my employees standard of living due to deficits. The public is making the connection between deficits and their standard of living. They're seeing their wages go to 80 cent dollars to 70 cent dollars. I have not been able to keep up with the effect of deficits." Full article here. |

Okay, so let's see...according to Glassdoor.com Wynn Resorts pays about average or less for most hotel/casino positions, so he's not actually giving away money in the form of compensation. Then there's the fact that Wynn laid off 265 workers last year. Fired employees often find it hard to realize an increase in their standard of living, at least right away.

As for Wynn's company (Wynn Resorts), pretax income grew 15-fold to a record. Tax expense has gone down! Revenues have grown steadily to a record. And Steve Wynn's personal income and net worth have gone up by quite a bit.

So, if he's worried about his employees' standard of living, then maybe he should pay them more and not blame it on the deficit, which actually adds to their income and savings.

Wednesday, October 19, 2011

Debt Serfdom and the Origin of the Crisis

Trapped assets that generate no income streams in the present are not capital; the value of such non-productive assets is illusory. Strip away these trapped assets and the reality is revealed: most American households toil to service their debts.

The typical American household is insolvent: its debts exceed its assets.There is nothing fancy about calculating insolvency: if debts exceed assets, the enterprise is insolvent. By this measure, most American households are insolvent, if their real assets are marked to actual market.For example:Auto loan balance: $9,000 Actual market value of auto: $6,000Credit card balance: $6,000 Street value of stuff purchased with credit card: $300home mortgage: $250,000 Auction value of house: $200,000Student loans: $60,000 Market value of education: Not applicable, as it cannot auctioned off or securitizedAnd so on.The typical American household is thus in service to its debt, not to its assets, and to the holders of that debt. This is debt-serfdom: serfdom in service to the owners of debt, debt that may well always exceed the value of the household's assets. This is debt-serfdom for life.

Read the rest at of two minds, Debt-Serfdom Is Now the New American Norm by Charles Hugh Smith

Smith continues in The Origins of American Debt-Serfdom where he traces the beginning and course of the long financial cycle culminating in Ponzi finance that was described by Hyman Minsky.

Amy Goodman interviews Bill Black at Democracy Now on Occupy Wall Street and control fraud

The video and transcript is available at Democracy Now,

Follows up on Dylan Ratigan's interview of David DeGraw and Bill at MSNBC

David invites Bill to stand for Attorney General at the General Assembly, and Bill responds positively.

Beowulf on campain finance reform — from the comments

"Would campaign finance reform require a constitutional amendment?"Short answer, it depends on what you mean by "campaign finance reform". Its like ex-Navy SEAL Richard Machowicz's great saying: target dictates weapons, weapons dictate movement.If what you want is to limit free speech rights (which as the Supreme Court interpretes it) means, essentially the right of any individual or corporation to spend whatever they want on a political race, that requires a constitutional amendment. Which, to pass, requires 2/3rds of both Houses and 3/4ths of the state legislatures to approve-- THAT is like hand-towing a howitzer up and down a mountain.The Supreme Court has allowed clean money schemes like Arizona's where candidates can voluntarily limit their own campaign fundraising and, in exchange, they receive a stipend from the state (or perhaps someday, the Federales) to fund their campaign. The idea is you can't turn down the volume of bought candidates, but you CAN turn up the volume of clean candidates. Passing a bill that appropriates money in this way must pass both Houses of Congress and to get through the Senate will need 60 votes. After which, the appropriation must be renewed annually. Now you're making progress, you have a mule train to haul the artillery piece.A I suggested to Larry Lessig a couple weeks ago, you could turn the last proposal inside out and gave a tax credit to the campaign VENDORS of clean money candidates (e.g. TV station who ran ads at no cost to candidate would be given a tax credit equal to the fair market value of an equivalent ad buy). That bring you into the world of tax expenditures, which have two unique properties. 1. Tax bills can pass the US Senate with only 50 votes (plus VP tiebreaker) by using the filibuster-proof reconciliation process. 2. Tax breaks don't have to be renewed annually like appropriations. Once they're on the books the inertia of the system makes them tough to repeal. That route is like a helicopter hauling your howitzer over the mountain.Clearly the first step is to figure out (if at all possible) how to achieve your goals through the tax code. The idea is tax activities you don't want (e.g. tobacco sales) and give tax credits to activities you do want (e.g. hiring disabled veteran).

Media Shift

Take a look.

CHART: Thanks To The 99 Percent Movement, Media Finally Covering Jobs Crisis And Marginalizing Deficit Hysteria by Zaid Jilani at Think Progress

Rodger Malcolm Mitchell to Occupy Wall Street

Rodger advises Occupy Wall Street that the sky is the limit if they acquaint themselves with monetary sovereignty. If they don't, they will self-sabotage with counterproductive objectives and demands.

Is the OWS movement being slyly manipulated?

It seems like OWS is acquiescing to calls to "hone their message" rather than keep their protest more about generic social and economic inequality and injustice. (Which I believe is a far more effective strategy judging from the rapid, global spread of the movement.)

By caving in to media and elitist demands that they specifically define and communicate their grievances (we've all heard the idiotic and phony, "What are they protesting about?" lines), they are rapidly destroying their efficacy, at least in my opinion.

When they declare one of their goals to be "Bringing down the deficit and the debt," they are clearly speaking, unkowingly perhaps, against their own interests. Screw the debt! This is about inequality and the entrenched policies that sustain it! The debt is not the problem!

When they start talking about reducing the debt they are buying into the same propaganda that the 1% has used so effectively to sustain the flow of income and wealth directly their way at the expense of the other 99%.

That being said, I did see this one sign (h/t Ritholtz blog) that correctly sums up at least one grievance (albeit a very large one). I thought I'd share.

If that doesn't clearly state one of the bigger problems, then I don't know what does.

George Lakoff to Occupy Wall Street — It's the framing, stupid.

Good advice from a cognitive scientist on how to frame the debate in terms of democracy and public purpose. Frame this as a moral issue that appeals to the 99%, and don't let opponents frame you. Above all, don't go negative.

How to Frame Yourself: A Memo for Occupy Wall Street by George Lakoff at TruthOut.

MMT needs to pay attention to the framing, too. Going public with idea is best accomplished with the appropriate framing. Emphasize public purpose, like achieving full employment at full utilization of capability, along with price stability and sustainability.

Bill Mitchell:

I think Modern Monetary Theory (MMT) does provide insights to the general population that are not only obscured by the mainstream media but which if they are broadly understand will empower the 99% to demand governments redefine their roles with respect to the non-government sector. Part of that re-negotiation has to be to reduce unemployment and redistribute national income more equally. We will also be better placed to have a sensible discussion about the human footprint on the planet. The three goals – full employment, reduced inequality and environmental harmony – should be central to the current civic protests (such as OWS).

(h/t Clonal in the comments)

Message to Occupy Wall Street — The way forward is the way of Gandhi and King

Michael Nagler, founder of the Metta Center for Nonviolence, has some advice for the protestors. Metta is a Pali word meaning lovingkindness. It comes from Sanskrit mitra, meaning friend. In this context it means "love your enemies." Good advice.

Crunch Time for Occupy Wall Street at Truth Out

Mish — more BOA shennanigans, with Fed approval

Bank of America, at the request of counterparties, just moved a Merrill Lynch derivatives unit to an Insured Deposits unit, under protest by the FDIC.The FDIC does not like the move because it puts the FDIC at risk. Bernanke is fine with the move, which means the Fed and FDIC are once again in an open feud about risk management

Read the rest at MISH'S Global Economic Trend Analysis, Bank of America Moves a Merrill Lynch Derivatives Unit to an Insured Deposits Unit (Putting FDIC at Risk); Fed approves Move, FDIC Doesn't

Also, Yves Smith at Naked Capitalism, Bank of America Deathwatch: Moves Risky Derivatives from Holding Company to Taxpayer-Backstopped Depositors (h/t Kevin Fathi)

UPDATE: Trader's Crucible piles on, Can We Prevent a $100 Billion+ BoA Taxpayer Ripoff? There's an important comment of Beowulf originally posted at Yves' place reposted by TC.

Let the outrage begin, or better, increase.

Tuesday, October 18, 2011

Nassim Taleb unloads

Video at Bloomberg, Nassim Taleb interviewed on Occupy Wall Street, banking, and the future. More about banking than OWS. Taleb's position is quite similar to Warren Mosler's view with respect to banking as a public-private partnership and utility. Taleb looks at the issue from the perspective of risk and accountability. He thinks that the protests are basically about lack of accountability and that by not addressing the issue in a timely fashion, we may be crossed over the line to class warfare, which may be difficult to resolve.

Olbermann interviews Sgt. Shamar Thomas

What he is saying is that there is a professional way to deal with protests and an unprofessional one — a way to allow legitimate protest and a way to suppress it.

We are now seeing this dichotomy in various towns and cities around the country. In some places, peaceful dissent is welcomed and the authorities act appropriately to ensure it remains within bounds and also that the demonstrators are protected, while in other locales the opposite is the case.

I had a similar experience when I completed my tour at the time of the Vietnam conflict and came back to protest what I considered behavior antithetical to American ideals being perpetrated under false pretenses. Protestors were certainly emotional, but they were not violent. Very often the violence was on the other side. Never forget that no one was ever held to account for the murders of protests at Kent State.

It can happen here. It has.

The sergeant is right. Veterans need to stand up here for what they fought for there.

Goldman Sachs Loses Money in 3rd Qtr

Goldman Sachs is out with their 3rd Qtr earnings this morning. They lost money in the quarter ($393M). Excerpt:

This follows some sub-par results from Citi the other day. It never pays to be a moron, their ignorance about the realities of macro economics is finally catching up with them, at this point they are their own worst enemies.

Results for the third quarter of 2011 included a loss of $1.05 billion from the firm’s investment in the ordinary shares of Industrial and Commercial Bank of China Limited (ICBC), net losses of $1.00 billion from other investments in equities, primarily in public equities, as well as net losses of $907 million from debt securities and loans.

Looks like they stayed long equities when the federal government implemented the strongest fiscal drag since the great recession began during the 'debt' ceiling debacle, and got caught short bonds during the big bond rally this past quarter.

This follows some sub-par results from Citi the other day. It never pays to be a moron, their ignorance about the realities of macro economics is finally catching up with them, at this point they are their own worst enemies.

I would attribute any previous outsized business success in this industry to luck and pure salesmanship. If they really were smart, they would immediately task their industry lobbyists to switch over to a message to Congress and the President promoting full employment based on MMT.

Monday, October 17, 2011

Really?

Three years after the beginning of the Great Recession, the US unemployment rate remains at 9%, double its pre-crisis level. This column suggests the credit crunch may be behind this high number. It argues this is not because lower debt impairs the hiring ability of firms, but because it places firms in a less favourable bargaining position, allowing workers to negotiate higher wages, and thus reducing employment.

Firms’ deleverage and the persistence of unemployment by Tommaso Monacelli, Vincenzo Quadrini, Antonella Trigari at Vox.eu

Dumb, dumb, and dumber.

It's the demand, stupid.

CNBC's Carney picks up on the Harvard International Review interview of Bill Mitchell

Very few people understand how the modern banking system really works.They have in their heads a model they learned from text books in which banks take deposits from customers, then lend out those deposits as loans. In reality, banks fund their loans by borrowing in the interbank market.Once a bank has agreed to make a loan, it then borrows the same amount of money in the interbank market at a slightly lower rate. The lending comes first, the borrowing to fund the loan comes afterwards. This is why so many loans are pegged to LIBOR : Banks charge borrowers rates that are set to levels at some point above what the banks themselves pay to borrow.A very similar misconception applies when the government spends and borrows. People imagine that the government must first collect taxes or borrow money in order to have funds to spend. In reality, the government just spends what it wants, and then collects taxes in order to balance out the effect the spending has had on the money supply.In short, banks lend first, fund later. Governments spend first, fund later.There's a great discussion of this in the Harvard International Review's interview with Bill Mitchell, the research professor in economics and the director of the Centre of Full Employment and Equity at the University of Newcastle, Australia. Mitchell is one of the founders of a school of thought called "Modern Monetary Theory" (MMT).

Read the rest at CNBC, How the Banking System Really Works by John Carney

(h/t Scott Fullwiler)

Of course, Carney rather botches the job, but, hey, it's a start.

Amazon muscles in on publishing

Amazon transformed book sales, now it is set to transform publishing, eliminating the middle man between authors and readers. This is a big deal and an indication that on line distribution, especially digital delivery, is the future.

Read the article at The New York Times, Amazon Signs Up Authors, Writing Publishers Out of Deal

By David Streitfeld

Citigroup Traders Got Clobbered By Volatile Markets

Story from Yahoo! here. Excerpt:

I wonder if many of the out of paradigm bond traders at Citi were caught short Treasuries via the same type of macro view on the bonds that PIMCO's Gross opined about when he Tweeted "who is going to buy them now?". It will be interesting to look at the YoY fixed income trading results of many of these so-called 'investment' banks for this past quarter when they are released.

It's pretty clear that Citi's traders just couldn't keep up with the third quarter's wild market ride. So what went wrong?

I wonder if many of the out of paradigm bond traders at Citi were caught short Treasuries via the same type of macro view on the bonds that PIMCO's Gross opined about when he Tweeted "who is going to buy them now?". It will be interesting to look at the YoY fixed income trading results of many of these so-called 'investment' banks for this past quarter when they are released.

Charles Goodhart – Dual currencies: learning from the Californian solution

D2 1445 Charles Goodhart from Feasta on Vimeo.

From Feasta’s Irish debt crisis conference — September 23, 2011.

Sunday, October 16, 2011

Marine Sergeant Shamar Thomas defends OWS protesters

Brave Marine Sergeant Shamar Thomas gets a bunch of NYPD with helmets and batons to back off. And they listen.

| "Last night at Occupy Wall Street in Times Square, Marine Sergeant Shamar Thomas boldly defended the occupiers. Sergeant Thomas calmly asked the NYPD why they aren't protecting the peaceful protestors. The NYPD ignored his questions and continued telling protestors to leave the sidewalk otherwise "they'd get hurt." Then, in an epic scene, Thomas approached the line of NYPD officers who held their batons. While many Occupy Wall Street demonstrators had been arrested for merely crossing the street, he exclaimed, "These are U.S. citizens peacefully protesting! These are the people you are supposed to protect!" The 10-15 NYPD officers he addressed dared not to touch him. Sergeant Thomas continued denouncing the NYPD's actions shouting, "This isn't a war zone! I've served overseas, that's a war zone! Get rid of your batons and helmets!" After five minutes of severely and loudly criticizing the NYPD, the Sergeant walked away leaving the scorned officers behind. The few people who were there applauded and cheered. Whether those officers mindset will change is uncertain. What is certain, however, is that the NYPD is conflicted when confronted by Members of our Armed Services. That said, I hope more Marines will join in defending U.S. citizens from megalomaniac individuals leading corrupt financial and political institution. Thank you Sergeant Thomas for defending American's rights to protest. You really are The Few and The Proud." |

Rogue Economist — Net Financial Assets

The rogue economist provides a long and detailed exposition of the meaning of "net financial assets" based on my previous comments there.

"Net financial assets" is a key MMT concept, so it is definitely a worthwhile read. I'm bookmarking it, too, in order to refer others to it. It meets a lot of objections and corrects erroneous ideas now being bandied about.

Read the post at Rogue Economist Rants, What is net financial asset

Here is my comment there:

Thanks for providing a detailed explanation of net financial assets.

I must clarity that the term "net financial assets" is not my term. It is a key term of Modern Monetary Theory (MMT).

MMT emphasizes the distinction between vertical, "outside," or exogenous money creation by the government as currency issuer, and horizontal, "inside," or endogenous money creation by bank lending.

When banks lend, loans create deposits, which are withdrawn and spent into the economy. Loans are booked as bank assets and deposits as bank liabilities. The net is zero. No net financial assets are created when banks lend. What is created, however, is an interest obligation that exceeds the value of the loan, which must be repaid in addition to the principle.

Conversely, when government deficit spends it creates financial assets in the private sector. These financial assets have no liability in the private sector, so they are non-government net financial assets. The net financial assets injected by government come with no interest payable by the recipient.

This is the basis of the vertical-horizontal distinction that MMT draws, and it is why the government as household analogy is erroneous. Households, firms, and states in the US are currency users, while the federal government is the currency issuer. Missing this distinction is the reason for a lot of junk economics.

A government that is the monopoly provider of a non-convertible floating rate currency is not operationally constrained because it funds itself with currency issuance. Such a government does not tax to fund itself and it does not borrow to finance itself. A currency issuer does not need to get money elsewhere. It issues it.

Taxes withdraw net financial assets previously injected by deficit expenditure. Governments withdraw some of the NFA through taxation for two reasons. First, taxes create a need for the government's money, which Warren Mosler calls a tax credit. This gives value to otherwise worthless pieces of paper. Secondly, governments withdraw NFA from non-government to regulate inflation.

Government does not usually withdraw the total net financial assets it injects. Historically, the US government has generally run a deficit. Only once was the national debt paid down.

The residual of deficit spending is the "national debt." It should be obvious from the above that the "national debt" is actually savings of NFA held by non-government, accruing interest that is also created by currency issuance and adds NFA. All the brouhaha is complaining about growing national wealth in the hands of non-government. Does that complaining make sense?

IN the MMT macro view and policy recommendations based on it, fiscal policy — injection and withdrawal of non-government NFA — is used to adjust nominal aggregate demand to nominal aggregate supply at full employment with a view toward achieving full employment and price stability. In this regard, MMT holds that fiscal policy based on "functional finance" is superior to monetary policy, since it can be adjusted to changing non-government desire to save in order to ensure that the balances of the sectors — government, domestic private, and external — sum to zero at full employment.

The Reformed Broker goes to Zucotti Park

Many of you haven't made up your minds yet about the images you're seeing from the Occupy Wall Street movements all over the nation. I haven't either, but this week I met someone who totally floored me and turned a lot of my preconceived notions upside down.

Read the whole post at The Reformed Broker, Suzanne by Joshua M. Brown

(h/t Mario at The Center of the Universe)

Pretty awesome reporting.

Harvard International — interview of Bill Mitchell

An Interview with Bill Mitchell

October 16, 2011 by Winston Gee

Bill Mitchell is the Research Professor in Economics and the Director of the Centre of Full Employment and Equity at the University of Newcastle, Australia. The following is an edited transcript of the interview, conducted August 15, 2011.

h/t Keven Fathi

Randy Wray mentioned at Washington's Blog

Economics Professor and monetary expert Randall Wray told me thatwe should end the regional Federal Reserve banks, as they have such terrible conflicts of interest, strip out all regulatory power from the Fed (since it doesn’t believe ine regulation, anyway), and implement monetary policy with a very small staff. He is not opposed to moving operations over to Treasury and/or the FDIC.

Washington's Blog, Economists: End Or Drastically Downsize the Fed

I've commented numerous times on MMT at Washington's Blog in the past to no avail, so I gave up.

The typical fare there about monetary economics is from neoliberal or Austrian economists and Steven Keen, all about how the national debt is bankrupting the country. But apparently the editor has finally gotten around to Randy, although the general thrust of the blog is still that the big problem in the US is the Fed and the national debt. Hopefully, the editors of the blog will pay some attention to the MMT message and stop spreading nonsense about monetary economics.

Jesse Jackson, Jr: Obama should 'declare a national emergency' like Lincoln

(h/t Hoonose at The Center of the Universe)

Jesse Jackson, Jr. gets that the US in now embroiled in civil war, although he does not use that term directly.

Rick Perry-Getting to know the candidates

Presidential candidate Texas Gov. Rick Perry released his economic plan Friday, promising that an energy-centric program to expand offshore drilling and domestic oil and gas exploration would create 1.2 million jobs.Perry, who spoke at a suburban Pittsburgh steel mill before a hard hat-wearing crowd, is building on the Republican Party's "drill, baby, drill" mantra, He'd move to open federal lands to drilling, including Alaska's Arctic National Wildlife Refuge, and would curtail the Environmental Protection Agency's regulatory powers....Struggling to seize a message of his own, Perry turned to the energy sector — familiar ground to any energy state lawmaker — as the basis for his jobs program....Saying the premise for his plan is "Make what Americans buy, buy what Americans make and sell it to the world," Perry predicted that, "We are standing atop the next American economic boom ... energy.""The quickest way to give our economy a shot in the arm is to deploy American ingenuity to tap American energy. But we can only do that if environmental bureaucrats are told to stand down," he said."America has proven but untapped supplies of natural gas, oil and coal. America is the Saudi Arabia of coal, with 25 percent of the world's supply. Our country contains up to 134 billion barrels of oil and nearly 1.2 quadrillion cubic feet of natural gas...."Perry said he'd open up federal and private lands for exploration in states such as Wyoming, Montana, New Mexico, North Dakota, Colorado and Utah. The Western states could produce 1.3 million barrels of oil per day by 2020, he said, adding that they also contain 87 trillion cubic feet of natural gas.Perry's harshest criticism was for the EPA. He said he'd stop "the EPA's draconian measures related to the regulation of greenhouse gases" and return air and water oversight to the states, "rather than imposing one-size-fits-all federal rules...."Perry plans to unveil the second part of his economic program Oct. 25 in a speech focused on overhauling taxes.

Read the full article at McClatchy, Perry, struggling in campaign, unveils economic program

Bruce Kasting on a transaction tax

Bruce Krasting warns Dean Baker and the 99%'ers to beware of what they wish for.

Read the post at Zero Hedge, Enlightened Self Interest by Bruce Krasting

Krasting concludes:

I’m half serious and half joking this morning. I’m looking at the TV and all of the OWS stuff that is happening around the world. This is gathering speed very quickly now. Anyone who thinks this is going to go away in a few days is just nuts.One global response from the “Deciders” to the current protests could be a transaction tax. That would be “popular”. It might just be something that is done as a way of appeasing the crowds. Whatever one thought of the possibility of a transaction tax a month ago, those estimates have to go up today. The bigger the protests, the greater the probability that the tax is implemented.A transaction tax would be like Prohibition. The Volstead Act just made crooks rich. It cost the government billions in lost revenue. The population came to hate it. It was bad policy that was adopted because of a visible protest movement of that time.The left side of my brain is with Rogoff. A transaction tax would kill liquidity/capital formation. That would result in a huge spike in volatility. This, in turn, would result in broadly lower equity multiples. The connection between stocks and the economy is too tightly correlated. A very sharp downturn in the economy would have to follow. For these reasons, I’m violently apposed to a transaction tax.The right side of my brain says, “Bring it on”. I’m confident that I can survive and thrive in that environment. Fortunes were made in the 30’s. What may come will be no different.I do want to be clear about this. The 99% have been pushing the transaction tax. They may get what they think they want. But in the end it will result in more pain for the 99’ers. The concentration of wealth in America will just get higher and higher up the ladder.A transaction tax that limits liquidity will not create jobs, it will end up costing the government net tax dollars. But guys like me will do just fine.Be careful of what you wish for.

Is it the case that "a transaction tax would kill liquidity/capital formation," as Rogoff claims?

Or is the real issue effective demand?

Noah Smith disses REH

1. Unlike heliocentrism, we don't know yet that Rational Expectations is right. It is certainly not the case that Rational Expectations is the only "easily modeled system grounded in compelling theoretical considerations." There are plenty of alternatives![...]2. The Rational Expectations people didn't just insist that macroeconomists use self-consistent, perfectly microfounded Theories of Everything. In fact, they didn't stop at insisting that people use Rational Expectations! They went so far as to insist that theories of business cycles should be driven by so-called "real shocks" - changes in technology, changes in government policy, or changes in people's willingness to work.[...]...the revolution has not yet led to a theory of business cycles that fits the data well. And it very well may never do so - especially, I predict, if its adherents keep insisting on including only "real shocks" in their models. Until RE gives us something constructive, I think that comparisons with Copernicus are premature.

Read the full post at Noahpinion, Rational Expectations vs. Heliocentrism by Noah Smith

For alternatives, economist should be looking at research in the life and social sciences. Rational expectations is contradicted by not so recent discoveries in cognitive science, for example. That is just not the way the brain functions, as Antonio Demasio and others have found.

Raising Cain-Getting to know the candidates

What to expect from a Cain campaign and the likely direction of a Cain presidency.

AlterNet Investigative Report: As Herman Cain Surges, Corporate Media Ignore His Koch Connections

More Kochiness.

Eliot Spitzer-Half Right

How the movement has already shaken up American politics, and where it should go from here.Occupy Wall Street has already won, perhaps not the victory most of its participants want, but a momentous victory nonetheless. It has already altered our political debate, changed the agenda, shifted the discussion in newspapers, on cable TV, and even around the water cooler. And that is wonderful.Suddenly, the issues of equity, fairness, justice, income distribution, and accountability for the economic cataclysm–issues all but ignored for a generation—are front and center. We have moved beyond the one-dimensional conversation about how much and where to cut the deficit.Questions more central to the social fabric of our nation have returned to the heart of the political debate. By forcing this new discussion, OWS has made most of the other participants in our politics—who either didn’t want to have this conversation or weren’t able to make it happen—look pretty small.Surely, you might say, other factors have contributed: A convergence of horrifying economic data has crystallized the public’s underlying anxiety. Data show that median family income declined by 6.7 percent over the past two years, the unemployment rate is stuck at 9.1 percent in the October report (16.5 percent if you look at the more meaningful U6 number), and 46.2 million Americans are living in poverty—the most in more than 50 years. Certainly, those data help make Occupy Wall Street’s case.But until these protests, no political figure or movement had made Americans pay attention to these facts in a meaningful way. Indeed, over the long hot summer, as poverty rose and unemployment stagnated, the entire discussion was about cutting our deficit.And then OWS showed up. They brought something that had been in short supply: passion—the necessary ingredient that powers citizen activism.......the point of OWS is not to be subtle, parsed, or nuanced. Its role is to drag politics to a different place, to provide the exuberance and energy upon which reform can take place.The major social movements that have transformed our country since its founding all began as passionate grassroots activism that then radiated out. Only later do traditional politicians get involved....

Read the full post at Slate, Occupy Wall Street Has Already Won by Eliot Spitzer

Spitzer gets it half right. He understands what a grass roots movement is. But his projections of where it might go are, of course, just more 1% nonsense. No surprise, since Spitzer is part of the 1%.

In asking where it could go, Spizter speculates:

Could it launch a citizen petition demanding that a Paul Krugman, Joseph Stiglitz, or Paul Volcker be brought into government as a counterweight to or replacement for the establishment voice of Treasury Secretary Tim Geithner? Maybe. Could OWS demand meetings with top—government officials? Could it demand answers to tough questions—from the specific (explain the government’s conflicting statements about the AIG-Goldman bailout) to the more theoretical (why “moral hazard” is a reason to limit government aid only cited when the beneficiaries would be everyday citizens)?