Evonomics

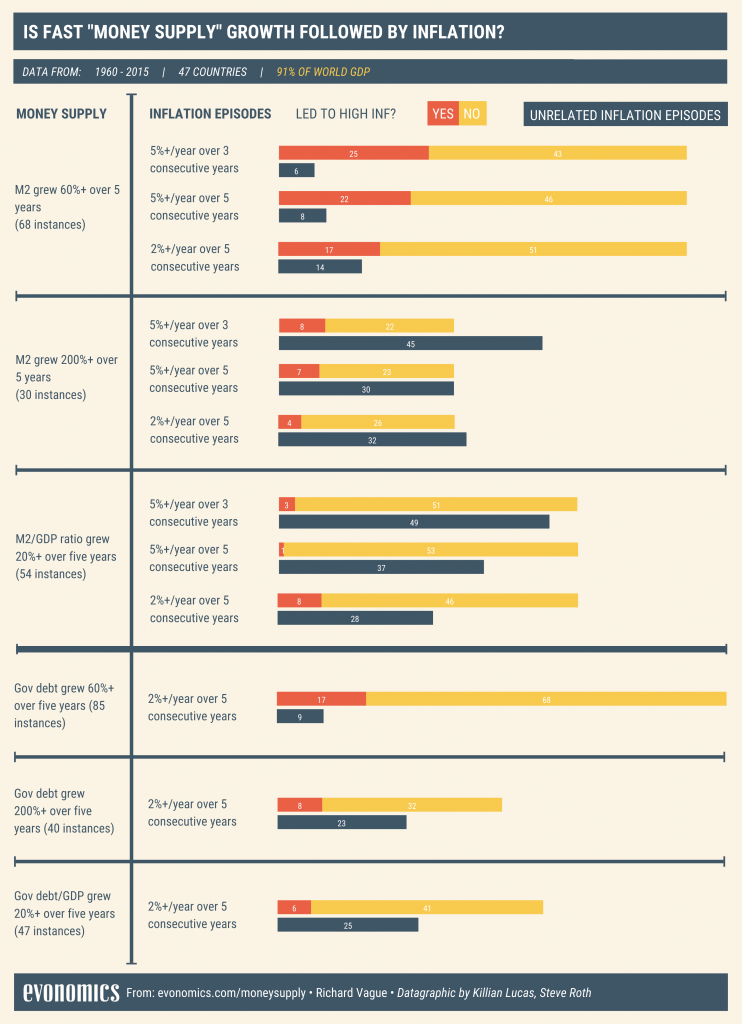

Rapid Money Supply Growth Does Not Cause Inflation

Richard Vague, currently managing partner of Gabriel Investments and the chairman of The Governor’s Woods Foundation, a non-profit philanthropic organization. Previously, he was co-founder, Chairman and CEO of Energy Plus, and also co-founder and CEO of two consumer banks, First USA and Juniper Financial

Richard Vague is the author of The Next Economic Disaster: Why It's Coming and How to Avoid It (2014).

Publisher's blurb:

Current debates about economic crises typically focus on the role that public debt and debt-fueled public spending play in economic growth. This illuminating and provocative work shows that it is the rapid expansion of private rather than public debt that constrains growth and sparks economic calamities like the financial crisis of 2008.

Relying on the findings of a team of economists, credit expert Richard Vague argues that the Great Depression of the 1930s, the economic collapse of the past decade, and many other sharp downturns around the world were all preceded by a spike in privately held debt. Vague presents an algorithm for predicting crises and argues that China may soon face disaster. Since American debt levels have not declined significantly since 2008, Vague believes that economic growth in the United States will suffer unless banks embrace a policy of debt restructuring.

All informed citizens, but especially those interested in economic policy and history, will want to contend with Vague's distressing arguments and evidence.

23 comments:

Here I read the same book in about 1992:

https://www.amazon.com/Bankruptcy-1995-Coming-Collapse-America/dp/0316282065

Used ones available for as low as $4 so save some munnie...

Matt,

One of the US largest exporters are about to raise their prices in Feb.

Johnson and Johnson

Thoughts please what this will do to the

USD/JPY

GBP/USD

In the current rate hike environment.

Thanks in adavance.

3 of Japan's biggest exporters have just increased their prices on the 1st Jan.

Toyoto 3%

Denso 5%

Takeda Pharmaceutical always increase prices.

2 of America's biggest exporters have just decreased their prices

Apple 25%

Pfizer

Why aren't the UK exporters increasing their prices and the German exporters decreasing their prices.

When the £ is so low ??

It looks like German exporters are taking job losses instead of cutting prices this can't last forever ?

Although, they are slashing prices within the Eurozone.

Foot it would be generally bullish USD in the case of JNJ... but bearish in case of PFE... so may offset each other depending on how much inventory is financed of each firms product is out there.. if there was a big imbalance between them then the effect would be towards the policy of the firm with the larger inventories out there...

And bullish JPY in the case of Toyota....

I think the Japanese autos went on sale into the close of last CY big rebates, etc... so the JPY went down with that... now if like you say they are reversing those end of 2016 price incentives here in early 2017, we should get a rally in JPY vs USD... sort of "higher Japanese car prices then stronger the JPY..."

btw my friend just priced a new F-series Super Duty at $72K !!! (strong USD... Toyota has plenty of room to raise Tundra prices imo... if so JPY rally should continue...)

AAPL lowering prices is bearish USD....

Just saw the other day that they do home loans in foreign currencies over in Europe so in case of UK, my hunch is the fall in GBP was largely property related after the Brexit vote... property prices probably took a big hit in UK after the vote so UK property was discounted and this reduced the UK terms of trade so GBP went down...

I'm looking at a possible UK property price recovery to lead the GBP back up but not seeing it so far... still in low 1.20s but at least up off the mat.... gotta get property prices heading north over there...

This is my theory in rote:

The exchange rate is a composite index of the current real terms of trade between two nations if the govt/CBs are not involved directly... iow if the govt/CB delegates the exchange function to the member banks... banks have effectively fixed capital within the periods of time or frequency of price strategy changes by the producers so they have to adjust other parts of the balance sheet (other than capital) in the face of significant price changes by producers... so they will acquire or shed currency reserve assets in the face of rising or lowering prices of the inventories they are financing to maintain a constant capital:asset ratio...

Why aren't the UK exporters increasing their prices and the German exporters decreasing their prices.

When the £ is so low ??"

Because it works the other way... iow the exchange rate is a function of what the firms are doing with their prices... not the firms are responding to the exchange rate...

ER = f(P) "exchange rate is a function of price"...

"In the current rate hike environment."

Another thing is that we're not picking up any sig. effects here in leading flow yet from the 2 small rate increases ... so not much if anything yet from the slightly higher rates... as far as fiscal support...

Thanks Matt,

Very interesting indeed.

“And yet today I see lots of people denying that monetary policy can control nominal variables. They often make arguments that are completely irrelevant, such as that the monetary base is only a tiny percentage of financial assets. That would be like saying the supply of kiwi fruit can't have much impact on the price of kiwi fruit, because kiwi fruit are only a tiny percentage of all fruits.

Beyond the powerful theoretical arguments against monetary policy denialism, there's also a very inconvenient fact for denialists; both market and private forecasters seem to believe that monetary policy is effective. Let's take a look at the consensus forecast of PCE inflation over the next 10 years (from 42 forecasters surveyed by the Philadelphia Fed):

Thus NGDP growth is not driven by structural factors such as productivity, regulation, demographics, fiscal policy, etc., it's determined by the Fed.

There is no question in my mind that the Fed could generate a 4% average rate of NGDP growth, or any other figure. The only question is whether or not they wish to.

PS. Of course there's lots of other evidence against denialism. For instance, exchange rates often respond strongly to unanticipated monetary policy decisions, and almost always in the direction predicted by monetarists, and denied by denialists.”

http://econlog.econlib.org/archives/2017/01/the_peculiar_pe.html

I always wondered how you picked up the interest rates in the leading flows if the interest payments were classed as redemptions ?

Because we use total withdrawels minus total redemptions. Or is the interest payments picked up in the total withdrawels.

Cheers.

It just amazes me how Germany can keep raising their export prices and yet still keep their market share.

As we all only have a set income every month. Which on aggregate will mean we will all start buying alternatives instead.

It seems they would rather accept job losses. VW are going to shred 30,000, Siemens are shredding jobs.

I surely is only a matter to time before German Exporters are forced to reduce their prices to the UK. Especially in a world of short demand.

Matt,

Here's the recent house prices figures

https://www.ft.com/content/6820da7a-dc99-11e6-86ac-f253db7791c6

UK house prices up by 6.7% in year to November. House price growth picked up in November, adding £2,000 to the cost of a property in one month.

High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our T&Cs and Copyright Policy for more detail. Email ftsales.support@ft.com to buy additional rights.

https://www.ft.com/content/6820da7a-dc99-11e6-86ac-f253db7791c6

Growth had been flat since the EU referendum: the average price was £215,635 in October, little changed from the £215,182 figure for June. But in November, prices rose by 1.1 per cent, to an average of £217,928.

This took annual growth to 6.7 per cent in the year to November, up from 6.4 per cent in the year to October, according to the latest figures published by the Office for National Statistics.

Monthly growth was most rapid in London, where prices rose by 1.9 per cent. The average house in London cost £482,000 in November.

Over the year, growth has been fastest in the east of England, with a 10.5 per cent rise.

Germany can raise prices because they serve high-end markets. Increases as the high-end are easily absorbed by income an wealth. People that drive Mercedes and Audis don't quibble about a few thousand plus or minus.

"I always wondered how you picked up the interest rates in the leading flows if the interest payments were classed as redemptions ?"

do you mean in a 'zero coupon' type of arrangements?

Where UST issues at a discount and then redeems at a higher price?

this is an area where I am trying to figure out what is happening at present...

Yes,

They do Tom but not all of their exporters are high end.

Yes,

And I've taken Mike's reading the Daily Treasury statement course and now do this myself.

I used passed MMT trader reports to make sure I was getting everything right. I'm now using my own spreadsheet to store the figures and produce my own MMT report now for myself.

I was just wondering how we captured the increase in interest payments after the rate hike on the daily treasury statement ?

Is it through total withdrawels ?

I've noticed before you said $18 trillion of assets after a 25 pts increase is the equivalent of a $45 billion fiscal expansion.

Also, is the interest only paid after they have matured ? What happens if they just roll them over into another security ? Or are the interest payments paid quarterly or at certain times of the term ?

Thanks in advance.

Matt,

This is why I wanted all of your posts on the blog in one place :)

Yes,

They do Tom but not all of their exporters are high end.

After the UK inflation figures today. What did the gold standard, fixed exchange rate zombies do ?

They bought the £ thinking that in the future the BOE are going to raise rates to control inflation.

As, we've have just proven without any shadow of doubt with an interest rate hike in the US. It weakens the currency and causes inflation via the increased interest payments channels.

What Carney should be thinking about is an interest rate cut, not a hike !

He's going to screw it up. He is going to send the £ even lower. The zombies who bought the $ and sold gold on a US interest rate hike are going to get burned again.

It's unbelievebale they learn nothing.

This time I'm waitig until Carney pulls the trigger and shorting GBP/USD big time.

Foot we have to work on this...

I have been trying to find out the % of UST issued are zero coupon with no luck...

If the % is low it wont matter very much...

There is a line item in the DTS called "Interest on Treasury Securities" it at 58B and up a small amount YoY but not as much as I would have thought even with a 0.25% increase...

So this is puzzling...

Thanks Matt,

Here's my take on it.

Now that you pay interest on reserves in the overnight interbank market instead of buying and selling bonds to control the overnight interest rate.

It will take time to flow through.

I think the interest on treasury security line item will be quite volatile and be HUGE at certain times of the year when those that bought bonds at previous auctions bonds mature.

So it might depend on

a) How often they did bond auctions.

b) How long the terms were.

c) How many people retire every month.

Could be way wrong though but just how my thought process sees it.

It's very interesting !

Please let us know on the blog when you start to see it flow through.

There is a line item in the DTS called "Interest on Treasury Securities" it at 58B and up a small amount YoY but not as much as I would have thought even with a 0.25% increase...

They raised the rate the same time in 2015 remember.

What did "Interest on Treasury Securities" look like when you compare Jan 2014 With Jan 2015 ?

Matt: "I have been trying to find out the % of UST issued are zero coupon with no luck..."

Sorry to sound like an ignoramus, but why wouldn't there be government stats for that?

Post a Comment