An economics, investment, trading and policy blog with a focus on Modern Monetary Theory (MMT). We seek the truth, avoid the mainstream and are virulently anti-neoliberalism.

Pages

▼

Pages

▼

Monday, January 30, 2012

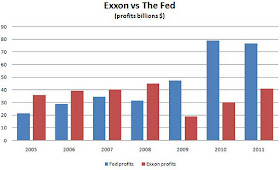

Exxon vs the Fed

Who's more profitable, Exxon or the Fed?

Results are in...

Final score:

Exxon $252 bln

The Fed $321 bln

It's the Fed by a knockout!

And all that profit without having to drill a single hole or refine a single gallon of gasoline. Plus, no messy spills to contend with. Just clean, neat Treasuries. A whole lotta them. About $2.6 trillion worth to be exact.

But where'd that profit go? Nowhere. To the Treasury and out of the private sector. Wow! What a stimulus!!! Let's have QE3, and 4 and 5 and 6 for that matter!!

Did the study mark FED holdings to market, or did they keep it marked to fantasy with better than 40 to 1 leverage

ReplyDeleteHow's Maiden Lane I, II and III doing because I seem to remember a recent auction where nobody wanted those assets, and it was a failed auction. Imagine people not wanting to pay pie-in-the-sky prices for overvalued assets.

ReplyDeleteYep, every liability the government owes to itself is just a scheduled destruction of money. The only question is whether the government's money destruction will be accomplished by crediting itself a new batch of dollars that it then extinguishes, or by taxing it out of existence.

ReplyDeleteThe whole business is a byzantine relic of a bygone monetary era, that serves no purpose other than to bamboozle and confuse the public.

We don't need bonds. If the government wants to expand its deficit and create more dollars through spending than it destroys through taxing, then just direct the CB to mark up the treasury account by the desired spending extra allotment. And if the government wants a surplus in some future situation when it needs to fight inflation, then just debit the account by the desired amount of extra money destruction.

On the other hand, if we decide we need to pay interest on dollar holdings as the net supplier of interest to the economy, and as a tool for managing lending rates and activity then sure - but let the Fed do that by itself. Paying interest should be the job of a bank, right? It has nothing to do with financing government spending operations.

Mcullogh, contributer to CNBC stated on wednesday in the afternoon during a discussion with Schiff about bullish or bearish on markets due to fed holding interest rates low until 2014.

ReplyDeleteHis answer " I am 92% cash as of the FOMC conference, reason the low interest rates will be a headwind to companies and the economy going forward to increase margins, Margins will get squeezed,as input cost increasing are a direct result of the TWIST. Sure enough the next day PG and Ford stated input commodity costs are rising and have risen and are squeezing margins. Bernanke says on the surface "I want to help housing" but what he is really doing is bailing out his buddies, everything but housing has gone up in price, housing and MY payroll has gone down. SO MR Bernanke walk the streets of Oakland and tell the protesters how wonderful the economy is doing.

The government is borrowing from itself and then claiming it owns an asset and owes a debt and that it has income from interest paid to itself. This sounds more like Lehman than Exxon.

ReplyDeleteAnon,

ReplyDelete40 of what? to 1 of what?

Resp,

Anon:

ReplyDeleteMark to market for Fed is irrelevant because Fed can hold for however long it takes, earning interest and earning back principal without a problem. For any "losses" the Fed takes on higher risk assets (and I'm not aware of any--Maiden made a profit), the Fed's vast holdings of Treasuries wipes that out in spades. If you're earning $70 bln per year, that covers a lot of bad bets.

Mike, what you believe the FED can do, and what I believe the FED do are two very different things. You view everything in a vacuum concerning what the FED will be able to do in the future, as in to infinity sparky. I would quote Cicero, but it would be lost upon your utopian condition. I keep forgetting that we are somehow special and apart from history.

ReplyDeleteMaiden Lane I, II, and III prove that hold till maturity is complete BS. This whole thing is bread and circus while they steal the last nickel from the American Treaury.

Matt, I believe I stated 40 to 1 levered by the FED. For every dollar of capital/asset, they are levering it 40 times.

ReplyDeleteA small loss will blow up a broker, as BS was levered 26 to 1 when it went under. Now Mike would say no worries because the govt. has reserve status and can print at will to infinity while I will allow history to be my guide and say that things stay the same till they don't. It's the Taleb Turkey Analogy for ALL Empires I'm afraid.

Anon,

ReplyDeleteHere is the Feds balance sheet:

http://federalreserve.gov/releases/h41/Current/

Total Assets on the BS is $2.965T so if I divide that by 40 it equals $74B;

So I guess you are saying they are "leveraging" $74B of something 40 times to get their $2.965 total assets.

What is this $74B "thing", what is this? Where is this "thing" documented in the Fed data releases?

Resp,

Dan Kervick, You forgot to mention a major advantage of the current system which you call a “relic of a bygone monetary era”: it keeps thousands of academic economists employed arguing the relative merits of monetary and fiscal policy :-)

ReplyDeleteAnon,

ReplyDeleteThe 74B? Donde esta?

Resp,

Matt,

ReplyDeleteFED'S Total Assets / Capital and Reserves

Anon,

ReplyDeleteWhen we speak in terms of dollar units of account, the Fed's capital is irrelevant. Its capital is the United States Government, which is the monopoly issuer of the dollar and that means that it can buy any amount of dollar denominated assets that it wants.

Anon,

ReplyDeleteWhere is this "capital" the Fed allegedly has documented? (You wont find it)

Read Mike's comment above, the Fed has the ability to simply credit the bank account of any entity they purchase any assets from. They call this "creating reserves".

As part of the monetary authority, they logically dont have to "get the money" from any other entity... this is just the way it works.

Resp,

The US Federal Reserve is on the brink of insolvency (not!)

ReplyDeletehttp://bilbo.economicoutlook.net/blog/?p=12414

apj

This is an oldy but goody:

ReplyDeleteEliot Spitzer: "The Federal Reserve Is A Ponzi Scheme" - Inside The Fed's Secret Pile Of TRASH Assets

http://dailybail.com/home/eliot-spitzer-the-federal-reserve-is-a-ponzi-scheme-inside-t.html