Bloomberg and other financial media outlets are running a story about how China sold $180 billion in Treasuries and the market did nothing.

Why are we not surprised?

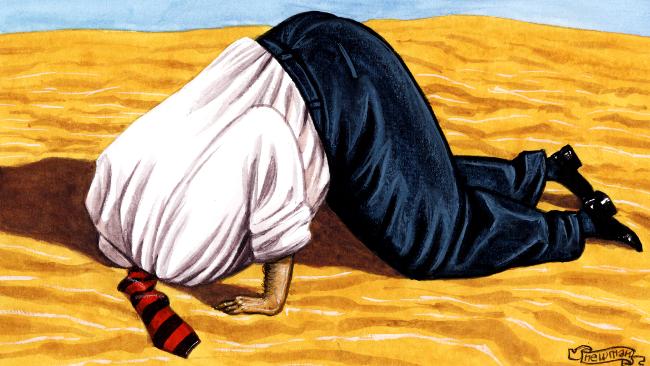

It seems that Bloomberg and the rest of the financial media mental midgets are still clueless. They still believe, I guess, that China sets rates in the U.S. or, that dollars come from anywhere else, but the U.S. government.

We have long said here in Mike Norman Economics that the worries over China selling our Treasuries or, any other entity selling Treasuries is meaningless because, a) there will always be demand for Treasuries when the Federal Gov't is spending $11 trillion per year (Gross "withdrawals" as per the Treasury's end of the Fiscal Year statement), which equates to vast amounts of resrves piling up in the bankiing system. And, b) when reserves pay nothing and Treasuries pay something.

Here are some of the idiotic statements by the media with regard to the China sales:

"America has relied on foreign buyers as the Treasury market swelled to $12.7 trillion in order to finance stimulus that helped pull the economy out of recession and bail out the banking system."

America relied on foreign buyers to stimuluate its economy and savce the banking system?? Seriously??? Hahahaha. What utter idiocy.

And this...

"Now, the Asian nation is stepping back as it raises money to support flagging growth and a crumbling stock market, and allows its currency to trade more freely."

China is selling Treasuies to "raise money to support flagging growth." Hhahahaha....are you fucking kidding me??? China is spending in yuan.

Then there's this by the woman who will probably be our next president:

And in 2007, Democrat Hillary Clinton, then a Senator from New York, said in a letter to then-Treasury Secretary Henry Paulson and then-Fed Chairman Ben S. Bernanke that foreign ownership of U.S. debt was a “source of great vulnerability.” The economy “can too easily be held hostage to the economic decisions being made in Beijing, Shanghai and Tokyo,” she said.

A real, "leader," she is going to be. Running over to China, begging them not to sell. Pathetic. And worse yet, that's "insight" coming from her advisers.

Let us not forget, either, the quote from our military commanders. This one from former Chairman of the Joint Chiefs, Admiral Mike Mullen who said:

“I’ve said many times that I believe the single, biggest threat to our national security is our debt, so I also believe we have every responsibility to help eliminate that threat,” he said. “We must, and will, do our part.”

There you go, people. These are our leaders. Totally, fucking, clueless ideologues who think they needn't know or understand anything more than the shit that litters their brain dead minds, which they spew out to us on a daily basis. And the media is there pathetic mouthpiece.

Bloomberg...ha!!

7 comments:

Imo what ends up suffering most under military leadership via idiots like that pos Mullen is force protection. .... they end up putting personnel at needless risk and casualties go up.. because these brain dead sobs think "were out of money!"

Imo the biggest threat the military faces is how morons like Mullen gain command....

Yes, China already owns the bonds. We don't owe them anything more! If China wishes to convert their bonds into bank deposits - so be it. That's their business. As we know, that is a trivial transaction.

What is important is why China converted some of its time deposits to demand deposits, both denominated in USD. The only reason to do this is to do something with the USD, either to spend them or exchange them for some specific reasons. Those reasons are what is really of interest.

What if they spend them all at once? A drop in the ocean, or a greater effect?

What if they are buying euro to counter the ECB selling. China as a net exporter is a major competitor of the EZ also as a net exporter.

Tom, could be :)

Maybe they will bail out the Greek government :b

They're not buying yuan :)

Post a Comment