Real World Economics Review Blog

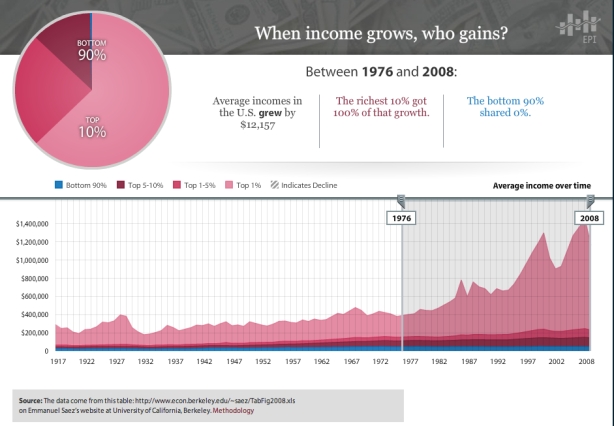

In the USA when income grows, who gains? 1976 – 2008 (chart)

David Ruccio | Professor of Economics at the University of Notre Dame

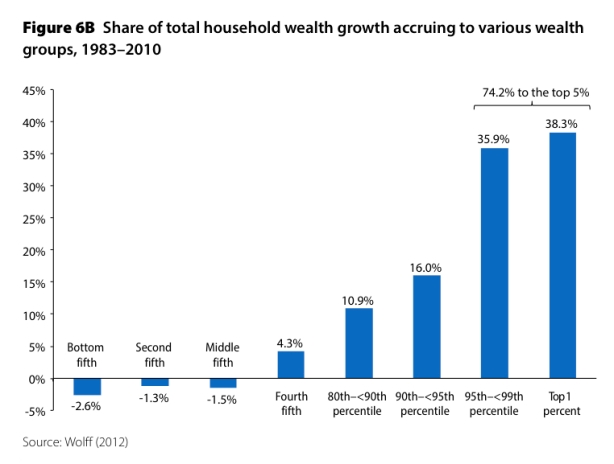

For the bottom 60 percent of households in the US, wealth declined from 1983 to 2010 (chart)

For the bottom 60 percent of households in the US, wealth declined from 1983 to 2010 (chart)

8 comments:

You can clearly see how Clinton's budget balancing affected income.

By balancing the budget he retracted government debt out of the real economy, and the real economy responded with drops across the board.

You cannot have investment "I" if there is no spending or "printing"

It's all a fight about which football team has the keys to the printing machine - that is all.

It's not fair to everyone who are passengers when the democrats and republicans are fighting over the keys to the printing vehicle while the car is in motion.

It's all agenda

Why can it not be like the judiciary and supposedly "apolitical"

there is also the 2008 downturn

shown on this graph

what was retracted from the real economy ?

nothing - it was just fake numbers disappearing

can one person on this blog tell us what monetary policy caused the down turn in 2008 ?

what was "balanced' ?

It's worth noting that the stagnation in real wages and massive increase in wealth inequality are concurrent with the age of floating exchange rates and large current account deficits, i.e. since the end of Bretton Woods.

Most Post Keynesians recommend a new form of Bretton woods agreement, with (relatively) fixed exchange rates and balanced trade, the latter to be achieved by current account surplus countries being obliged to spend their surpluses.

MMT obviously disagrees with this point of view, and it's this disagreement which really defines the main difference between MMTers and Post Keynesians.

Why can it not be like the judiciary and supposedly "apolitical"

And even the judiciary is packed with pro-business and pro-FIRE judges and justices.

y Most Post Keynesians recommend a new form of Bretton woods agreement, with (relatively) fixed exchange rates and balanced trade, the latter to be achieved by current account surplus countries being obliged to spend their surpluses.

MMT obviously disagrees with this point of view, and it's this disagreement which really defines the main difference between MMTers and Post Keynesians.

I would say that MMT economists would hold that either the PKE solution must adopted or govt has to make up for the demand leakage to exports, the flip side of which is export of US jobs abroad. Seeing imports are advantageous in real terms of trade, MMT economists recommend the latter over the former, since increasing deficits and debt to accomplish this won't lead to inflation but rather to full employment if an MMT-based economic policy is put in place.

Most Post Keynesians seem to believe in the 'balance of payments constraint', and think that at best only the US might be able to escape it, as the issuer of the dominant reserve currency.

PKE vs MMT on trade would make for an interesting tangent when the modern money & public purpose seminars at columbia get to the panel with Fullwiler and Lavoie discussing monetary v fiscal policy in a few weeks. Especially with Dean Baker moderating, he's been very vocal about the trade deficit as a root problem.

The MMT economist are most concerned with unemployment and not with the "BoP constraint," which as far as I can see don't accept it as a universal constraint, although it may be a particular one depending on the country.

There are two courses to take to FE wrt trade. 1) A country either needs to run balanced trade or it will export jobs if is a net importer, and if it is a net exporter, it's workers will be working for foreigners Or 2) the country has to offset the demand leakage with sufficient deficits and accumulated debt if it issues debt in offset of expenditure.

Post a Comment