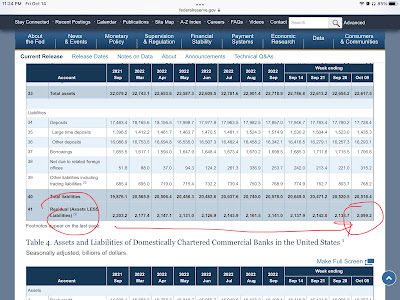

Fed rate increases crushing NPV of system regulatory capital:

They are doing the same thing they did in September 2008 ie putting their own Depositories and Dealers into violation of their own regulatory capital requirements… credit system is again getting close to failure mode:

Bank of America, $BAC, is worried about bond market volatility and says risk of a 'crash' is rising, per CNBC.

— unusual_whales (@unusual_whales) October 14, 2022

Why is the Swiss National Bank drawing $10 BILLION USD (last two days) from the swap line with the U.S. FED?! #CreditSuisse @SNB_BNS #Trouble

— 🇺🇸Kyle Bass🇺🇦 (@Jkylebass) October 14, 2022

Treasury might have to intervene directly again:

THE US TREASURY HAS ASKED MAJOR BANKS WHETHER IT SHOULD BUY BACK SOME US GOVERNMENT BONDS IN ORDER TO IMPROVE MARKET LIQUIDITY.

— Breaking Market News ⚡️ (@financialjuice) October 14, 2022

12 comments:

Hi Matt,

I did some googling and found the following. (I'm assuming these are all the capital ratios that US banks has to abide by)

(i) A common equity tier 1 capital ratio of 4.5 percent.

(ii) A tier 1 capital ratio of 6 percent.

(iii) A total capital ratio of 8 percent.

(iv) A leverage ratio of 4 percent.

(v) For advanced approaches national banks or Federal savings associations or, for Category III OCC-regulated institutions, a supplementary leverage ratio of 3 percent.

Now when you say, "It’s pretty simple … (A-L)/A = 0.07 to 0.08 or thereabouts… all they have to do is keep it in that range... 8th grade algebra… they are too dumb..."

Are you referring to the total capital ratio of 8%? As in from the table referenced in your post, the ratio has fallen from about 11%(Sep2021) to 9%(Oct2022).

Saint, We’re not going to solve it here in a blog comment …

There are several regulatory functions that become in conflict… there is one that uses NPV of HQLA to deposit liabilities too… it’s not just SLR…

We need access to the real time data which only they have.. etc..

Would need 10s of $M of R&D budget to do design a proper system administrative procedure..,

Fed gets $Bs for what? Jerking off? Looks like it…

Here:

https://www.investopedia.com/ask/answers/043015/how-can-i-calculate-tier-1-capital-ratio.asp

“Tier 1 capital, under the Basel Accord, measures a bank's core capital. The Tier 1 capital ratio measures a bank's financial health, its core capital relative to its total risk-weighted assets (RWA). Under Basel III, banks and financial institutions must maintain a minimum Tier 1 capital ratio to ensure against unexpected losses such as those that occurred during the financial crisis of 2008. The minimum tier 1 capital ratio is 10.5%.”

If they increase the risk free rate they decrease the NPV of regulatory assets …. ipso facto..,

Close enough for a blog comment.. I’m not going any further…

If anybody doesn’t see it then they are not qualified technically …

Fed gets $Bs of R&D to jerk off…. We don’t get any munnie here…

Thanks Matt for the explanation.

I presume the reason why treasury is asking whether it needs to buy back government bonds is to boost their price and hence stop the NPV drop so to keep the banks in compliance of their own regulatory ratios...

Watch to see if they redeem early AT PAR…

if they redeem at par (instead of current discounted prices) it would effectively be a way of adding capital to depositories instead of providing capital directly via TARP like they did in 2008… which would be politically unacceptable…

Pocahontas would go on the warpath…

These Fed people are some of THE … MOST … duplicitous people on earth…

btw ANOTHER ONE , the diversity hire in Atlanta, just got got busted AGAIN trading..

https://www.reuters.com/markets/us/bostic-acknowledges-accidental-trades-that-violated-fed-ethics-code-2022-10-14/

Scum of the earth…

SNB drew $6.3 bln from Fed's swap lines, not $10 bln as Bass claims.

Bass is probably adding up the 2 days total … 🤔

Oh yeah. My bad.

But it’s a daily operation so the running total is what ever is published…

It’s like Bass thinks if he refinances his $1M mortgage he’s borrowed $2M…

I think it's interesting that mike and mosler show that the higher interest rates are supporting the economy in terms of jobs, net interest income for banks and general price levels. But at the same time Matt is showing us how the higher rates are bringing down NPV of assets. It's hitting a lot of funds ie: UK pension funds. We really could run into a situation where we have high inflation but falling asset prices.

Ike makes the point that the intersection rate is in the cost of all PRODUCTS…

stocks bonds etc are not products they are financial assets…

* Mike

*interest rate

Post a Comment