See the comment that accompanies the cartoon. (It's short.) China is taking off the gloves.

ECNS (Chinese official English news service)

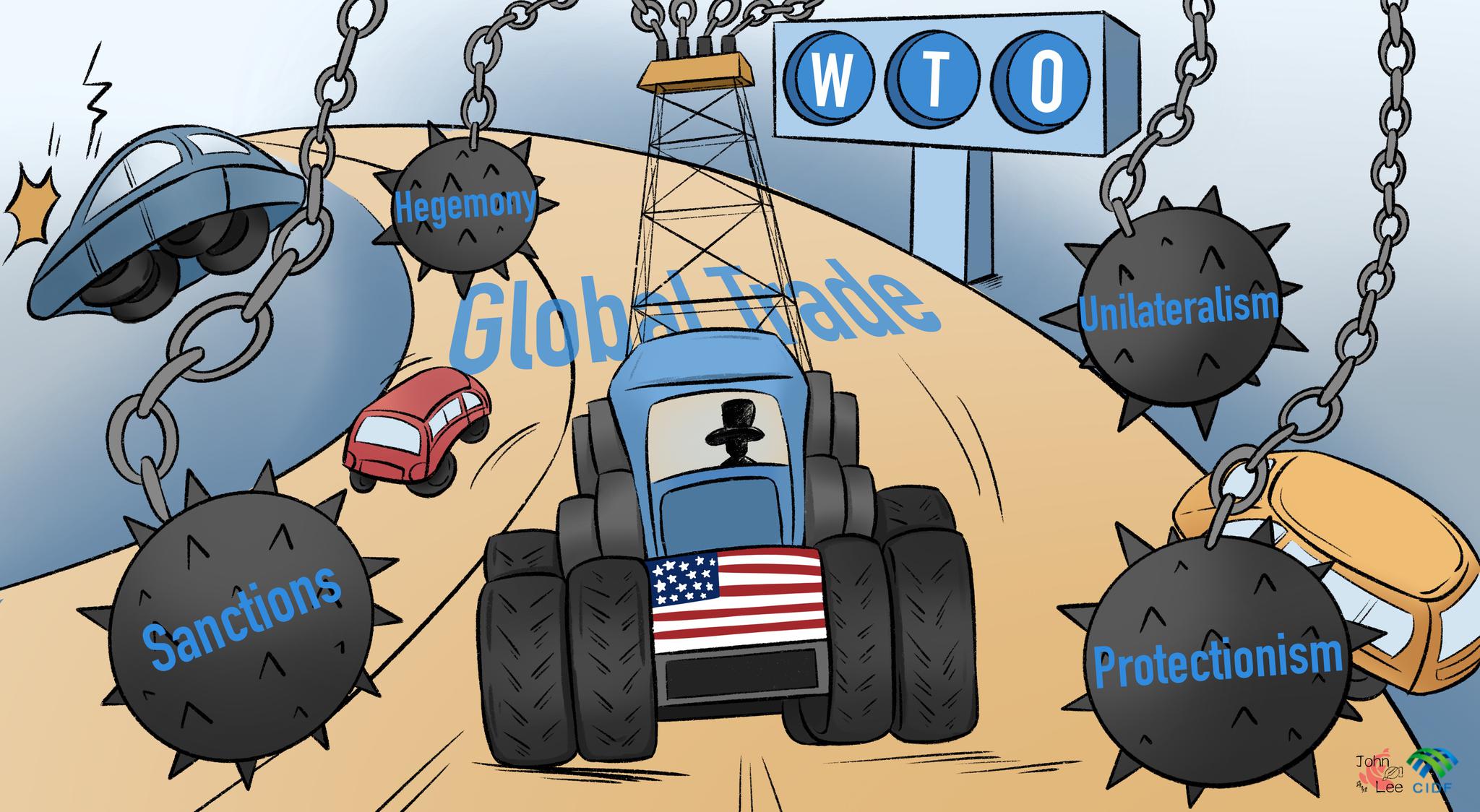

Comicomment: U.S. unilateralism, trade protectionism harm global trade

Chinese cities issue vouchers to prop up consumer spending

33 comments:

I only see the cartoon.

China banned imports from Lithuania, because Lithuania dared to do some official business with Taiwan. Behold the new bully on the block.

Oops. I forgot the link.

http://www.ecns.cn/photo/2022-12-24/detail-ihciertf7990349.shtml

Scroll down below the cartoon for the ECNS comment on it.

Why would there be opposition to Hong Kong products labelled as made in China?

The WTO will rule in the Lithuania dispute, where there are actual damages. Then the shoe might be on the other foot.

@ Tom Hickey

Funny that you should mention that, because Australia and China team up to protest WTO blockages caused by US vetoes on appeal body

@Magpie

Yes, even UUS allies are getting fed up with being put at a disadvantage by the US-centric "rules-based" order that allows the US to make the rules and not follow them if it chooses.

The Bush Doctrine of "you are with us or against us" is being challenged.

For one thing, US hegemony depends on keeping Europe separated from Russia and China economically and European prosperity depends on the opposite.

India Punchline

A German-China-Russia triangle on Ukraine

M. K. Bhadrakumar | retired diplomat with the Indian Foreign Service and former ambassador

@Peter Pan

“To be an enemy of America can be dangerous, but to be a friend is fatal.”…Henry Kissinger

Maybe the Lithuanian regime (bought & paid for by the US State Department) should have heeded those words.

If you voluntarily decide to be an attack dog of the US empire and start playing geopolitical silly buggers regarding the One China Policy don’t start crying and playing the victim card when the Chinese stop buying your EU Cartel (political-economic wing of nastynato) subsidised crap.

Your regular reminder that there is no law without enforcement.

The WTO is falling apart because the basis of international agreement is falling apart. There is no longer any consensus on the best way to conduct international trade.

As with the currencies everything will start to fall back toward bilateral arrangements, with blocs forming and ripping themselves apart as we relearn the lessons of Westphalia.

@Prince Andrew

Anyone wanting to do business with Taiwan has to go through Taipei. Beijing has no role to play - and that makes them furious. Another humiliation in their eyes.

Behind the cover story of "free" trade and globalism is the same old game of geopolitics. While Tom dreams of universality, the players are jostling for power. As they have for centuries.

"Made in Taiwan"

If that's not worthy of a WTO ruling, what is?

“ back toward bilateral arrangements”

That is the MAGA/Trump policy…

That is the MAGA/Trump policy…

Which is about as stupid as you can get.

There's no reason why bilateral trade should balance. I run a trade deficit with the supermarket. I buy thousands of dollars worth of groceries from them, and they buy nothing from me.

My wife is a hair stylist. She runs a trade surplus with her clients. They buy from her, and she buys nothing from them.

It's even worse than that. Trump wanted South Korea to run balanced trade with the US AND invest in the US... like where are they supposed to get the money to invest in the US if they don't run a trade surplus with the US?!

I'll let Michael Pettis weigh in...

TRADE CLEARS GLOBALLY, NOT BILATERALLY

The first and perhaps most obvious problem with this approach is it assumes that trade clears bilaterally. This may have been largely true 150 years ago, when transportation costs were too high to allow production across many locations, but it has become less true over time. In the first chapter of our book, Trade Wars Are Class Wars, Klein and I discuss how the global collapse in transportation, communication, and travel costs beginning in the 1980s has made bilateral trade a mostly useless measurement. Imbalances in one country are far more likely to be transmitted to another country indirectly, through other (sometimes multiple) parties, than directly through the bilateral account.

Even if we knew what to count and how to assess its employment impact, in other words, it would be meaningless to limit the discussion of the costs and benefits of trade with any one country solely to that bilateral trade account. To hammer this point home, my mentor at Columbia University, the late Michael Adler, once glared angrily at his students and warned that if any of them even mentioned bilateral trade they would immediately fail the class. Bilateral trade data convey very little about the overall trade relationship between two countries.

Trump’s Washing Machine Tariffs Stung Consumers While Lifting Corporate Profits

President Trump’s decision to impose tariffs on imported washing machines has had an odd effect: It raised prices on washing machines, as expected, but also drove up the cost of clothes dryers, which rose by $92 last year.

Research to be released on Monday by the economists Aaron Flaaen, of the Fed, and Ali Hortacsu and Felix Tintelnot, of Chicago, estimates that consumers bore between 125 percent and 225 percent of the costs of the washing machine tariffs. The authors calculate that the tariffs brought in $82 million to the United States Treasury, while raising consumer prices by $1.5 billion.

And while the tariffs did encourage foreign companies to shift more of their manufacturing to the United States and created about 1,800 new jobs, the researchers conclude that those came at a steep cost: about $817,000 per job.

Trade war backfire: Steel tariff shrapnel hits U.S. farmers

KANE COUNTY, Ill. (Reuters) - Lucas Strom, who runs a century-old family farm in rural Illinois, canceled an order to buy a new $71,000 grain storage bin last month - after the seller raised the price 5 percent in a day.

The reason: steel prices jumped right after U.S. President Donald Trump announced tariffs.

Throughout U.S. farm country, where Trump has enjoyed strong support, tariffs on steel and aluminum imports are boosting costs for equipment and infrastructure and causing some farmers and agricultural firms to scrap purchases and expansion plans, according to Reuters’ interviews with farmers, manufacturers, construction firms and food shippers.

The impact of rising steel prices on agriculture illustrates the unintended and unpredictable consequences of aggressive protectionism in a global economy. And the blow comes as farmers fear a more direct hit from retaliatory tariffs threatened by China on crops such as sorghum and soybeans, the most valuable U.S. agricultural export.

Then there is this from the same article:

The metals tariffs also hitting makers and sellers of farm equipment, from smaller firms like A&P Grain to global giants such as Deere & Co DE.N and Caterpillar Inc CAT.N. Such firms are struggling with whether and how to pass along their higher raw materials costs to farmers who are already reeling from low commodity prices amid a global grains glut.

That last part is Abba Lerner's statement about tariffs acting as an export tax, making it harder for Deere and Caterpillar to sell their equipment internationally, which destroys American jobs in the export sector.

Woke farmer...

Ex-GOP official and farmer: I wouldn’t vote for Trump again if he walked on water

Trump will have to give up his obsession with 'balanced' trade figures. It's like numerology.

If trump were president interest rates would still be zero …

Trump doesn’t care if us prices go up as a result of trade policy …as long as much of the price increases are accruing to labor share…

https://www.cnbc.com/amp/2018/01/31/pay-gains-under-trumps-best-since-the-great-recession.html

This was what trump wanted as a result of the us trade policy…

Now dumb Brandon listening to Larry summers and increasing interest rates… regressive…

“ Such firms are struggling with whether and how to pass along their higher raw materials costs to farmers who are already reeling from low commodity prices amid a global grains glut.”

So why complain that higher steel prices prevent increase in productive capacity for grains when there is already a grains glut?

Your reasoning doesn’t make financial sense… the guy shouldn’t be Loki g to increase his production in a surplus business environment … unless he is looking to gain more financial subsidies or something … which is actually what trump did with the tariff revenues …

This is like when you guys say “we’re exporting our oil!”… WE are not doing anything the oil is the property of the corporations that own it…

The issue is domestic labor policy in that there is a political preference by voters as to what we produce domestically …

The voters currently prefer that we produce more domestically so the politicians should revise the Cold War soft power offshoring policies and adjust to policies that foment onshore production…

It’s called representative government …

It’s not like we do whatever you guys think … nobody made you guys boss of the rest of us…

MMT people saying we shouldn’t produce anything here and just print money to buy it from foreigners are sounding lazy and unproductive paper pushers … and also that is not what the people want as our national policy…

So we should not do it

MMT people are mostly Art Degree people so they have not rigorously trained in STEM KSAs associated with materially productive endeavors..

So they are going to be biased against those of us that have…

Fortunately we still live in a democracy…

"a rise of one percentage point in the ratio of trade to G.D.P. increases income per person by at least one-half percent."

Empirically determined. Trade is win-win.

It makes more sense for Americans to grow corn and trade it for cars from Mexico. America gets more cars that way than if they built them themselves. Mexicans also get more corn that way than if they tried to grow the corn themselves.

Trade is a two-way street. A nation's exports finances its imports. It's equally true that a nation's imports finances its exports. You need to import from Mexico to put US dollars in their hands, so they can buy your corn.

re: the Fanjul brothers

Have you heard of the Fanjul brothers? These guys who have a lock on your sugar market:

The Fanjul brothers—Cuban born Alfonso "Alfy" Fanjul Jr., José "Pepe" Fanjul, Alexander Fanjul, and Andres Fanjul—are owners of Fanjul Corp., a vast sugar and real estate conglomerate in the United States and the Dominican Republic. It comprises the subsidiaries Domino Sugar, Florida Crystals, C&H Sugar, Redpath Sugar, former Tate & Lyle sugar companies,[2] American Sugar Refining, La Romana International Airport, and resorts surrounding La Romana, Dominican Republic. —Wikipedia

More here:

In the Kingdom of Big Sugar

After their father lost one of Cuba’s great sugar fortunes to Castro’s revolution, Alfy and Pepe Fanjul built a new empire in Florida, importing cheap Jamaican labor to do the brutal, dangerous work of sugarcane harvesting, and wielding ever more political power in Tallahassee and Washington, D.C. In 1989, outraged by what he calls “modern-day slavery,” a crusading 37-year-old lawyer named Edward Tuddenham took them to court, spawning four ongoing class-action suits on behalf of 20,000 former workers. Marie Brenner investigates an epic legal war that pits the Fanjuls’ American Dream against the nightmare of migrant laborers.

Why Americans pay more for sugar

The dispute pits some of America’s largest food companies against one of its most powerful agricultural lobbies -- and against the Trump administration itself. In doing so, it also exposes a central paradox in President Trump’s aggressive, “America first” trade approach: any policy that benefits some U.S. firms will also, inevitably, hurt others.

“Today’s announcement is a bad deal for hardworking Americans and exemplifies the worst form of crony capitalism,” said the Coalition for Sugar Reform -- which represents Coca-Cola, Nestle, Kraft Heinz and hundreds of other food companies -- in an incendiary statement. “U.S. sugar policy should empower America’s food and beverage companies to create more jobs, not put hundreds of thousands of good-paying U.S. jobs at risk just to benefit one small interest group.”

re: the effect of sugar tariffs

But higher sugar prices also come with costs -- not to farmers, but to companies that use sugar in their products. Higher ingredient costs cut into manufacturers’ margins, which has prompted several to relocate outside of the U.S.

The makers of Life Savers, Dums Dums and Jelly Belly beans have all opened factories overseas, citing the high cost of American sugar. It was implicated in the closure of a Chicago Nabisco plant last summer, which resulted in the layoff of 600 people.

“From a jobs perspective, there are 600,000 people working in the sugar-using industry,” said Rick Pasco, the president of the Sweetener Users Association, which represents manufacturers. “The sugar-processing sector only employs 18,000 people.”

This article is about how Life Savers moved to Canada. The US is still importing that cheaper sugar but now in products, but we in Canada get the jobs.

Life Savers takes business to Canada over sugar costs

But not much longer. Kraft Foods is shutting the 35-year-old factory in this prosperous western Michigan city and shifting production of the American candy icon to Canada. Kraft rejected a last-ditch $38 million incentive package from Michigan last week and said its decision "is based on factors over which the state has no control."

This is death by sugar. Although Kraft officials cited several reasons for the decision to shutter the 600-employee plant, the high cost of sugar that has led to the closure of candy producers in Chicago in the last several years was a major factor.

The exit of Life Savers could loom larger as an issue as the U.S. Senate revisits the farm bill, the jealously guarded larder of agriculture tariffs and subsidies that, in the case of sugar, are directly responsible for sugar costing roughly twice as much in the U.S. as it does in Canada and Mexico. Through import quotas, the $1.8 billion sugar program is designed to shield sugar growers from lower-priced imports, but the economic law of unintended consequences and the complicated politics of sugar are driving some American candy manufacturers out of business or out of the country.

"If we believe it is in America's national interest to have a sugar industry, there are better ways to help it than this," said Rep. Peter Hoekstra (R-Mich.), who lives in Holland. "This [sugar program] is tampering with the market."

The mathematics of candy production--a Life Saver is about 99 percent sugar--provides no comfort to those who worry about the future.

Steel tariffs also cost jobs, despite the fact that they are meant to protect jobs. Note like in the example of sugar, the foreign steel still comes into the US but this time in manufactured products and it comes in in larger quantities. (bold mine)

First, U.S. mills produce about 80% of the steel needed in this country; the remainder is imported. Import restrictions cause the price for all steel to rise, not just steel from overseas. Steel mills enjoy higher prices on the 80% of the market they serve; users must pay the higher costs on 100% of domestic consumption. Since costs to users are substantially greater than benefits to producers, the economy as a whole loses. America ends up poorer because of steel protection.

Second, steel producers constitute a much smaller portion of the economy than do steel consumers. As of 2019, there were 144,000 workers in steel mills. They added $31 billion of value to the economy, which is equivalent to 0.15% of GDP. Companies that buy steel and make useful things out of it, however, have a much bigger footprint. They employ 6.7 million workers and produce an economic value-add of $1.1 trillion (5.4% of GDP). So steel users employ 46 times more people and add 35 times more to GDP than do steel producers.

Although it may not be well understood by the Biden team, U.S. manufacturers of finished goods can find it exceedingly difficult to compete with imported products made with world-price steel. The reality is steel tariffs are a highly effective mechanism for decreasing the international competitiveness of the manufacturing sector. Imported finished goods made with world-price steel often can handily undersell U.S. products. It’s not easy to succeed in manufacturing when the government is going out of its way to raise your costs.

Not surprisingly, reduced competitiveness is leading to job losses. A pre-pandemic February 2020 analysis by economists Lydia Cox (Harvard) and Kadee Russ (UC-Davis) found tariffs may have led to the addition of roughly 1,000 workers in steel mills. However, they caused the elimination of 75,000 jobs at value-added manufacturers. Many of those were the very “good-paying union jobs” of which the Biden administration is so fond.

Steel is not as important as food, but it deserves some protection. Consider it a national security issue.

The "national defense" argument

Civilian manufacturing capacity is now ALMOST ENTIRELY USELESS for defense purposes. Whereas in WWII, auto assembly lines could be used to make planes & tanks, and Singer made guns instead of sewing machines… Now all but the most basic defense products (personal firearms, sewing of uniforms, etc) must be made by specialized expert-firms. Super-weapons such as the F-22/F-35, M1A3 Abrams (it’s under development now), and whatever we make when we finally field a next-generation artillery piece (cancelling the Crusader was a mistake, btw) require such a specialized knowledge-base & facilities, that they MUST be made by a dedicated defense industry – something we have (on a best-in-the-world level). Re-purposing a factory that built 2-ton SUVs to build 70-ton tanks just isn’t happening. Even if it could, how much experience does your average auto-worker have in assembling uranium-ceramic-steel-composite armor properly, so as to maintain it’s ability to take 125mm KE hits?

A final point on this issue, is that modern war moves to fast to ‘develop and manufacture new products after the fact, using civilian industries’. It’s a ‘run what ya brung’ sort of affair

The US cannot manufacture enough artillery shells to help their Ukie proxies. Yet you have these traitorous economists arguing that civilian manufacturing capacity is useless for defense (say military) purposes.

Hey Ahmed, are you working for Putin? And Xi?

All these brainwashed economists waxing eloquent about workers losing their jobs because of tariffs... well then, why don't you advocate for a job guarantee?

All these brainwashed economists waxing eloquent about workers losing their jobs because of tariffs...

That's not what the articles I quoted said. They said "losing their jobs in the steel-using industries".

Trade does not destroy jobs in aggregate. It changes the mix of jobs. Trade wars take you back to where you were before you started trading, but GDP falls because you're now less efficient. You also bear the cost of stranded assets.

Trade Wars, Stranded Assets, and the Stock Market (Wonkish)

Yet there is a reason why stock prices might overshoot the overall economic costs of a trade war. For a trade war that “deglobalized” the U.S. economy would require a big reallocation of resources, including capital. Yet you go to trade war with the capital you have, not the capital you’re eventually going to want – and stocks are claims on the capital we have now, not the capital we’ll need if America goes all in on Trumponomics.

Or to put it another way, a trade war would produce a lot of stranded assets.

First, about the costs of trade war. This is the wonkish part, so feel free to skim and don’t worry if it seems incomprehensible, as long as you’re willing to accept the bottom line for the sake of argument.

The costs of protectionism, according to conventional economic theory, are not that tariffs caused the Great Depression, or anything like that. They come, instead, from moving your economy away from things you’re relatively good at to things you aren’t. American workers could sew clothes together, instead of importing apparel from Bangladesh; in fact, we’d surely produce more pajamas per person-hour than the Bangladeshis do. But our productivity advantage is much bigger in other things, so there’s an efficiency gain – for both economies – in having us concentrate on the things we do best.

Trade causes a shock in one direction, lessening trade causes a shock back in the other direction.

Meanwhile, the factories that do exist were built to serve globalized production – and many of them would be marginalized, maybe even made worthless, by tariffs that broke up those global value chains. That is, they would become stranded assets. Call it the anti-China shock.

Of course, it wouldn’t just be factories left stranded by a trade war. A lot of people would be stranded too. The point of the famous “China shock” paper by Autor et al wasn’t that rapid trade growth made America as a whole poorer, it was that rapid changes in the location of production displaced a significant number of workers, creating personal hardship and hurting their communities. The irony is that an anti-China shock would do exactly the same thing. And I, at least, care more about the impact on workers than the impact on capital.

If you have a steel tariff you can apply it to the steel content of finished products too…

More bureaucracy to count up how much steel in each imported product adds to costs in society. Then the other countries put tariffs on you, which hurts your export sector.

Like China and soybeans.

Trade does not destroy jobs in aggregate. It changes the mix of jobs.

Tariffs are a tax, leading to a downturn if not offset by increased spending.

Without a JG, displaced workers end up underemployed, long-term unemployed, and otherwise see their real wages diminish. It's quite telling that the opposite rarely happens for displaced workers.

Have you forgotten that this is an MMT-aware blog?

As for a trade war, that is just posturing for geopolitical aims. There is a great deal of trade that is mutually beneficial and would continue but for political interference. Wars that effect ordinary people are kinetic.

affect ^

“ More bureaucracy to count up how much steel in each imported product ”

One person’s bureaucracy is another persons Job Guarantee….

There's an endless supply of free trade globalism propaganda - thanks to academic job guarantees...

Post a Comment