Yves Smith — IMF Paper Finds That Too Much Finance is Bad for Growth

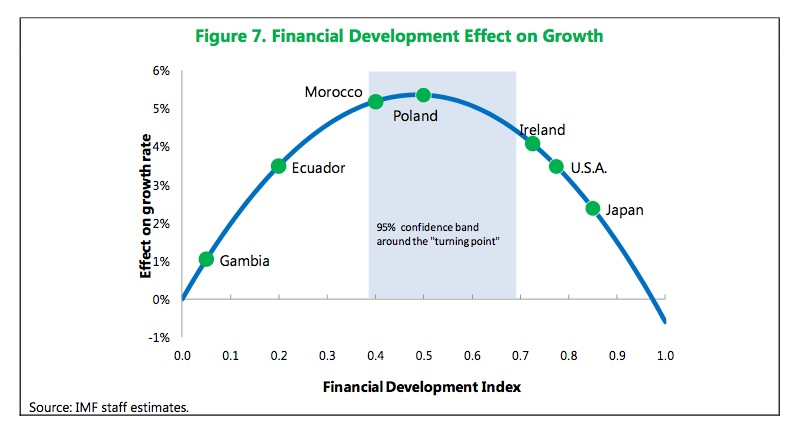

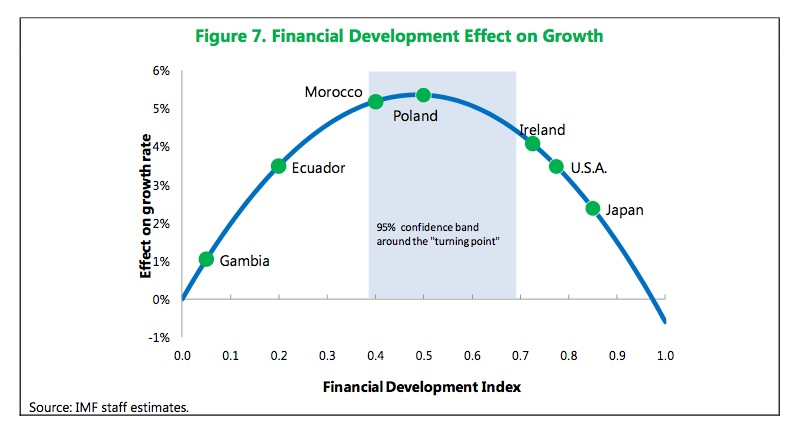

The authors have a more sophisticated and nuanced assessment than “Having a financial sector that is more developed than Poland’s is a bad idea.” From the paper:

There is no one particular point of “too much finance” that holds for all countries at all times. The shape and the location of the bell may differ across countries depending on country characteristics including income levels, institutions, and regulatory and supervisory quality. In other words, a country to the right of the average “too much finance” range may still be at its optimum if it has above average quality of regulations and supervision; conversely, a country to the left of the range with weak institutions may have reached its maximum already.

This implies that countries like the US, UK, and Japan before its crisis went pedal to the metal in the wrong direction, deregulating institutions and markets at the same time, which in combination with overt and covert subsidies, fostered explosive growth in products and trading volumes, particularly is the least regulated sectors.

The authors used the subcomponents of their index to decompose why “too much finance” hurt growth and whether certain aspects of increased financial activity might still be salutary. They concluded that excessive financialization hurt total factor productivity.….

No comments:

Post a Comment