There's a new farce playing on L Street.

If you're afraid of fiat, then of course the CBO's outlook on fiat is frighteningly predictable.Who's Afraid Of The Big Bad Fiat?starring NEUTER THE FIAT as arch Deficit Terrorist

Previous generations were easily frightened by these type of Budget Slasher movies, but younger generations expect more initiative, and more sovereign action. So let's hope & pray that this play runs for only a short time before audiences lose interest.

And if a corporation is a person, surely a culture and an economy are animals too. Do we really want to emasculate AND defeminate both our economy and culture? Why not just drain all the private savings too? Oh, because they'd already be gone, as a consequence of neutering the fiat. I'd advise getting a second opinion before letting these dingbats go on a nip and tuck spree.

The following news release has been edited for clarity, with out-of-context semantics replaced with context-relevant semantics.

---------- Forwarded message ----------

From: [Neuter The Fiat] Campaign

Date: July 15, 2014

Contact: Jack Deutsch (deutsch@[NeuterTheFiat].org, 202-735-2801)

The following news release has been edited for clarity, with out-of-context semantics replaced with context-relevant semantics.

---------- Forwarded message ----------

From: [Neuter The Fiat] Campaign

[NEUTER THE FIAT!!!]For Immediate Release

Date: July 15, 2014

Contact: Jack Deutsch (deutsch@[NeuterTheFiat].org, 202-735-2801)

[Neuter the Fiat] Says CBO's Long-Term Budget Outlook Frightening and Predictable

The Congressional Budget Office's new long-term budget projections show debt on an unsustainable long-term path. Under CBO's current law projections, [then IF NOTHING CHANGES - even though it always does] debt will grow from less than 74 percent of GDP in today to 80 percent by 2025, will exceed the size of the entire economy in the mid-2030s, and will double GDP after 2080.

Maya MacGuineas, head of [Neuter the Fiat], made the following comment:

"This report shows just how dire the long-term [private financial savings] situation is. The government's official scorekeeper itself says these [private saving] levels 'would ultimately be unsustainable.' Anyone that looks at the current situation and thinks our [private financial savings] problem is solved just isn't paying attention.

Unfortunately, the cost of this [private financial savings] isn't abstract. As CBO explains, it would lead to slower growth, higher interest rates, and less flexibility for the government to address new challenges. In only a quarter of a century [if nothing else changes, though it always does], income per person could be $2,000 to $5,000 lower as a result of our growing [private financial savings] levels.

The [gold-std] lining in this report is that policymakers still have time to act. CBO explains that if policymakers act soon, the [private financial savings] could be reduced with smaller and more gradual changes that can improve economic growth and give people time to plan.

But if Washington continues to kick the can and avoid dealing with the long-term drivers of our [private financial savings] , the magnitude of changes that will be necessary and the risk of a fiscal crisis will be greater. That's something this country just can't afford."

###[Huh!? What currency system are these people from?]

For more information about the [Neuter the Fiat] Campaign, please visitwww.NeuterTheFiat.borg.

[Neuter the Fiat] Campaign | 1899 L Street, Suite 225 | Washington | DC | 20036

[Neuter the Fiat] Campaign | 1899 L Street, Suite 225 | Washington | DC | 20036

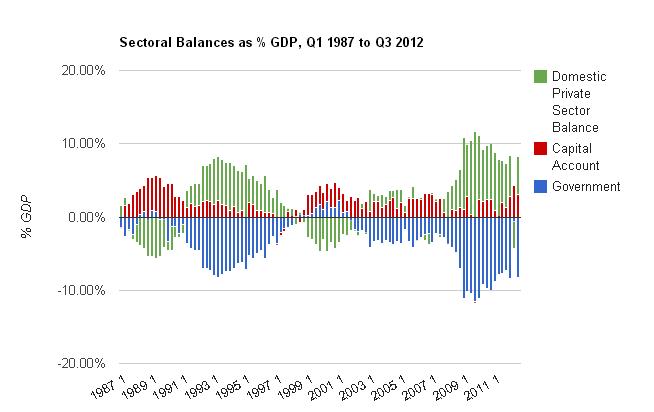

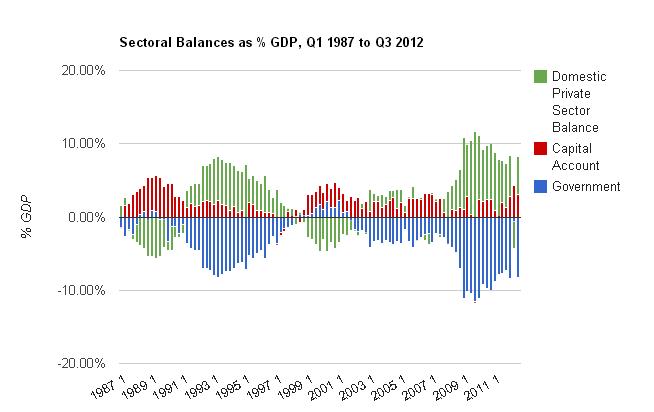

###Meanwhile, in the chart below, can they neuter one part without neutering the obligately yoked parts? I'd rather they experiment on themselves, and prove it it a self-neutering clinical trial, before practicing on the rest of us. Where's the Federal Dingbat Administration when we need one?

These folks are all perfectly well aware that the government can always create additional money or issue additional debt to discharge the obligations on its securities. When they say that current estimated flows of revenues, debt-issuance and payments are "unsustainable", what they mean is that these flows cannot be sustained indefinitely without causing inflation. Maybe they are right; mayber they are wrong. But until MMT has a serious, non-hand-wavy theory of price levels and a quantitatively precise fiscal and monetary policy rules and mechanisms to propose, it is simply not playing in the major leagues.

ReplyDeleteInstead of assuming everyone else in the world is a moron, and repeating tired and non-responsive talking points ad nauseum, maybe MMTers should think about how to elevate their game?

Have you ever met any of these people, Dan?

ReplyDeleteI have, multiple times, and their usual rhetoric never mentions inflation whatsoever. In person, I've never heard them indicate an understanding of fiat currency operations.

In public, despite what they may privately know, they're as duplicitous as any NeoLiberal frontman I've ever read.

Given that, the absence of the word "inflation" in the vast majority of output from their several organizations severely questions your starting thesis.

We just finished hashing out responses to your questions about fiat currency operations, political economy and "inflation" over at

http://mikenormaneconomics.blogspot.com/2014/07/frances-coppola-attacks-mmt-straw-man.html

Not much worth adding to that.

"what they mean is that these flows cannot be sustained indefinitely without causing inflation."

ReplyDeleteWhen they say that explicitly, I'll believe that's what they mean. Until then, I'll take them at their word.

I wouldn't say anything got "hashed out" very well in that discussion, Roger.

ReplyDeleteTom, you are perpetuating an idle debate. You want to atribute to your opponents the stupidest version of a position, so that you can continue to think they are all "morons" and continue to win an argument whose outcome doesn't matter on territory that is insignificant.

ReplyDeleteYou are certainly aware that most deficit hawks talk incessantly about inflation and the monetization of debt: even the Fix the Debt crowd. Just as an example, here is Maya MacGuineas herself:

Higher debt can also contribute to higher inflation, whereby deficits add too much to aggregate demand in a given time frame, lead monetary authorities to try to reduce the real value of debt by printing more money (often referred to as monetizing the debt), or lead some people to believe that monetary authorities could deliberately increase

inflation. Such outcomes would

have obvious negative implications for business and investor confidence and economic growth , as well as many savers in society

— in particular, the elderly.

http://budget.house.gov/uploadedfiles/macguineastestimony3102011.pdf

Why don't you use this space to encourage MMTers to move on and get serious, and elevate their game? I have never seen Roger offer a single semi-concrete prosposal for the solution of a single policy question.

Here's a question for any one of you: Let's suppose next year you are made Social Security czar with unlimited fiscal power. You can unilaterally make any changes he wants to the structure or outlays of the program; you can make any adjustments you want to the payroll tax; you can even increase of decrease any other taxes. I'll even allow that you are permitted to issue non-interest-bearing currency directly, if you like, in lieu of selling securities. What would you do?

I'm looking for some specific numbers here, not atmospheric ruminations on the adaptive rate of humanity or of the US citizenry, not prophetic forays into the next stages in human "consciousness", not diatribes about the debt payment customs of ancient Germanic tribes or the precious metal mining of the Mycenaeans: just some concrete, present tense policy engineering.

... and as I said earlier, the inflation hawk worries about the size of the government deficit and the size of the government's debt can certainly be challenged. But then challenge them, and don't pretend the argument is about something it is not about. Everybody who matters in the contemprary political debate about the US budget is perfectly well aware that the United States Government has the power to issue money. This ongoing conceit that MMTers are the only ones who have received the sacred tablets revealing the secrets of "fiat money" are silly.

ReplyDeleteDan, I'd say the Maya MacGuineas quote pretty much proves what Tom just said. They're the ones blanketly linking "deficits" to excess inflation.

ReplyDeleteShe doesn't mention the deflationary downside of constraining currency supply for a growing population - exacerbated by the steady desire for members of a growing economy to increase their transaction rates.

ps: Dan, perhaps you've never heard how complex systems (and dynamic policy) actually work?

ReplyDeleteplease reconsider these two, very famous, quotes

http://www.brainyquote.com/quotes/quotes/g/georgespa106027.html

http://lexician.com/lexblog/2010/11/no-battle-plan-survives-contact-with-the-enemy/

Agility & willingness to work together trumps ANY specific plan. The essence of all War Colleges, Officer Training, Gov Schools, and MBA programs is to drum rote planning OUT of people's minds, so they can get back to being a bit more agile, inventive and cooperative.

for policy agility, formal planning has pretty much been replaced by OBT&E

www.lesc.net/system/files/ReasonsWhy.pdf

if you can grasp fiat, on-demand currency supply as an aid to policy agility, then you can grasp agile policy as an aid in exploring novel, emerging policy space

ps: there is a fair consensus on initial policy steps, or at least Desired Outcomes

http://moslereconomics.com/proposals/

anyone with an agile mind is going to consider these as potentially necessary but not sufficient steps, AND NOT THE ONLY POSSIBLE WAY TO PROCEED

if we got into this mess by losing agility, the most important lesson is to regain & retain agility going forward, by not shooting first & re-aiming policy after each new context

Dan, they are clearly talking about the IGBC as I read them regarding "unsustainable." This is the common objection to excessive borrowing. As borrowing increases beyond a "prudent" level, investors demand a premium in the form of higher interest rates. This increases the budget deficit and mandates even more borrowing to service the debt, which leads to more rate increase, etc. Since such trends cannot proceed to infinity, the point of insolvency is ultimately reached. No mention of inflation in this argument, which Scott refuted in "Interest Rates and Financial Stability."

ReplyDeleteThis is what many people believe. They see the issue of insolvency looming down the road, not inflation. They see inflation coming from monetizing the debt.

BTW, we already went through this with Paul Krugman, who after some time batting it around admitted that insolvency was not the issue but rather inflation.

ReplyDeleteGreenspan admitted this, too, without using the term inflation. He said that solvency of SS was not the issue but rather whether the real resources would be available. Inflation occurs when demand exceeds the capacity of the economy to supply it.

But from what I can see, most are stuck in the inter-temporal budget constraint and solvency.

A major recent challenge of MMT has been showing how solvency is never an issue for a sovereign currency issuer and that real resources is the only constraint, which implies inflation if money-induced demand exceeds available supply.

Thank you for your repetitions Roger. But I'll take that response as further indication that you really have no concrete proposal to make.

ReplyDeleteYou have some general ideas about what kinds of traits decision-makers ought to have, but no concrete proposal to make about what decsions they should actually make in our actual historical circumstances.

Tom, it seems to me that you are simply choosing to ignore, wihtout further argument, the passage I actually quoted.

ReplyDeleteBTW, we already went through this with Paul Krugman, who after some time batting it around admitted that insolvency was not the issue but rather inflation.

ReplyDeleteYes, exactly. Progress on identifying what the real issue is has ocurred. And the debate should moved on. And yet has the repetitive MMT sloganeering changed since then? Nope.

Has MMT come up with a logically clear and empirically well-grounded theory of price levels and inflation since then? Nope, they continue to avoid serious thinking about the topic and throw out a flea market grab bag of collectively incoherent suggestions: "It's all about oil and supply shocks!"; "the government is the monopoly price setter!"; "it happens when actual output exceeds potential output!"; "It's all about the buffer stocks!"

If that is the general view rather than insolvency, I would call it a victory for MMT. Once it is clear that the argument is over the availability of real resources in the future, then we can actually have an intelligent debate.

ReplyDeleteObviously, we can only have increased resources in the future if we use present resources efficiently and effectively. It's pretty easy to show that saving fiat money for future use is just as silly as saving present resources for future use instead of growing the economy through investment now both public and private and not wasting resources by leaving them idle.

This involves using public investment to drive private investment, both structurally and cyclically.

Then it becomes a matter of political choice over what percentage of real resources to provide pensioners in future based on transfers.

If we have to wait on a theory of the price level and inflation that every one agrees on to change policy, then we are screwed.

ReplyDeleteRoger,

ReplyDeleteI'm afraid you are mistaken and this never happened:

https://www.youtube.com/watch?v=NQ4RU9rlnbM&feature=youtu.be

This was a body double of the President being overdubbed with sophisticated audio editing using a voice impersonator of the President and a duplicate of the C-Span set...

Its all a big neo-liberal conspiracy to paint our leaders as morons... I'm afraid Dan is right and we have been misled...

Just to accomodate your fixation on absolutes, Dan, one consensus policy suggestion that I'd be comfortable starting nearly any discussion with is complete removal of the SocSec or FICA taxes - to increase the degrees of freedom of the MiddleClass.

ReplyDeleteHowever, I would NEVER go into any policy debate whatsoever with that as a 100% requirement.

Like any chess game, I'd let the debate move along, define the paths where all the amateurs fixated on methods vs results will eventually converge (the consensus Desired Outcome), and then work on whatever novel path is amenable to all those present.

There's a difference between a Desired Outcome and the better/faster/leaner path FOR A GIVEN AGGREGATE to get there.

If I have a flock of elephants, dogs, or weasels ... I'd help them define their optimal path, as long as they all got over the pass to their desired destination.

If you insist on a given method before defining context & audience, then you're making too many presumptions about your audience and context.

You can't have it both ways. Reality is that we have zero predictive power, and those who survive are always teams with the most agile policy apparatus, NOT those with the most complete plans.

Dan K: 'You want to atribute to your opponents the stupidest version of a position, so that you can continue to think they are all "morons" '

ReplyDeleteTo be fair, Dan, that's always a possibility we shouldn't forget, but it's also an ever present possibility that you're presuming more understanding than MacGuineas, Obama, Walker & Peterson actually express.

Personally, I don't think we can ever tell for sure, precisely because there is so much political duplicity, where political people are unwilling to publicly say what they will admit in private.

One forcing function for lay citizens such as ourselves is to call 'em on the BS and demand explicit answers. If they won't be as explicit as Tom requests, and remain as inscrutable as your MacGuineas quote ... then the burden of proof is on them - to dispense with the Kabuki.

Tom, it's not necessary to have a theory that everyone agrees on, just one sufficiently plausible and comprehensive enough to defeat one's political and intellectual opponents in an open debate, and to provide practical guidance for dealing with concrete problems. I don't think MMT is there yet. I think they shoould spend a little more time on opening up important new lines of research and a little less time on propaganda.

ReplyDeleteI have criticized J. D. Alt in the past for a few things. But at least he came up with an actual proposal last week. Having a proposal on the table provides some context for a debate.

Dan K: "Everybody who matters in the contemprary political debate about the US budget is perfectly well aware that the United States Government has the power to issue money."

ReplyDeleteNo, Dan. Absolutely not.

I've been to multiple beltway events where junior politicians & staffers absolutely prove beyond doubt that they do NOT understand that point ... at all, or have even considered it as a possibility. Once in a blue moon you'll hear a Sr politician bluntly remind everyone that "when the time comes, we'll do what we've always done ... Congress will decide what the country needs and then we'll appropriate the funds."

Comically - when these increasingly rare reality checks occur, you can literally hear a pin drop in the room. Then everyone goes back to arguing minutia.

I'm afraid that on this point that it is you who is assuming too much about people you don't meet often enough.

There's too much uncertainty about what Congresspeople, staffers & Thinktank members do & don't know ... to jump to the presumptions that you're making. There's too much at stake to act on such presumptions. We have to be sure. Leaving policy processes to that chance hasn't worked out very well so far.

OK Roger, that's a start. I'm not asking for absolutes. I'm asking for concrete proposals. If a town is debating how to build a school, it is not enough to get up in the town meeting and say, "We need to be flexible and intelligent, adaptable and open to change." Yes, sure, right. But at some point, what is needed is an architect's proposal, and finance proposal, etc. - suggestions as to what exactly should be done. The same is true when the question is how to build a large nation's retirement system.

ReplyDeleteI believe that the payroll tax haul is currently about 35% of total federal tax revenues. So eliminating it altogether will add about a trillion dollars to the current deficit and bring it up to somewhere around $1.7 trillion. And of course, as the share of retirees to the rest of the population continues to increase, the gap between outlays and revenues will rise.

Now the issue here is not "solvency", since as we all accept that the US government can always issue liabilities in some form or other to make whatever dollar payments it is determined to make. The issue is whether any estimated spending and revenue trajectory is sustainable within the bounds of an acceptable monetary policy (price stability policy). MMTers all accept that one purpose of taxation is to help regulate demand and prevent unacceptable price instability. So is a $1.7 trillion deficit in 2015 consistent with those goal? How about $2 trillion? How about $3 trillion? And more importantly, what tools do we use to answer these questions? What's the formula - even roughly?

Be aware that any attempt to deal with these issues responsibly requires a certain amount of political foresight and long-range planning. If the rate of inflation suddenly shoots up to 10% some year, or begins to oscillate wildly and unpredictably, it will be very hard for politicians to suddenly increase taxes on everyone by some large and decisive amount to cool down nominal spending. Rightly or wrongly, voters tend to respond to infaltion as a threat to their standard of living, and will be in no mood for an emergency tax increase when things get bad. Nor is the proposal, "The Fed chair can throw the economy into reverse and engineer a Volcker-style recession" the kind of proposal we should be happy with.

Roger, this kind of statement:

ReplyDelete"when the time comes, we'll do what we've always done ... Congress will decide what the country needs and then we'll appropriate the funds."

... has nothing to do with the government's role as a supplier of fiat money. Appropriating funds is something a legislature does with an appropriations bill. Even state legislatures appropriate funds, and they are not fiat money suppliers.

My guess is that almost everyone at those meetings you attend understands perfectly well that a government can print money (or issue it in some other electronic way). But if you got up at those meetings and said,

"When the time comes, Congress will just issue new money to pay the bills."

everyone there would think you were a wild-eyed refugee from some incompetently governed banana republic, and they would firmly say, "No thank you. I think I will NOT be Nigeria today."

Now, at this point, answers can be given. But it is not a good answer to say, "Well sometimes money creation can be excessive and lead to excessive nominal demand and high price inflation; but sometimes it isn't and doesn't." What is needed is a more precise policy rule, one that can be implemented in the real world, that would allow a responsible policy maker to know the difference between the two.

Dan, either the MMT economists are missing what you consider necessary, or they have decided on a different strategy. I suspect the later.

ReplyDeleteSame with the armchair critics of Occupy that assert the movement "failed" because they didn't put forward "demands", i.e., a policy proposal.

Dan K: '"when the time comes, we'll do what we've always done ... Congress will decide what the country needs and then we'll appropriate the funds."

ReplyDelete... has nothing to do with the government's role as a supplier of fiat money.'

Actually, it does. You had to be there. The last comment of that type I heard was preceded by a direct q&a:

Q - "But how will we ramp up defense spending when we're running out of money? What about the deficit?"

A - "I think the whole deficit debate is a copout. [we'll just appropriate as usual]"

And these were GOP members.

A - "I think the whole deficit debate is a copout. [we'll just appropriate as usual]"

ReplyDeleteThat just means, "We'll appropriate the money, whether we get new revenues or not, running a deficit if needed."

Dan K: "If the rate of inflation suddenly shoots up to 10% some year, or begins to oscillate wildly and unpredictably, it will be very hard for politicians to suddenly increase taxes on everyone by some large and decisive amount to cool down nominal spending. "

ReplyDeleteThere are 1001 combinations of things (even more) to do, if inflation gets out of hand. Your statement is akin to saying it was impossible to mobilize our electorate like we did in WWII. Nevertheless, we did, by doing whatever was found to work, even though NONE of it was predicted, or predictable.

If anyone could predict anything, there wouldn't BE the phenomenon of evolution - but there is.

As Tom said, inflation is a balance of supply & demand, and either can be adjusted in endless ways, through policy imagination. You can try to predict all you want, but we have zero predictive power, and seemingly infinite adaptive power.

Better to just get all heads together when a bridge appears, before stating how you'll cross it.

You weren't listening, and missed the whole point of the classic lesson of all war/biz/policy plans going out the window as soon as the next day of reality sets in. It's actually better NOT to say how things WILL be solved, because it literally never turns out that way, except in trivial examples.

No improvisation, no adaptation.

Dan K: "My guess is that almost everyone at those meetings you attend understands perfectly well that a government can print money (or issue it in some other electronic way)."

ReplyDeleteFirst, we can't rely upon guesses.

Second, I've seen proof that your guess is wrong. Have you visited either House of Congress & asked either reps or their staff? I have.

Dan K: 'But if you got up at those meetings and said,

"When the time comes, Congress will just issue new money to pay the bills."

I guarantee you that that is exactly what experienced Senators have told junior politicians (in off-the-record presentations) - I've seen it in person.

Dan K: 'everyone there would think you were a wild-eyed refugee from some incompetently governed banana republic'

Let me repeat, to be clear. When these exchanges have occurred, the junior pols just shut up (you can hear a pin drop in the room), accept it, and go back to other forms of horse trading.

You've heard similar stories from Mosler, Wray & Kelton. It's all true. Experienced Congresspeople admit in private what they're not willing to say in public. Most junior pols

just avoid the topic like the plague.

That, in a nutshell, is exactly why it's worthwhile beating this dead horse, until at least 10% of pols & voters admit the poor horse really is dead.

The level of discussion in politics really is lower than you can possible imagine. Largely because of the declining quality of the people we elect, and the inadequate staffs we allow them to hire.

Dan K: 'That just means, "We'll appropriate the money, whether we get new revenues or not, running a deficit if needed."

ReplyDeleteAgain, you had to have been there. Some of th highly experienced Congresspeople (e.g., those on budget/finance committees) understand that "fiscal deficit" is just a peculiar jargon, & with no more meaning than saying population growth is matched by an equal & opposite "population deficit" in double-entry tracking of population.

It's the junior pols who are totally unpracticed in even discussing dynamic instead of static systems.

You'd really have to visit the halls of Congress & be at some of their press conferences to get a sense of this, Dan. Or better yet, hear pols talk in more relaxed, off-the-record Beltway lobbyist conferences.

Go up to Sacramento and survey some of your California state Reps & Senators. Take your own poll, instead of guessing.

There is no constraint other than reality.

ReplyDeleteFor a human being, the inroad to reality has always been through ‘Vision’. The lifting of a curtain over the familiar landscape of human existence, to reveal more of what is actually there. A fresh look at our purpose. Human creativity has always followed the path of Ideals >> Ideas >> Icon - proposals and ideas knit into a plan by the millions of DanK-like people of this world, and built as Icons by the artisans. But these have always been subject to Vision and Purpose (Ideals). Planners would turn the exquisite blue dome of the sky into a billboard, with lurid colours flashing just about everywhere, propagating Illusion – just like they do our cities. So, not a fresh look at what we create on the outside: the society and everything people do each day to propagate it. But at a look at who we are: as a being, a consciousness, extant on planet earth, for seventy laps around the Sun. What do you want – and why do you want it? As a being, what do You long for? One day (and soon), you will no longer exist (at least in your present form is certain) – so what motivates you; what is Your Point? Where are You going? Who are you - forever caught up in this moment called NOW! This has always been the province of Vision. There has always been the Plan of that Universal Energy, working out in Creation – one of its little pastimes has been the creation of the human being: then there are the plans of the humans themselves! One set of plans belongs to Reality: the other to our Dreamtime, our Imagination – there will be a time when looking back on out modern age with its preoccupation with $ and the fabric of our little creative efforts, and the hypnotic aggrandisement of the ‘I’ - will seem just as primitive as our view of Stone Age cave-dwellers with no cell-phones to enlighten them. Our modern-day Neanderthals are hard at work: but even they get their day in the Sun.

It is the consciousness that creates whatever is on the outside, and human history can be viewed from that particular angle. Unfortunately, the people with the greatest grasp of this are the advertisers. Planning and proposals play their part, but it is from consciousness Ideals emerge.

The ultimate reality is within, and it is that experience and unlimited Universal Energy which conditioning consciousness, will ultimately condition that which is without. This means the human being has to ‘stand under’ to understand. If you think of an infinite Generator hooked up through an almost unlimited network, stepping down, stepping down, to a little 5W bulb you will get the picture. It always pays to be humble; otherwise you draw too much current that you are not equipped for. Without understanding, consciousness reels from pillar to post, blindly reacting to what is happening on the outside, or within its own ring-pass-not. I think DanK is right to focus on concrete proposals, logic, and working things through – but only in the context of Ideals >> Ideas >> Icons. By design, this little bulb was built to glow! That is THE PLAN.

But that is a profound conversation, spanning Time. I think Science is actually closer to it these days than any other aspect of human inquiry. Religion, Philosophy, Law, Politics and Psychology all seem to be looking in the rear view mirror? (Hopefully Tom can correct me here?). Dissolving the material ‘atom’ into energy was a step in the right direction, but typically, under the pull to the outside this ‘revelation’ became concretised and captured by our modern-day Neanderthals. Transferring the origins of consciousness from the material atom to the Self (Universal Energy) was set out by Patanjali perhaps 10,000 years ago and is not something new. Then mind and the human heart are seen in an entirely different light. Change is forever on its way and geometrically. The distance traversed over the last 200,000 years just a few steps I feel, compared to our real potential.

(Cont.)

ReplyDeleteThe skin of the earth, its resources, people and their values, a means of exchange ….. all of this is by courtesy of that Energy; whether it is known or not. Ignorance and unconsciousness are immaterial in the end – that little bulb lighting up is written in the stars. This is Knowledge and this is Certainty. The Key is in the human heart. But even without this lifting of the veil, the human Spirit dares to span the abyss, across a seemingly endless hiatus - dares to Hope and Believe - with only half a bridge. The materials are of the human intellect, and experts fish off this half-bridge hoping to catch something. But of course it would be better to know than hope and believe.

The banality of the monetary system is, it is just a plug-in, coded to do ANYTHING you want it to do. People who say the software of this monetary plug-in, is locked in concrete, don’t know how to breathe.

For me, the biggest and dumbest joke is, $money is like fresh air and sunshine: absolutely abundant – its power to shift resources constrained only by human covetousness and stupidity. It is incredibly painful watching the experts, mean and grasping - talking through their fishermen’s hats. Their focus is predictably the ‘I’ – its aggrandisement: ‘look at my catch’. There is no real intelligence in such a focus. Still, there are many who struggle sincerely dismayed by the human condition. But the social conditioning is too great and the path of the heart not understood.

Over the millennia people have become so indoctrinated by the institutionalisation and socialisation, enshrinement of their concept of money – it has become a heavy yoke locked firmly over our heads; and a ball-and-chain around our feet. Do you know - do you ever consider - the real human being, the one whom you really are: you gain absolutely no benefit at all in the sense of your existence, not one step is taken – when you covet some aspect of the fabric of this world. Desire leads you out into a desert and dumps you there, unfulfilled. Then maybe you feel like an idiot …. Maybe you get a little more street-wise; develop the intellect a little as servant to your desire - but not existence-wise?

A plug-in is meant to control a machine; but a living human being?

The output of this plug-in leaves millions on the planet in dire need, the rest enslaved: - the planet turned into a belching factory or a theatre for war, an asylum where ‘I’s do battle - the ‘bulls of the earth’ locking horns. In the heat of the battle the rest of the herd is endangered and suffers; especially the more vulnerable including children. Is this the noblest aspiration of the human being? Humans chained like battery hens to the factory conveyor belt, or working like beasts of burden out in the fields; the planet trashed and polluted. Or manacled to their cell-phones,on-call 24/7. Human doings frenetically chasing a miasma. Is this a human being?

For me, money is simple: - it is meant to facilitate ministering to real human need. There is no point in banging on about the finiteness of human and planetary resources when the real issue is human creativity and consciousness. Freedom of the human spirit to rise and dance the dance of enjoyment in being alive! To live life to the full and learn. To enjoy our little moment in the Sun. And not be caught up like spiders in our own web.

People who try to nail feet to the kitchen floor always have an agenda. All of the people who love to mold and fold the society into their own image.”People before money and machines”. People are real but money and machines are not. I would rather listen to the song of the Sun rising on the horizon each day, spreading its beautiful light out into the world as it passes around the planet, awakening everything to the new day; or the beautiful harmonies of the stars as they move across the heavens serenely at night, or the wind as it blows amongst the leaves and ripples the ponds, than the proposals of the men who fish blindly off a half-bridge.

(Cont.)

ReplyDeleteHow about finding out about the reality within you – discover who you are? There is more potential coded into one human being than could be coded into 10T_TB of monetary software. For me, the last 200,000 years points towards one looming crisis and beautiful opportunity–to know the Self! Of what value (for example) is kindness? Where is the Forbes list of the world’s kindest people? Who is there on the planet that can point to the unlimited value buried deep within each human heart. For a human being to respect something it has to be real, and money and the fabric of our material existence are just temporary. To our existence, they are not real and our hearts know. We too actually know – but do we understand? How kindness can make a human far wealthier than anybody in their wildest imagination could ever dream was possible; and to give away this wealth – even wealthier still?

Looking around, the world built by desire is quite incredible. What sort of world might emerge, built from an evolving energy of Love? People do not realise that Love is Energy - as real and as tangible as the material spectrum of electromagnetic radiation or its narrow band of heat and light; tangible and Forcible. Love is the second half of the bridge. Love is the foundation of a truly human world and in my understanding, human evolution leads us there. Love is fundamental to the coming science of being human – being Conscious and conscious Being. Love lifts us out of the primordial soup. Love is more than being a mere animal with an egotistical intellect, serving only desire and the ‘I’. Psychology and the other human sciences should be the study of Love; the power of Love, the wisdom hidden with Love – to unify and reveal, to unfold and lead on to the Universe within. Desire has taken us outwards, through a stage: the door to the next stage is through the human heart. Mind is useless without the heart to guide. Intellect goes around and around in circles. The heart knows what it wants – it understands cycles and direction, motivation and Will: mind left to itself swirls around in vapour.

There is a difference between those who fish off the bridge, seeking to capture something from the Hall of Knowledge, no matter how noble their aspiration, to those whose hearts awaken in the Hall of Love and Wisdom – and carry that beautiful light and beautiful energy – out into the world. This difference is in the Vision and Ideals, and is based on real experience. These men and women are, in my humble opinion, the real warriors and innovators in this world. Their focus is the heart and they value Peace. There are Masters of Peace. There have always been real Teachers come and go on the planet. All of you experts should know there is a story of far more grandeur and far-reaching scope than the proposals you dream up about a monetary system, fishing off your half-bridge. There have been Teachers and their truths are worth knowing and experiencing for oneself – their stories persist and resonate in the human soul. Their teaching underlies humanity and today is the day the outer (largely conceptual churchianity) religion must translate to the inner experience. It is the human soul, consciousness itself, which needs to be explored. It is the path to the human heart the innovators tread. Out of consciousness kindness emerges – that is only angel that can save us all.

Kabir knew and felt the power backing up this knowledge and laughed and laughed!! And was politically very incorrect …. bless his great and poetic soul!!!!!