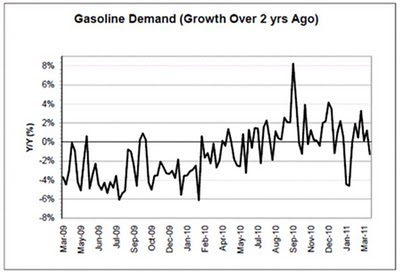

Free market ideologues would have you believe that recent gasoline price increases have to do with supply and demand. Yet a glance at the facts indicates there is no problem with supply, which recently hit a 20-year high, while demand is actually falling.

Meanwhile, open interst in gasoline futures has gone up by a factor of 18 in the past five years.

While gasoline supplies have risen and demand has fallen, open interest in gasoline on the NYMEX has increased by a factor of 18 in the past five years!! Speculators now have a claim on nearly 300 million barrels of gasoline, whereas they had practically none in 2006. And that’s just NYMEX. There’s a lot more being held in over the counter transactions.

6 comments:

Doesn't Krugman argue that speculation can only force prices up if oil/gasoline is being physically stored in increased amounts?

Yes and he's right, only he fails to see where it's being stored. It's being stored in the ground, by the Saudi's, principally. They've come to understand that it's a lot more profitable to hold onto your one resource--oil--and be long futures market, then to deplete the one asset. The game they're playing is sort of like a game of securitization. They earn income on their product without actually having to sell it.

Storage in the ground is discussed in Gold, Infinite Debt, and the Problem of Capital Storage: Has The Hotelling Moment Arrived? See the comments there, too.

Thanks guys.

Mike, you seem to be contradicting yourself here. Your post states that production has never been so high. And here, in the comment section, you say that prices are going up because the oil producers are keeping the oil in the ground... Which is it?

Severus.

No, I said inventories were high.

Post a Comment