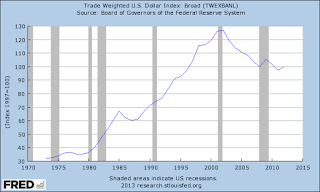

I saw in an earlier post that Randy Wray was interviewed by Thom Hartmann, where the question was posed, "Why has the dollar fallen so much since the 1970's?"

Well, it didn't. Take a look. This is the dollar index against a broad basket of currencies.

The dollar may have gone down against the major currencies, but when viewed against a broad basket of currencies, it didn't go down, it went up.

The statement that the dollar went down after we went off the gold standard is commonly put out there, but it is wrong.

Here's the link to the Fed data for anyone that's interested. Enjoy.

7 comments:

People see that prices have gone up since the 1970s and assume it's because the dollar has lost value.

Prices in nominal terms have gone up, however, purchasing power has not gone down. If you calculate how much labor hours are required to purchase and item, say, a new car, then you will see that less time is required today to purchase that car than was the case back in the 1970s. Moreover, the car you get is so much more technologically advanced--power steering and brakes, power windows, door locks, power everything, air conditioning, an engine that starts every time, even in freezing cold weather, sound systems, ABS and other built-in safety features, navigation, onboard computers, etc. You get so much more for your money today and you work less to be able to afford it. Purchasing power has gone way, way, up, so don't be fooled, as most people are, by the nominal price level. That is NOT a measure of purchasing power.

Great post, Mike. This is essential information.

Purchasing power is the right answer, of course, but there is also the question of what happened with whose purchasing power, i.e., disaggregating the data.

Purchasing power at the bottom went down since the wage of unskilled labor did not keep pace with the price level.

At the top (1% and 0.01%) , the increase in purchasing power per hour of "work" (including rent) was huge, as "productivity gains" were distributed to the top.

There is a sliding scale in between, in which the middle class did OK and the upper level (top 20%) did pretty good in terms of what an hour of work would purchase.

Perhaps a better question would be: Why have prices gone up?

And then to Tom's point: Who got the subsidies and who didn't, and why?

rsp,

We have a ways to go to get back to 1974 levels, don't we? :)

please also graph the increase in money supply under Bush and whatever they did to promote exports with the usd

Post a Comment