SummarySeeking Alpha

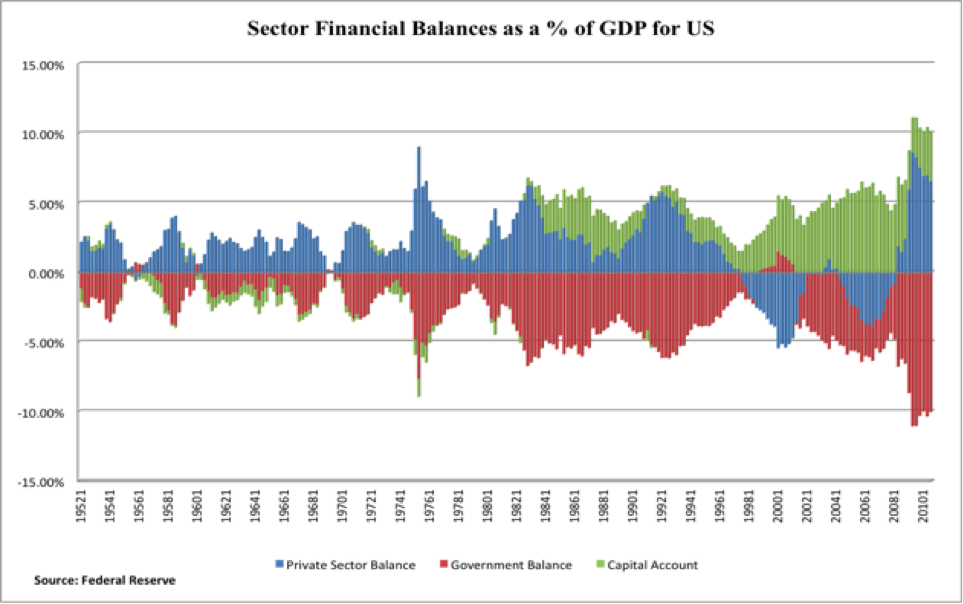

- The US budget deficit is $147 billion in March 2019; this is a net add to private domestic sector income.

- Dollars added to the economy by the federal government allow the private sector to post a $147 billion surplus and add to its stock of net financial assets.

- Private credit growth was again flat and added less than $1.8 billion to the money supply. A big drop from the January contribution of over $70B.

- Further, income flows from the national government impact investment markets with a one-month lag, and so, can be a useful predictive tool. April is looking good up until the 15th when Federal income tax is paid and markets will fall into May 2019.

U.S. Private Domestic Sector Balance Books A $147 Billion Surplus Through March 2019

Alan Longbon