Mike posted an update on Treasury spending the other day here and this trend continues.

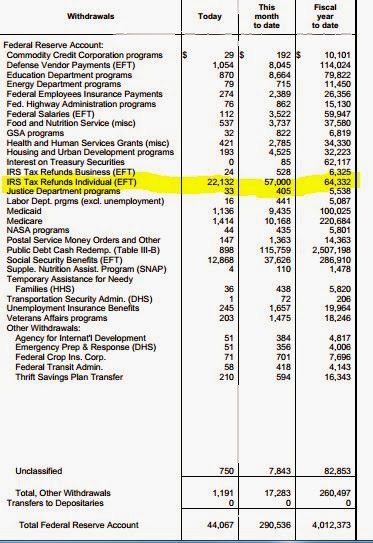

Below is a snip from today's Treasury statement and net spending is at $175B for the first 8 statement-days of the month of February. We note again here the large amount of IRS Tax Refunds continues this month as electronic filings started no earlier than the 1st of February this year.

You can see that we had a one day "helicopter drop" of $22B yesterday and an 8-day "helicopter drop" of $57B or over $7B a day being "helicopter dropped" into the non-govt sector this month so far.

This number is on track to be over $100B this month, resulting in probably a 30% MoM increase in total leading USD flow, and I will predict we will maintain "stable prices" more or less regardless. Folks who look at the potential advent of a JG or a BIG as somehow "automatically inflationary" would do well to observe these events and the resultant LACK of price instability from this $100B+ "helicopter drop" in one month.

Or they can just throw in with the morons and ignore empirical observable facts as the morons are often want to do.

Meanwhile speaking of those people in the moron cohort, all the monetarist moron libertarian metal-loving nut-jobs, over there on that traitorous side of humanity, are fretting over the "tapering" of the "Quantitative Easing" that may be "increasing the money supply" with the potential for "inflation in the money!" and are too stupid to even read a simple Accounting 101 income statement that the Treasury publishes daily to examine what the heck is really even going on with the leading flow of USD balances between the government and non-government sectors, which is going to have the REAL effect.

Are any of these people even qualified to even be having anything to do with any of this? I'd say not to say the least.

The FYoY picture is also much improved over just this short time so far in February. Interactive chart below that shows we are now only about $24B behind last FY when February started at $64B behind. The October and November months affected by the "shutdown" account for a $37B FYoY shortfall so we are making up ground this month and may be soon back to showing a more typical increase in the FYoY Treasury spending levels.

We'll keep an eye on this data to see how it comes out for the month and into the rest of the 1st quarter, but looks like any projected weakness in 1Q aggregate revenues and earnings at the big firms at this time is going to be short-lived if this short term trend in YoY Treasury spending we currently see ends up continuing.

Firms smarting from poor 4Q quarter performance may be well advised to "stay the course" a bit here in 1Q and perhaps not do anything "drastic" that may preclude them from taking advantage of what is increasingly looking like an at least small 1Q recovery.

4 comments:

Thank you Matt

Excellent.

Obamacare will drop around $250 x10,000,000 per month to insurance industry who will divert

50 - 70 percent to providers and suppliers.

Great data Matt...and the individual refund checks are almost 2x the Social Security ones...interesting. I wonder though if this is less than previous years due to the expiration and non-renewal of some of these credits this year.

"Meanwhile speaking of those people in the moron cohort, all the monetarist moron libertarian metal-loving nut-jobs, over there on that traitorous side of humanity.........are too stupid..."

Matt - Sounds like you're really trying to win over a lot of hearts and minds. By any chance do you suffer from Tourette's syndrome?

Ed,

They dont have any hearts or minds to win over... that's what makes them morons in the first place...

rsp,

Post a Comment