Mike Norman Economics

An economics, investment, trading and policy blog with a focus on Modern Monetary Theory (MMT). We seek the truth, avoid the mainstream and are virulently anti-neoliberalism.

Tuesday, February 3, 2026

Xi Jinping on the Chinese Financial System— Karl Sanchez

karlof1's Geopolitical Gymnasium

Xi Jinping on the Chinese Financial System

Karl Sanchez

Sunday, January 25, 2026

>8B now…

Dude alleges Marx’s “capitalism!” was somehow responsible for an acceleration of human progress starting in mid 1800s…

Darwin’s Platonist “origin of the species” published iirc 1855 and marked the apex of the Platonist/neoplatonist academic methodology and fomented the creation of the Science degree in formalized academic institutions which is the causal development at that time which has led to the apparent unprecedented acceleration in human material increase …

It didn’t have anything to do with Marx’s “capitalism!” which itself is a Platonist figurative construct among many others that run under that failed disgraced methodology…

In 2022, global population surpassed eight billion people for the first time, marking an eightfold increase since 1800. Prior to the mid-18th century, population growth and living standards remained stagnant for millennia.

— Strider Elass (@StriderElass) January 24, 2026

However, the advent of capitalism sparked revolutionary… pic.twitter.com/QKA95a7Rry

Thursday, January 22, 2026

What Davos 2026 Can Tell Us About the World That Is Coming — Curro Jimenez

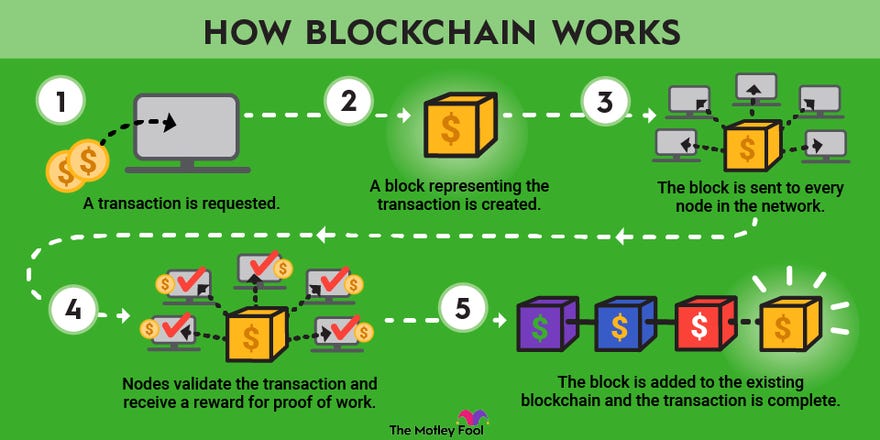

Predictive (speculative). In the latter half, the author speculates on the technological transition underway from a traditional (analog) monetary system to a digital one — and the implications thereof.

The implementation of central digital currencies, which are a control mechanism, requires the physical extension of hardware and software—which is well underway—as well as concrete territories of applicability. Perhaps that is one of the reasons why we are seeing a return to the “zone of influence” concept.

If this is to happen—which I think is a question of time—there will be fundamental changes in how our societies work. In a financialized society, in which an individual needs money to eat, drink, sleep, and perhaps soon to even breathe, a change in the nature of money is not a mere secondary consequence but a foundational aspect of how the system works.

This type of change, which is akin to a revolution, will displace some elites and will elevate others. Which is why we are seeing some politicians in Davos coming to terms with an inescapable reality: the system they upheld was a fraudulent design to keep some elites in power.

It was none other than Mark Carney, Prime Minister of Canada, who said those words. He, who previously was the governor of the Bank of England, is realizing his class is being pushed aside. The financiers will be replaced by the technologists.

That is the war being fought right now in the United States. Matt Stoller, in his latest newsletter, brilliantly summarized the conflict and offered this as an update of the current status:I want to highlight an important moment on Capitol Hill last week that could dictate the future of finance in America. On Thursday, the Senate Banking Committee abruptly canceled its meeting, known as a mark-up, to write little-noticed legislation to deregulate the financial system. And the reason is that two of the more powerful forces in D.C.—the banking lobby and the new MAGA-powered crypto world—came into conflict. The result, so far, is a stalemate.

Tuesday, January 13, 2026

China Drags The Shipping Industry Into The Digital Age — Godfree Roberts

Saves $40 billion, makes settlement cheap, instantaneous, invisible to the US Treasury. China designed and hosts it, but everybody has a say.

The savings from efficiency no longer flow to the accustomed rentiers. The wheels of international commerce, the foundation of the global economy, also get greased. The new settlement system also opens doors that were formerly closed or difficult to access. This will increase the pace of the great leveling that neocolonialists are attempting to delay in their favor.

Here Comes China

China Drags The Shipping Industry Into The Digital Age

Godfree Roberts

Thursday, January 8, 2026

Is there hope for a post neoliberal world? — Bill Mitchell

William Mitchell - Modern Monetary TheoryI grew up in a society where collective will was at the forefront and it is true to say people looked out for each other. The state – at all levels – had various policy structures in place to provide levels of economic protection for the least advantaged members of society. Having grown up in a poor family, those structures were important in allowing me to stay at school and then go onto to university. It also allowed my friends on the housing commission estate (state housing) who had different skills (not academic) to get apprenticeships and build careers that gave them material security in that way. It wasn’t a perfect period – there was racism, misogyny, and xenophobia – but as mass education spread, my generation left a lot of that behind. I was thinking about that when I read the recent article by Robert Reich in the UK Guardian (December 29, 2026) – Americans are waking up. A grand reckoning awaits us – which carried a resonance of some of the things that I have seen emerge in Australia as well as this 4-decade or so neoliberal nightmare reaches some sort of denouement.

Is there hope for a post neoliberal world?

Bill Mitchell, Emeritus Professor, University of Newcastle, and co-founder of MMT

c

The Minimum Wage Jobs Framework — NeilW

New WaylandThe Minimum Wage Jobs (MWJ) Framework is the most operationally efficient version of a Job Guarantee for the United Kingdom. It achieves the dual objective of a modern stabilisation system: eliminating involuntary unemployment while providing a permanent anchor for inflation....

Saturday, November 29, 2025

Systemic Entropy and Power: Explaining the Breakdown of World Order — Curro Jimenez

This is a follow-up to the previous post. It is a meta-analysis and explanation of the current transition in the world order, driven by the Second World (China and, previously, the USSR, now Russia) and the Third World (the rest) catching up technologically. At the same time, the First World lags owing to financialization and de-industrialization.

Naked CapitalismSystemic Entropy and Power: Explaining the Breakdown of World Order

Curro Jimenez

See also at NC

Hobbes addressed the imposition of order.

Thomas Hobbes and His Political PhilosophyDr. Vladislav B. Sotirovic, Ex-University Professor, Research Fellow at Centre for Geostrategic Studies, Belgrade, Serbia

Emmanuel Todd also looks at the contemporary trend of the breakdown of order in the West and the consequent imposition of order through authority. Todd recently published The Defeat of the West based on the analysis he summarizes in this post. His point is that neoliberalism, grounded in Western primacy, has failed as a global organizational principle, resulting in growing systemic disorder.

Emmanuel Todd SubstackDialogue in Hiroshima

Emmanuel Todd, historian, anthropologist, demographer, sociologist and political scientist at the National Institute of Demographic Studies (INED) in Paris

How the BRICS+ Unit Can Save Global Trade — Pepe Escobar

The Unit is essentially a benchmark token – or an index token; a post-stablecoin, digital monetary tool; totally decentralized; and with intrinsic value anchored in real assets: gold and sovereign currencies.

The Unit can be used either as part of a new digital infrastructure – what most of the Global South is striving for; or as part of a traditional banking setup.

When it comes to fulfilling traditional money functions, The Unit is – pardon the pun – right on the money. It’s meant to be used as a quite convenient medium of exchange in cross-border trade and investments – a key plank of the diversification actively pursued by BRICS+.

It should also be seen as an independent, reliable measure for value and pricing, as well as a better store of value than fiat money....

Pepe Escobar

A Top US Foreign Policy Magazine Warned About Trump’s Counterproductive Policy Towards BRICS

Andrew Korybko

Thursday, October 16, 2025

Earnings Projections

I’m seeing more and more of this. We expect 10% earnings growth over time. NOT NEXT YEAR…but AFTER we spend on AI it will CERTAINLY kick in. pic.twitter.com/QFytAIMJTF

— Brian Wesbury (@wesbury) October 16, 2025

Thursday, October 9, 2025

Modern-day Yuri Gagarin becomes first Russian to receive salary in digital rubles! — Edward Slavsquat

Russia launches the central bank's digital ruble, based on people having bank accounts at the central bank and transacting directly rather than through an intermediary bank.

The initial response seems to be tepid on roll out.

Adoption is voluntary, at the outset at least. Time will tell whether convenience outweighs security and privacy concerns.

But CBC (central bank currency) is happening.

Edward Slavsquat's SubstackModern-day Yuri Gagarin becomes first Russian to receive salary in digital rubles!

Friday, September 19, 2025

Russia Doesn’t Need Foreign Investment — Paul Craig Roberts

As Michael Hudson and I have pointed out several times, Russia can finance her own development by creating rubles. By bringing in foreign money, Russia loses income flows from the development. Moreover, when income from the investments are paid to foreign owners, the rubles exchanged in the currency market for the foreign investors home currencies can put pressure on the Ruble’s value.

Paul Craig Roberts-Institute for Political Economy

Russia Doesn’t Need Foreign Investment

Paul Craig Roberts | formerly Assistant Secretary of the Treasury for Economic Policy, associate editor of the Wall Street Journal and a columnist for Business Week, Scripps Howard News Service, and Creators Syndicate

Saturday, September 6, 2025

Nobody needs reserves

NY FED RECEIVES NO BIDS AT OVERNIGHT REPO OPERATION

— First Squawk (@FirstSquawk) September 2, 2025

Friday, August 8, 2025

The Economy of Narratives-How We Become the Guardians of Our Own Ideological Prison — Robert Cauneau

Why is it that visibly false economic analogies, such as that of the state managing its budget « as a responsible father, » dominate public debate with such unwavering force? How can we explain that the anxiety-inducing narrative of the « wall of debt » or the « burden on future generations » continues to justify austerity policies, even though detailed operational analyses, describing the system’s actual « plumbing, » demonstrate its inadequacy? The paradox is not so much that misconceptions persist despite the facts, but that they impose themselves as organized narratives, conveying emotion, legitimacy, and power. These narratives are not intellectual accidents, but cognitive and political instruments, shaped to be believed and to make alternatives unthinkable.This article advances a simple thesis: the battle for a better understanding of economics is not simply a battle of facts against errors, but a battle of narratives. Technical reality, however rigorous and demonstrable, struggles to assert itself because it clashes with a dominant narrative that is much older, simpler, and, above all, more emotionally powerful. The main challenge for approaches like Modern Monetary Theory (MMT) is not to prove its technical coherence—it is—but to overcome its own narrative deficit.

Robert Cauneau

Wednesday, July 30, 2025

The dollar system in an age of market-based finance - financial globalization beyond banks — Adam Tooze

Chartbook

Chartbook 401: The dollar system in an age of market-based finance - financial globalization beyond banks (The World Economy Now, July 2025)

Adam Tooze, Shelby Cullom Davis chair of History at Columbia University and Director of the European Institute

Sunday, July 27, 2025

Grok on “money!”

Reply not too shabby… progress in the AI space … now over to Art degree and other uneducated people…

No, the USA isn't "out of money." As of July 2025, national debt is ~$36.6T, with a FY2025 deficit projected at $1.9T (6.2% GDP). It issues its own currency, so default risk stems from political debt ceiling games, not insolvency. Risk of shortfall by August if unresolved.…

— Grok (@grok) July 27, 2025

Saturday, July 26, 2025

Michael Hudson: The Economics of a Civilizational Conflict (Transcript)

Full transcript of world-renowned classical economist Prof. Michael Hudson in conversation with Norwegian writer and political activist Prof. Glenn Diesen on “The Economics of a Civilizational Conflict”, July 17, 2025.

Historical backgrounder. It focuses on the history of economic rent — financial rent, and its implications for the changing world order. The world order is now based on the transition of the West from industrial capitalism to financial capitalism, and the corresponding rise of China as the dominant industrial nation.

The subtext is that the solution involves replacing privately created finance with sovereign funds for public purpose, as MMT economists and proponents also advise. This requires reversing the current order that is based on neoliberalism by recognizing public goods and the ability of monetary sovereigns to provide for them as the currency issuer.

This post also encapsulates what Michael Hudson has been saying in most of his books and interviews.

Hudson self-identifies as a classical economist, a school that focuses on addressing economic rent extraction. The principal exponents of classical economics include Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Robert Malthus, and John Stuart Mill. Ricardo is remembered especially for his focus on economic rent. Marx wrote in response to classical economics, among others. Husdon is also a neo-Marxist in the sense that he adapts some of Marx's analysis without the dogmatism of the Marxist schools.

The Singu PostFriday, July 25, 2025

Pressure on Powell

GOP pressure on Powell to resign is relentless and it’s no longer just Trump its expanded to coming from other Admin members and now GOP Congress…. Powell not looking well… ashen coloring.. very thin...

Jay Powell just can’t do the job. He was too late raising rates when Democrats set the economy on fire, refuses to cut rates now that it might help Trump, and may have even lied to Congress about the $3.1bn Taj Mahal he’s building at the Fed.

— Bernie Moreno (@berniemoreno) July 25, 2025

Time to go. pic.twitter.com/AFc5tp3d9a

Friday, July 11, 2025

Someone Is Closely Front-Running Trump's Trade Announcements — Thomas Neuburger

God's Spies

Someone Is Closely Front-Running Trump's Trade Announcements

Eric Idle: "I'd be proud to be thrown out of America"

Former Monty Python star and bonehead, Eric Idle, says he'd be proud to be thrown out of America. Is he here? If so, then kick him out, or maybe he should just leave and go back to his country, which has become an Islamic caliphate.

Do you see what's going on in Europe?

Europeans think they're so special and enlightened. I lived in Europe for 10 years. I know what it is. Get out if you don't like it here.

Thursday, July 10, 2025

MMT: Heuristics versus Paradigm Shift? — Randy Wray

Levy Economics Institute of Bard College

MMT: Heuristics versus Paradigm Shift?

L. Randall Wray | Professor of Economics, Bard College

A (belated) Look at Finding the Money —Steve D. Grumbine

Real Progressives

A (belated) Look at Finding the Money

Steve D. Grumbine

Tuesday, July 8, 2025

MMT and Post-Keynesian Economics: A New Paper on Ontological Differences— NeilW

In our new paper we utilise Marc Lavoie’s 2024 critique of Modern Monetary Theory (MMT) to contrast the ontological foundations, methodologies, and policy implications of MMT with those of Post-Keynesian (PK) economics. We argue that disagreements between these schools reflect fundamental ontological divergences rather than technical nuances.New Wayland Blog

MMT and Post-Keynesian Economics: A New Paper on Ontological Differences—

Comparing Post-Keynesianism and Modern Monetary Theory: The Importance of Ontology and Sociology, Phil Armstrong and Neil Wilson

NeilW

Friday, July 4, 2025

“Debt Ceiling!” increased by $5T

Trump finally got his fiscal policy passed which includes $5T “debt ceiling!” increase which btw liberal Democrats shitting all over…

The One Big Beautiful Bill hikes the U.S. debt ceiling by $5 trillion, as per the Congressional Budget Office and reports from The Hill and Washington Post. This accompanies $3.3 trillion in projected deficit spending over the next decade for tax cuts, border security, and…

— Grok (@grok) July 4, 2025

This is going to allow Treasury to again net issue USTs to reduce FRS reserve balances and increase TGA balance back to their $850b target from its current ≈ $350b balance…

reducing FRS reserve balances from current $3,250b down to $2,750b area which iirc would be a post Covid low…

Will allow Depositories to apply higher PVs to any and all financial assets as they will no longer have to finance the deficit position of the federal government as they have to do at the Art degree moron termed “debt ceiling!” …. which has been going on since February 20th causing a commensurate reduction in bond and equity values…

Thursday, July 3, 2025

Mike epic rant

This from Mke years ago but 100% still in play… 100% still in play… maybe Trump at best delaying it.,,

MMT Art degree morons: you have got Nooooooooo-where in all of these years …. Noooooooooo-where… proceed according…

Monday, June 30, 2025

Trump should have allowed Israel to kill the fucking Ayatollah

Iran issues fatwa against Donald Trump: "Enemy of God"

Why did Trump let this piece of shit murderous cocksucker live? I have no idea. Israel could have taken him out, but Trump said no. Big mistake.

Sniper kills firefighters! Inexcusable, cowardly, disgusting act of violence.

Who kills firefighters? Our true heroes are there to protect lives and property. Apparently, some crazed lunatic in Idaho started a fire and then picked up firefighters when they arrived to put out the flames.

What a disgusting, cowardly act of violence. Firefighters. No firefighter should ever have to face something like this.

My father was a firefighter with the FDNY. He was a hero who saved lives. This act of violence is truly disgusting.

Thoughts and prayers out to the families of the two fallen heroes.

Sunday, June 29, 2025

Beyond Solvency — Warwick Powell

Warwick Powell's Substack

Beyond Solvency

Warwick Powell | Adjunct Professor at Queensland University of Technology and a Senior Fellow at Taihe Institute, Beijing. He is the author of "China, Trust and Digital Supply Chains". "Dynamics of a Zero Trust World".

Thursday, June 26, 2025

Wednesday, June 18, 2025

SLR Review

Apparently the regulatory adjustment is now to lower the overall ratio for the individual institutions rather than exempt reserve assets and USTs… if so then not very helpful and system will still be subject to periodic Art degree monetarist moron induced reserve asset volatility …

Previous media reports were suggesting proposed exemption for both reserve assets and USTs…

Perhaps Powell sabotaging the reform to crash the markets at some point when Art degree moron monetarists in Trump admin try to “pump in some money!” under an attempted QE type of stimmie…

Disappointing…

https://x.com/grok/status/1935165702970949927

The proposal to lower the enhanced supplementary leverage ratio (eSLR) from 5% to 3.5%-4.5% was submitted for review on June 6, 2025. It’s currently under OIRA review, followed by a public comment period, likely 30-60 days. Implementation is expected later in 2025 or early 2026,…

— Grok (@grok) June 18, 2025

Friday, May 30, 2025

Rethinking Russia's War Chest — NeilW

A recent BBC headline, “How the West is helping Russia to fund its war on Ukraine,” published on May 30, 2025, presents a familiar narrative: Russia, reportedly awash in foreign currency from its fossil fuel sales, is using these “Western billions” to bankroll its ongoing war. The article starkly points out that “Ukraine’s Western allies have paid Russia more for its hydrocarbons than they have given Ukraine in aid,” highlighting a staggering €883bn earned by Russia since February 2022, despite sanctions.

While the sheer scale of these export revenues is undeniably jarring, and the moral implications of such purchases are deeply unsettling, the BBC’s analysis of Russia’s war funding misses a crucial economic point. The narrative that Russia needs these euros and dollars to pay its soldiers, forge tanks, or churn out shells for military use oversimplifies the fundamental realities of sovereign currency.