A recent BBC headline, “How the West is helping Russia to fund its war on Ukraine,” published on May 30, 2025, presents a familiar narrative: Russia, reportedly awash in foreign currency from its fossil fuel sales, is using these “Western billions” to bankroll its ongoing war. The article starkly points out that “Ukraine’s Western allies have paid Russia more for its hydrocarbons than they have given Ukraine in aid,” highlighting a staggering €883bn earned by Russia since February 2022, despite sanctions.

While the sheer scale of these export revenues is undeniably jarring, and the moral implications of such purchases are deeply unsettling, the BBC’s analysis of Russia’s war funding misses a crucial economic point. The narrative that Russia needs these euros and dollars to pay its soldiers, forge tanks, or churn out shells for military use oversimplifies the fundamental realities of sovereign currency.

An economics, investment, trading and policy blog with a focus on Modern Monetary Theory (MMT). We seek the truth, avoid the mainstream and are virulently anti-neoliberalism.

Pages

Pages

Friday, May 30, 2025

Rethinking Russia's War Chest — NeilW

Saturday, May 24, 2025

Bessent: could change SLR over summer

Significant in helpful way:

See here entire US banking system added about $500B loans and lease Assets in over an entire year:

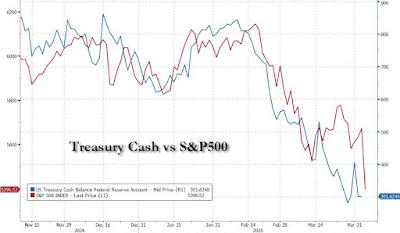

While Treasury added $550B of reserve assets in just a few weeks starting February 20th this year reducing TGA from $850B to $300B at the morons “debt ceiling!” … causing a corresponding precipitous drop in all other financial asset prices as Depositories don’t have the regulatory capital to comply with leverage regulations in these situations where the second rate Art degree monetarist morons think they literally “inject money!” like this:

Policy discussion around the SLR reform has previously addressed only these reserve assets at the Depositories but lately the discussions have expanded to also include USTs …. 🤔

This could be related to the advent of USD stablecoins and the threat these coins pose to traditional Depository businesses… we have to see how this part works out..

The important part is getting the reserve asset exemption … this will eliminate the effect of what has been the most destabilizing Art degree monetarist moron monetary policies in our lifetimes..

Thursday, May 8, 2025

Trump stablecoin off and running

Trumps USD1 now up to $2.2B issued in just a couple of weeks on an exchange… at the Fed’s current screw Trump 4.40% risk free rate he’s already making $88M annual rate … if he can get issuance up to $100B then he’s grossing >$4B annual which would probably be his most valuable enterprise … iirc Tether is at >$160B…

With the Art degree “money pumping!” Fed morons obviously trying to screw him (and with him all US borrowers) with their current unprecedented high risk free rate he’s now able to take advantage of that via his stablecoin…

So with the higher rates he makes bazillions in his stablecoin while if they lower rates he’ll make bazillions in his CRE and DJT shares…

BULLISH: Trump-backed $USD1 has skyrocketed to a $2.2B market cap in just 2 months, now the 7th-largest stablecoin globally.

— Bitcoin Magazine NL (@BitcoinMagNL) May 8, 2025

Politics meets stablecoin adoption, fast.#USD1 #Stablecoins #Trump pic.twitter.com/7RaXbEfwpX

Thursday, May 1, 2025

US National Accounts – growth contracts but likely to be temporary — Bill Mitchell

People are closely watching the US data at present to see what the impacts of the recent tariff decisions by the new US President might have. I am no exception. Yesterday (April 30, 2025), the US Bureau of Economic Analysis published the latest US National Accounts figures – Gross Domestic Product, 1st Quarter 2025 (Advance Estimate) – which provides us with the first major data release since the new regime took office. The fact though is that this data cannot tell us much about the tariff decisions, given that Trump’s – Executive Order 14257 – only really became operational on April 4, 2025, although there had been some earlier tariff changes before then....William Mitchell — Modern Monetary Theory

US National Accounts – growth contracts but likely to be temporary

Bill Mitchell | Professor in Economics and Director of the Centre of Full Employment and Equity (CofFEE), at University of Newcastle, NSW, Australia