An economics, investment, trading and policy blog with a focus on Modern Monetary Theory (MMT). We seek the truth, avoid the mainstream and are virulently anti-neoliberalism.

Tuesday, July 4, 2023

Debtors of the world, unite! — Liam Kennedy interviews Jayati Ghosh

Jayati Ghosh speaks about the growing debt crisis in the global south, the IMF’s never-ending affinity for austerity and the need to confront the power of financial capital.

MR Online

Debtors of the world, unite!

Liam Kennedy interviews Jayati Ghosh, Professor of Economics at the Centre for Economic Studies and Planning, School of Social Sciences, at the Jawaharlal Nehru University, in New Delhi

Will War-Torn, Power-Starved Ukraine Be World’s First Cashless Economy? (Serious Question)

Nick Corbishley

Monday, July 3, 2023

William Mitchell — A large government presence required for energy transition does not mean massive deficits are required

There appears to be confusion among those interested in Modern Monetary Theory (MMT) as to what the implications for a green transition that will fasttrack the transition to renewable energy will require by way of government. I regularly see statements that government deficits will have to be ‘massive’ for extended periods because the private (for profit) market entities will not move fast enough to deal with the climate emergency in any effective way. The confusion inherent in these claims is that they fail to separate the ‘size’ of government from any particular ‘net spending’ (deficit) recorded by government. The two outcomes are quite separable and have to be if government action is to achieve sustainable outcomes, not only in terms of environmental goals but also price stability goals. So let’s work all that out. Failing to do so, leads MMT activists to make claims that open them up to criticism from those who understand the point I am making but have different ideological agendas. So they make erroneous claims such that ‘MMT just advocates big deficits’, or that ‘MMT thinks that deficits do not matter’. But they have been lured into that position, in part, by the social media behaviour of some MMT activists.

This is now going on at scale as capital resists the changes needed to address emergent challenges in a timely way. This is being worked out that the level of the world system in terms of the Global South/East confronting the five-hundred-year dominance of the Global North, which manifests historically at present as neoliberalism, and its attendant neo-imperialism and neocolonialism. The basis is economic (control of resources), political (control of territory), and social (confrontation of cultures and ideologies). There is no "solution" to this. The solution — the replacement of this moment of history with the next moment — is being worked out on the battlefield of history in the same way that such issues always have been and competing worldviews and interests collide.

William Mitchell — Modern Monetary TheoryA large government presence required for energy transition does not mean massive deficits are required

Bill Mitchell | Professor in Economics and Director of the Centre of Full Employment and Equity (CofFEE), at University of Newcastle, NSW, Australia

Sunday, July 2, 2023

A dose of pessimism

Why the World Is on the Brink of Great Disorder

Climate risk stress tests underestimate potential financial sector losses

Henk Jan Reinders, Dirk Schoenmaker, Mathijs Van Dijk

Saturday, July 1, 2023

China’s demographic doomsayers cite the wrong data — David P. Goldman

Asia Times

China’s demographic doomsayers cite the wrong data

It Is Friday... [when Andrei posts some music]

Andrei Martyanov, former USSR naval officer and expert on Russian military and naval issues, and author of Losing Military Supremacy, The (Real) Revolution in Military Affairs, and Disintegration: Indicators of the Coming American Collapse (Clarity Press)

Wednesday, June 28, 2023

Athenian dialogues on global income inequality — Branko Milanovic

A clever take-off on Plato using the Socratic method called elenchus (which became the template for the tradition of free inquiry and open debate as a foundation of Western liberalism).

Global Inequality

Athenian dialogues on global income inequality

Branko Milanovic | Visiting Presidential Professor at City University of New York Graduate Center and senior scholar at the Stone Center on Socio-economic Inequality, senior scholar at the Luxembourg Income Study (LIS), and formerly lead economist in the World Bank's research department and senior associate at Carnegie Endowment for International Peace

China’s Response to Decoupling — Yu Yongding

Project Syndicate

China’s Response to Decoupling

Tuesday, June 27, 2023

US Congress plots to save dollar dominance amid global de-dollarization rebellion — Ben Norton

Note that there is a difference between "de-dollarization" as replacement of the USD as the dominant global reserve currency and dollar avoidance to reduce exposure to political and economic manipulation by the US government and financial system.

Geopolitical Economy ReportUS Congress plots to save dollar dominance amid global de-dollarization rebellion

Ben Norton

Chartbook 223 Acting out of ignorance: the new logic of central bank inflation-fighting — Adam Tooze

...what actually is the base rationale for action? A particularly searching answer was offered in mid-June by ECB Executive Board member Isabel Schnabel in a talk she gave in the financial center of Luxembourg.Most of the post answers this question. Depressing from an MMT standpoint.

Chartbook

Chartbook 223 Acting out of ignorance: the new logic of central bank inflation-fighting

Adam Tooze | Shelby Cullom Davis chair of History at Columbia University and serves as Director of the European Institute

Monday, June 26, 2023

MMT Basics: Interest Rates — NeilW

New Wayland

MMT Basics: Interest Rates

William Mitchell — Japan’s monetary policy experiment is working

Last week – RBA wants to destroy the livelihoods of 140,000 Australian workers – a shocking indictment of a failed state (June 22, 2023) – I wrote about the sense of being in a parallel universe when one reads official statements from the Bank of Japan and juxtaposes them against the stream of statements coming out of other central banks. The day after I wrote that post (June 23 2026), the Japanese e-Stat service (the portal for Japanese government statistics) released the latest – Monthly CPI data – which showed that the annual inflation rate fell by 0.2 points to 3.2 per cent in May, on the back of significant easing in electricity and gas prices, in part the result of government policy aimed at reducing energy prices rises in the domestic economy. Here is some more about the parallel universe. I conclude that the experiment underway between central banks is indicating that Japan’s zero interest rate regime (with fiscal expansion) is not an inflationary factor. It has not driven dangerous shifts in inflationary expectations for businesses or households. Further, the decision by the Bank of Japan not to hike rates has reduced the cost-of-living squeeze on mortgaged households that is being imposed by the (transitory) inflationary pressures. By way of contrast, other central banks have imposed extra burdens on those with debt and are engineering a massive redistribution of income from poor to rich into the bargain. As they continue with their blindness, they are risking recession and a major rise in unemployment, which will add to the pain the citizens are enduring.

Bill Mitchell | Professor in Economics and Director of the Centre of Full Employment and Equity (CofFEE), at University of Newcastle, NSW, Australia

Friday, June 23, 2023

The Greater Eurasia project: Building bridges and breaking barriers — Pepe Escobar

The Cradle

The Greater Eurasia project: Building bridges and breaking barriers

Pepe Escobar

Existing Global Financial System Exhausted, Not Up to New Challenges - French President

Thursday, June 22, 2023

More in U.S. Say Inflation Is Causing Financial Hardship

Recent poll from a month ago… the Brandon people still have a serious political problem due to “inflation!”… will be continuing to tell the monetarists at Treasury/Fed to correct this which means ever higher policy interest rates (and continued QT) still for now… headed for a “full Volcker”? 🤔

Thanks to reckless spending

— Senator John Cornyn (@JohnCornyn) May 22, 2023

by POTUS and Congressional Democrats: More in U.S. Say Inflation Is Causing Financial Hardship https://t.co/3hTwwJ73q8 #

Wednesday, June 21, 2023

The New Global Financing Pact equals the old failed global financial arrangements — Bill Mitchell

William Mitchell — Modern Monetary Theory

The New Global Financing Pact equals the old failed global financial arrangements

Bill Mitchell | Professor in Economics and Director of the Centre of Full Employment and Equity (CofFEE), at University of Newcastle, NSW, Australia

Tuesday, June 20, 2023

Art Degree hypocrites

LOL can’t even make this up…. Two Roman Catholic “hypocrites!” (Mat 23) criticizing the Church’s recommendation of the dialogic method which is the founding methodology of their entire Christian sect… UFB…

If any Christian out there is trying to figure out why all this gender bending is currently going on it’s to provide a high profile opportunity to reveal hypocrite morons like this…

Monday, June 19, 2023

Beware: pension systems about to collapse. Not! More mainstream fiction — Bill Mitchell

William Mitchell — Modern Monetary Theory

Beware: pension systems about to collapse. Not! More mainstream fiction

Bill Mitchell | Professor in Economics and Director of the Centre of Full Employment and Equity (CofFEE), at University of Newcastle, NSW, Australia

Our Systems Reward Dysfunction And Destruction: Notes From The Edge Of The Narrative Matrix

Caitlin Johnstone

Saturday, June 17, 2023

Links on geoeconomics and geopolitics

Pepe Escobar: Russia’s New Roadmap for Multipolar World

Putin and What Really Matters in the Chessboard

Demonstrative Restraint as a Recipe against Unnecessary Decisions—A reply to the article “A Difficult but Necessary Decision” by Sergei Karaganov (questioned about the use of tactical nukes, Putin said "neyt.")

Ilya S. Fabrichnikov, Council on Foreign and Defense Policy, Russia Communication Advisor

Nations lining up to join BRICS – Russian deputy FM [Sergey Ryabkov]

Chartbook 220 Biden's "new industrial policy": Revolution in the making, or an exercise in defying gravity?

Bill Black and Michael Hudson on Corruption in Finance — Patrick S. Lovell interviews Bill Black and Michael Hudson

Naked Capitalism

Bill Black and Michael Hudson on Corruption in Finance

Patrick S. Lovell, producer of The Adventure Core and The Con, interviews Bill Black and Michael Hudson

Has the West already suffered a coup d’etat? Have the central bankers already seized power?

Richard Murphy | Professor of Practice in International Political Economy at City University, London; Director of Tax Research UK; non-executive director of Cambridge Econometrics, and a member of the Progressive Economy Forum

Friday, June 16, 2023

Interest Transfer vs S&P earnings

Cumulative TTM earnings for the entire S&P 500 about $1.5T … Fed transferring 5% IOR on $3T Reserve Balances to Depositories = $150B annual… Treasury in transition process of paying 5% on $25T public debt to USD savers in Treasury Securities Accounts = (eventually) $1.25T annual….

Collectively these two are in process of providing approximately additional amount of annual free munnie equivalent to what a year of blood sweat and tears shed by all of the millions of people working at the S&Ps are earning…

And the Art Degree morons are trying to tell us this is supposed to be bearish? 🤔

Thursday, June 15, 2023

Ferrari new all time highs everyday...

Dems imposing what has to be the most regressive policy in the last 20 years at least…

Let’s go Brandon! 🤑

Ferrari new all time highs everyday.. looks like only poor see recession pic.twitter.com/rE0ZdLZtSI

— 🅰🅻🅴🆂🆂🅸🅾 (@AlessioUrban) June 14, 2023

Links — 15 June 2023

Top US Companies Admit to Hiking Prices to Pad Their Profits: Analysis

My new book is out

Lars P. Syll | Professor, Malmo University

RFK Jr. ranks higher in favorability than other major 2024 candidates: [YouGov] poll [the new maverick]

Historic German national security strategy sees beyond military [Germany had better be thinking about the economy as vital to national security,]

Our Ongoing March Into Dystopia And Oblivion

Caitlin Johnstone

Elaboration On Macron And BRICS. [Rothschild family front man]

Andrei Martyanov, former USSR naval officer and expert on Russian military and naval issues

Correcting the Record on the Origin Story of Beowulf’s Trillion Dollar Coin — Lambert Strether

I was motivated to write this post partly to [looks heavenward piously] correct the record, partly to defend the blogosphere’s importance, then and now, and partly to defend the honor of my own blogs, Naked Capitalism and (then) Corrente. I was also, quite frankly, shocked at New York Magazine’s sloppiness, and I hope any Google search brings up this post along with it.Naked Capitalism

More importantly, however, dear members of the NC commentariat, Beowulf’s Coin began as a comment, and was nurtured by unpaid and obscure bloggers who believed in it, until it caught fire. Perhaps the same will happen for one of your comments! It really is possible, as I have shown! Beowulf’s comment sets a high baseline, however, do remember.

Correcting the Record on the Origin Story of Beowulf’s Trillion Dollar Coin

Tuesday, June 13, 2023

Links — 13 June 2023

Michael Hudson at Global University, Hong Kong, on Ukraine, Europe, China, and the Dollar’s Future

How the BRI train took the road to Shangri-La

Plot to Seize Russia Makes #1 Book on Amazon

Martin Armstrong

India Punchline

The rise and rise of far-right in Germany [politics and economics]

MK. Bhadrakumar | retired diplomat with the Indian Foreign Service and former ambassador

The Climate Crisis Will Be the Mother of All Financial Crises [severe dislocation affecting the world system already being felt]

The ‘Fourth Turning’ that will define our Century

Sunday, June 11, 2023

Links — 11 June 2023

The Hegemon Will Go Full Hybrid War Against BRICS+

Naked Capitalism

Michael Hudson on the US Economy – Surprisingly Resilient or Potemkin Village? [video and transcript]

Michael Hudson | President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City, and Guest Professor at Peking University

Flassbeck Economics International

Germany and Europe: Severe recession, falling prices and a totally misguided economic policy

Heiner Flassbec

Naked Capitalism

The EU Looks to “Jungle” Sacrifice Zones to Help It Out of Energy Crisis

Conor Gallagher

The war in Ukraine and the fight over raw materials [So was Vietnam according to the US DOD]

LOSING THE WAR — WHAT COMES NEXT ON THE BATTLEFIELD, AND THE POLITICAL CONSEQUENCES

John Helmer

Real-World Economics Review Blog

Victoria Chick, 1936-2023 in memoriam

Editor

The torch has to be carried on

Lars P. Syll | Professor, Malmo University

Saturday, June 10, 2023

Still bearishness on TGA increase

Many investors short term bearish on a reduction of their figure of speech “liquidity!”…

Druckenmiller is 100% spot on here 👇 pic.twitter.com/1LGMs9FXqM

— Financelot (@FinanceLancelot) June 10, 2023

What could neuter a new bull market? A recession that knocks down earnings would be a big one, of course. But the more immediate concern is liquidity.

— Jurrien Timmer (@TimmerFidelity) June 9, 2023

With the debt ceiling finally passed, the Treasury is expected to issue at least $1.2 trillion in T-Bills, with half of that… pic.twitter.com/lwGmjNjw3w

If USD reserve balances are simply transferred from the RRP account to the TGA account there won’t be any adverse regulatory effect…

But if instead the USD reserve balances are transferred from the Depository account to the TGA account then system regulatory leverage ratio will increase allowing Depository system to apply HIGHER prices (NOT lower prices ) to remaining non-USD Reserve assets while maintaining an equivalent leverage ratio…

Though may cause more chaos in small banks that have a dearth of Reserve assets… but that would be their problem…

$400b of new Bills being issued Monday and Tuesday and will settle a few days after that… have to watch what the regulatory effect of TGA refunding is… it may be very favorable to Depositories…

Tuesday, June 6, 2023

Why China’s socialist economy is more efficient than capitalism — John Ross

Socialist China’s investment is much more efficient in creating growth than in capitalist countries such as the U.S.. As will be shown, this efficiency of China is integrally linked to the socialist character of its economy.

As usual the method will be used to use the wise Chinese dictum to “seek truth from facts”. The first section of the article will establish the facts showing the greater efficiency of China’s investment. The second section will demonstrate that the reasons for this lie in the socialist character of China’s economy....

Monday, June 5, 2023

Debt Ceiling

Art degree moron fest finally over… Now let’s see what happens…

President Joe Biden’s signature of legislation suspending the federal debt ceiling has given the Treasury Department the green light to resume net new debt issuance https://t.co/F7sKoSNIeq

— Bloomberg Markets (@markets) June 4, 2023

Consensus is bearish on the imminent Art degree figure of speech “liquidity drain!”…

Wall Street is warning markets aren't ready for a tsunami of Treasury issuance now that the debt-ceiling deal is sealed https://t.co/8Ie5pbnTk0 @marketsより

— Yanagi (@iLWCwlFgbaUIAeH) June 5, 2023

これから金利が上がりやすく、そのためスプレッドも大きくなることが予想されるので株には良くない環境になりそう。

Saturday, June 3, 2023

Primer: The Cantillon Effect — Brian Romanchuk

The Cantillon Effect is the label applied to a process described in Richard Cantillon’s , «Essai sur la nature du commerce en général», published in 1755. (One English translation of the title is “An Essay on Economic Theory.”) The basic premise is that an initial inflow of money will raise prices as the original recipients of the money spend it, which will then raise other prices as the “new money” enters others’ hands.Bond Economics

Primer: The Cantillon Effect

Brian Romanchuk

Thursday, June 1, 2023

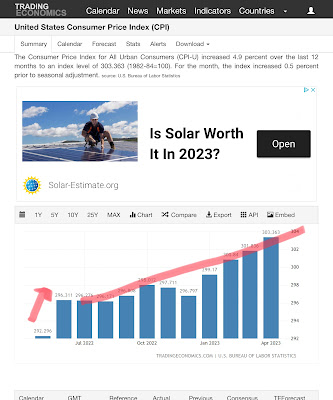

CPI

June ‘22 CPI was 296 on a impulse increase due to Brandon’s Russia sanctions… if we can get a May flat M/M then YoY is 296 to 303… 7/296 = 2.4% which is back to normal…

Will this effect the Art degree morons thinking on their figure of speech “inflation!” ?

Who knows with these deranged people…

Student loan payments

-$16B per month net fiscal flow starting Aug 1st… more regressive fiscal policy on top of regressive interest rate policy… Brandon’s economic polls should take another hit…

Student loan repayments are about to start again on August 1st, after 3 years of being able to skip without penalty.

— Wall Street Silver (@WallStreetSilv) May 31, 2023

40 million people paying an average ~$393 per month each will be pulled from the economy in discretionary spending.

Should be interesting to see how this plays… pic.twitter.com/MLYSX72IC6

Already in the toilet:

Fox News Poll: Across the board, voters say economy getting worse for them https://t.co/AwjsaqF15k

— Fox News (@FoxNews) April 27, 2023

Will get worse with these payments being reinstated and more policy interest rate increases…