Paul Tudor Jones, the billionaire founder of Tudor investment Corp cut 15% of his staff amid losses and redemptions. You could see this coming a mile away.

The hedge fund industry is reeling because these guys are complete morons. They got everything wrong from predicting hyperinflation from monetary operations to debt crises that never materialised to warnings about skyrocketing interest rates to endless recession calls and market crashes, and promises of soaring gold prices and on and on.

All because they don’t understand sovereign money systems. All because endlessly conflated currency issues and currency users. All because they were too “serious” to pay attention to MMT.

Now they’re dying. Good. A total bunch of unjustifiably rich jerks.

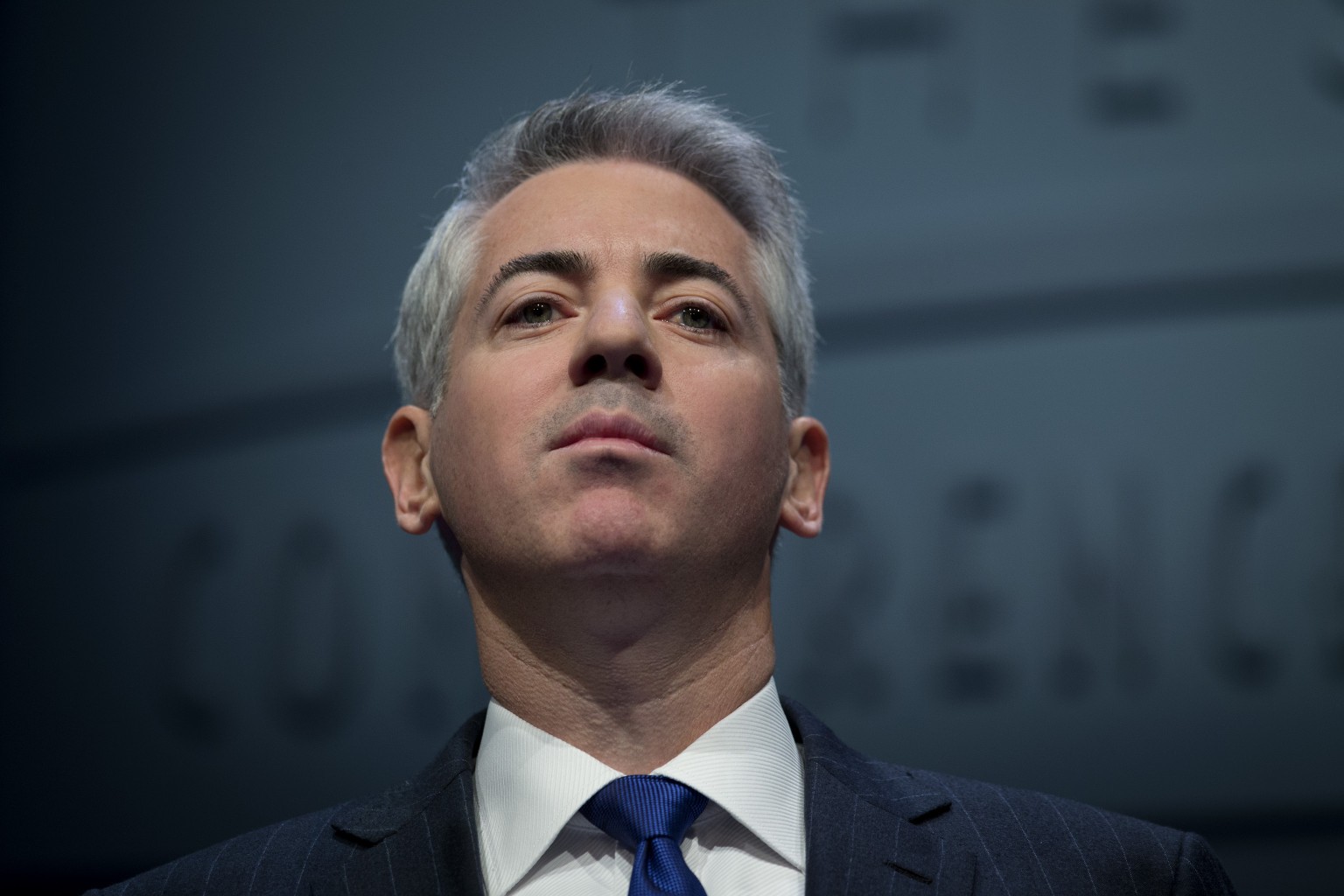

Tudor Jones, Soros, Druckenmiller, Chanos, Kyle Bass, Schiff, Gundlach, Gross, Dalio, Ackman, Einhorn...I’m sure I am leaving out many, but those are some of the big names. Totally clueless. They don’t understand MMT and if by chance they've heard of it I am sure they scoffed at it. Losers.

Let ‘em laugh. I am talking their money.

This is the approach that allowed me to call everything right. My students and followers, many novices, running circles around these hedge fund clowns. In currencies, bonds, commodities, stocks, gold, economic forecasters.

The pretenders are exposed for the fools they are. Their money will be gone soon unless they buy some more politicians that will allow them to cheat and commit fraud and insider trading so that they can protect their fortunes.

In the meantime me and my team will be taking nice chunks of their money away. Honestly. Legally. Without cheating.

Knowledge is power and combined with the right information that's killer.

Dogma, ideology, arrogance, ignorance, stubbornness, blindness...all applied to these idiots. Good bye to the whole lot of them. Ignorant parasites. They suck.