An economics, investment, trading and policy blog with a focus on Modern Monetary Theory (MMT). We seek the truth, avoid the mainstream and are virulently anti-neoliberalism.

Wednesday, December 9, 2020

Wednesday, September 7, 2016

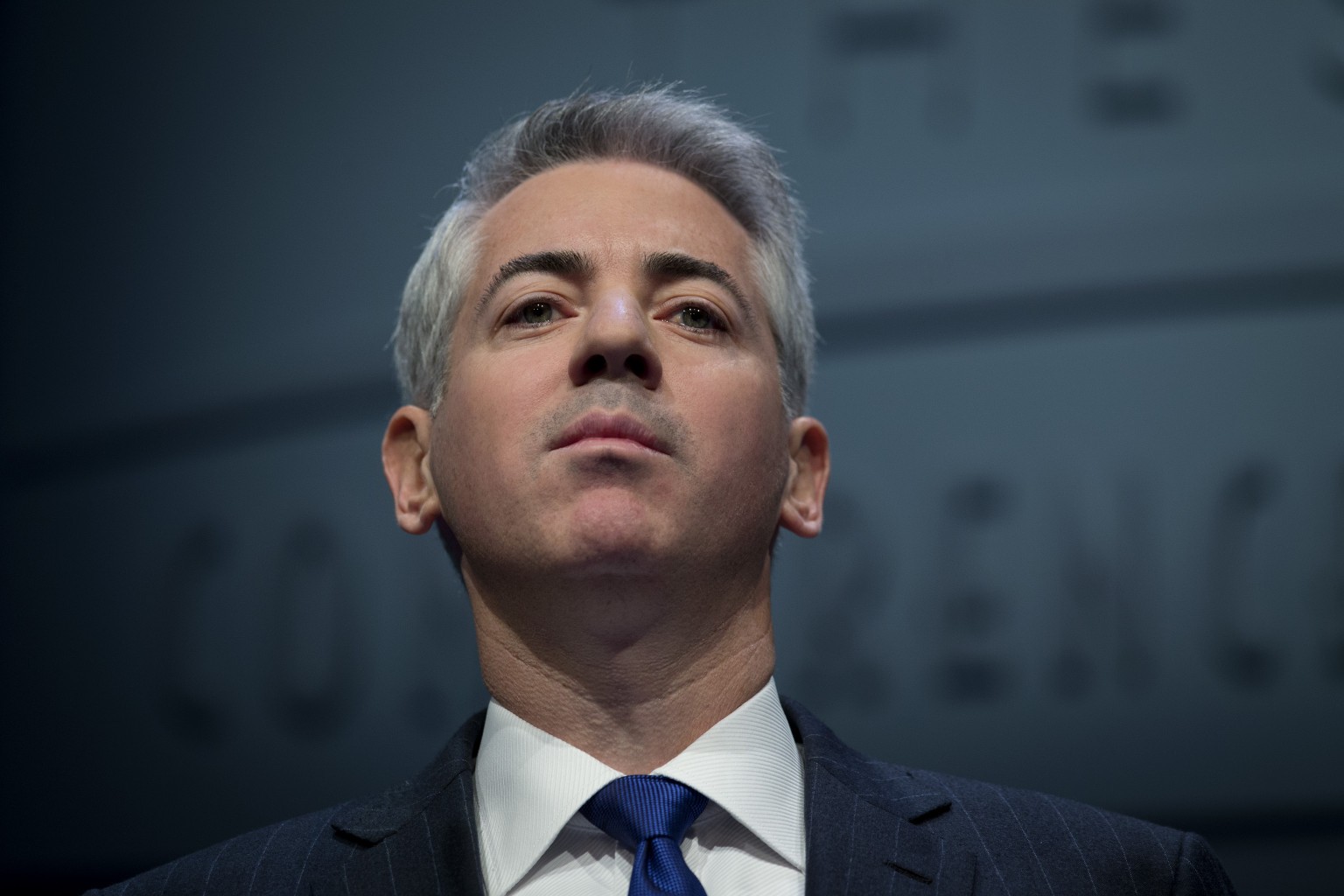

If I could short Bill Ackman and his hedge fund right now, I would do it!

Wednesday, April 20, 2016

I have yet to see a hedge fund operator who knows anything about economics or the monetary system

This should be no surprise. I have been documenting how clueless these guys are for a long time here on this blog.

Whether it's Kyle Bass or David Einhorn or Bill Ackman or John Paulson or even Bill Gross or any of them, they don't know what the fuck they are talking about.

They got everything wrong: monetary operations, inflation, the dollar, interest rates, commodities, "stimulus," etc.

On the other hand, I (we) got everything right because of our understanding of flows and MMT.

(Which begs the question: why am I not managing $15 billion? Go ahead and ask, it's a good question. Probably because I suck at marketing myself.)

Anyway, you can do better than them. Start by signing up for a 30-day free trial to my weekly report, MMT Trader. Take the money from these loser hedgies.

Tuesday, March 15, 2016

Valeant...another disaster for Bill Ackman. What's with this guy? What's with all these guys?

Valeant shares are getting pummeled today. Hedge fund guy, Bill Ackman, was long a boatload. He's getting creamed.

That comes after his disaster with shorting Herbalife. That was a disaster even despite teh fact that he tried to get the government to intervene on his behalf and start an investigation into the company. (Sleaze.)

Then we find out he recently shorted the Chinese yuan because he thought there was going to be a "debt crisis" in China. Like, China would run out of yuan. The other idiot that did that was Kyle Bass, who keeps losing money in one fictitious debt crisis after another. (Remember the Japan debt crisis he predicted?)

What's wrong with these guys? Ackman, Bass, Einhorn, Gross...they all suck. They all do the same, wrong thing. They're all fucking clueless.

I should be managing billions. Maybe I suck at marketing. Yeah, I do.

Saturday, October 17, 2015

Does billionaire hedge fund guy, Bill Ackman, ever make any money? Legitimately?

"Ackman’s hedge fund may have lost over $160 million on Valeant’s stock on Thursday, and about $580 million since March 31"

The only thing I ever see coming from this guy are losses and that's even with the help of the media that he enlists to spread lies about companies he has positions in or, getting regulators to launch investigations where they're not warranted.

For the life of me I cannot figure out these hedge fund guys. They seem really clueless or, only capable of cheating or defrauding. It seems like Ackman really doesn't know what he is doing, but he certainly goes around talking like he's a VSP (very smart person).

Go figure.

Thursday, May 14, 2015

Robin Hood gala shatters record for money raising and hypocrisy

On Tuesday night the Robin Hood Foundation had its annual gala and raised a record breaking $101 million in one night, shattering every record by any fund raising event ever.

It also shattered something else: the record for most monumental hypocrisy of all time.

That's because, while all these super rich hedge funders, celebrities and "0.1 percenters" basked in their self-importance and patted each other on the back for their obscenely phony show of "help" to the poor, the vast majority of these folks support political candidates and causes that have removed tens of billions if not hundreds of billions of government support for the truly needy. So their $100 million was really only "paying the tab" for their over the top display of self adulation.

If you think about the absurdity of this: a hedge fund guy (Paul Tudor Jones), worth $4 billion, who makes his money; a) by speculating--often driving up the price of food and fuel, which only adds to poverty and; b) charging hefty fees on the money he manages, which is largely in retirement funds of working people, he is lauded to the point of being considered, like, the new Mother Fucking Theresa.

Or consider, Bill Ackman, whose "job" it is to destroy companies and jobs (Herbalife) with malicious short selling raids designed to take a business down, yet he is also lauded as some benevolent prince?

And all their speculator hedge fund friends who do the same?

WTF??

Like a good friend of mine said, "Nobody takes time to connect the dots."

Friday, March 14, 2014

Whiny hedge fund idiot, Bill Ackman, buys the government's help to bail him out of his Herbalife short

Bill Ackman, the whining, crybaby hedge fund manager who has been disastrously selling short shares of Herbalife for two years, bleeding money in the process, has finally found someone to help his losing cause: the U.S. government.

Wednesday, September 4, 2013

The "Japan is going to have a debt crisis" man, Kyle Bass, now taking a position in JC Penney

Bill Ackman is out, after his disastrous foray into JC Penney (and before that, Herbalife) where he took major losses and contributed nothing of value or fresh perspective to the embattled retailer.

So now a new group of clueless hedge fund morons comes in, this time headed by none other than "Japan is going to experience a debt collapse," Kyle Bass. Bass has been putting on quite the dummy show in the past ten months telling everyone who would listen (mostly CNBC) that Japan won't be able to find enough "external funding" to pay its debts (which are in yen and which, last time I checked, are created solely by the Japanese government).

I guess Bass has now decided to focus his Einstein-like intellect on the retail sector and, seriously, that ought to be fun to watch.

I'm wondering if Bass might decide to take some cues from a fellow "genius" hedge funder, Eddie Lampert, you know, the Libertarian, Ayn Rand espousing, CEO of Sears Holdings (Sears, K-Mart), the American retailing icon that he has been phenomenally successful in destroying?

Line 'em up, folks. Whether we're talking about Bass or Lampert or Ackman or Paulson or Cohen or even Jamie Dimon and Goldman, this is what American capitalism has devolved into. A bunch of privileged, whiny, egotistical, arrogant, sociopathic jerks playing casino games with vast amounts of chips who leave a path of destruction in their wake everyhwhere they go that the rest of America has to swim through.