An economics, investment, trading and policy blog with a focus on Modern Monetary Theory (MMT). We seek the truth, avoid the mainstream and are virulently anti-neoliberalism.

Pages

▼

Pages

▼

Tuesday, November 1, 2011

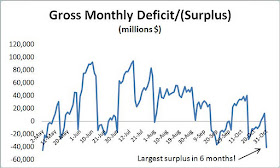

Federal Gov't running largest surplus in six months, threatening economy

Deficits add to private sector financial balances and surpluses reduce those balances. That's why running a surplus is bad for the economy.

The most recent data from the US Treasury shows that the government is now running the largest surplus in six months. What this means is that the rosy, 2.5% GDP (preliminary) number we saw for the third quarter is not going to be repeated in the fourth quarter if this surplus is not reversed soon.

Expect the economic data to start getting very, very, bad.

If credit contracts too we certainly are going to see very bad data coming in soon.

ReplyDeleteHere in some parts of Europe we are already feeling it.

Recession first, and depression later if something is not done (I guess they will increase spending, cut taxes or something while CB's support at some point, certainly if we print some deflation numbers).

Dick Grasso, former NYSE director, was on CNBC video at the NYTIMES.

ReplyDeleteHe said the banks' problems originate from the community investment act.

Once again putting the blame on the wrong thing.

Googleh,

ReplyDeleteMore on Dick Grasso on narco Dollars for Beginers

The CRA blame game has been so discredited by now. Grasso is a tool.

ReplyDeleteIt's hard to believe that's even the right data?!?

ReplyDeleteAssuming it is, perhaps there are strong seasonal factors around when benefits get paid and/or tax receipts come in. Seems problematic to look at such a granular level without seasonal adjustment.

Have there been any austerity measures actually implemented in the US? Unless the drop-off in the past stimulus spending (or resulting multiplier effects) has accelerated, an alternate conclusion regarding the surplus could be that the economy is improving more rapidly through exports and/or a willing reduction in corporate or household savings rates, thus boosting tax receipts and lowering benefit payments.

(I'm not going to make the case that it is because I don't know, and there are lots of reasons for concern, I'm just running through the logical options).