Mnuchin says the U.S. government must cut spending and reduce the deficit. This will absolutely guarantee a recession.

It's amazing that these views still prevail. Complete and total ignorance.

An economics, investment, trading and policy blog with a focus on Modern Monetary Theory (MMT). We seek the truth, avoid the mainstream and are virulently anti-neoliberalism.

Showing posts with label deficit. Show all posts

Showing posts with label deficit. Show all posts

Thursday, January 23, 2020

Monday, September 9, 2019

The deficit has just surpassed one trillion

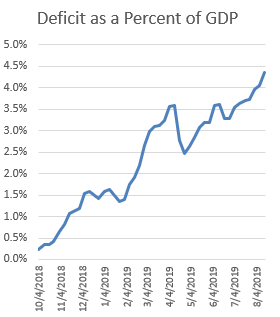

The deficit has just surpassed $1 trillion. Actually, $1.033T as of September 5.

This is the largest deficit in 7 years and the largest as a percentage of GDP in 7 years as well. (4.8% of GDP.)

The deficit has experienced a rapid escalation in the past 2 years.

I don't hear any cheering from the MMT gods about this.

And Mosler is still bearish.

This is the largest deficit in 7 years and the largest as a percentage of GDP in 7 years as well. (4.8% of GDP.)

The deficit has experienced a rapid escalation in the past 2 years.

I don't hear any cheering from the MMT gods about this.

And Mosler is still bearish.

Monday, August 19, 2019

Deficit is $930 bln. Why are all the prominent MMTers silent on this? They should be cheering, no?

The deficit as of August 15, was $931 bln. That's the highest in 7 years. And as a percentage of GDP it's now at 4.4%, the highest in 6 years.

So why are all the prominent MMTers silent about this?

Nothing from Kelton. Mosler continues to put out bearish forecasts. (Going on 5 years now!)

They only talk about deficits when it's convenient for them?

They say they're not political, but it seems to me that not mentioning the deficit is a way of not giving credit to Trump, even obliquely.

Their information and analysis is discredited in my opinion. If you want to play objective you have to be objective.

Wednesday, October 10, 2018

Scott Minerd again. Calls stock market "Titanic heading for an iceberg." You gotta buy.

Guggeheim Partners' Scott Minerd says the stock market is like "the Titanic heading for an iceberg."

Look...

“Just as an iceberg loomed in the distant darkness to be struck by the Titanic under full steam, so the US economy approaches the distant fiscal drag of 2020 under the full steam of rate increases to contain inflation and an overheating labor market...”

He's got a flowery way with words.

Fiscal drag? What fiscal drag is he talking about? The government is operating with record spending and in 2020 according to the CBO spending will be even higher along with the deficit.

The fiscal drag that Minerd is referring to is the deficit. He thinks that's fiscal drag when he should be cheering these numbers.

You gotta buy in this dip.

BTW...I've put up numerous posts about Minerd's calls in the past. Check them out here.

Sunday, September 9, 2018

Deficit balloons to $980 bln. Where are all the MMT gods cheering this??

A giant end-of-month spending spree in August has ballooned the Federal defiicit to $980 bln and 4.8% of GDP.

This is the largest nominal deficit since 2009 and the largest as a percentage of GDP since 2012.

The MMT gods should be cheering this. They're not. Weird.

This is the largest nominal deficit since 2009 and the largest as a percentage of GDP since 2012.

The MMT gods should be cheering this. They're not. Weird.

Sunday, December 18, 2016

Trump stimulus? Fuhgeddaboudit. A super duper deficit hawk is now his Budget Director.

Trump has been choosing deficit hawk after deficit hawk, casting MAJOR doubt on his stimulus plans, except of course for rich people and corporations. Everyone else is likely to get screwed.

The Donald just chose super hardline deficit hawk, Mickey Mulvaney (R-SC) as his budget director.

Here's Mulvaney:

He has been an advocate for spending cuts, often taking on his own party to push for more aggressive curbs to government spending.

And Trump seems to be 100% behind this. Check it out.

Recession time, people. Recession time. I am shorting stocks.

The Donald just chose super hardline deficit hawk, Mickey Mulvaney (R-SC) as his budget director.

Here's Mulvaney:

Mulvaney, 49, was elected to Congress in 2010 in the wave that brought a cohort of younger, staunchly conservative members into the House. Mulvaney quickly staked out ground as one of Congress’s most outspoken fiscal hawks — playing a key role in the 2011 showdown between President Obama and House Republicans that ended in the passage of strict budget caps.

He has been an advocate for spending cuts, often taking on his own party to push for more aggressive curbs to government spending.

And Trump seems to be 100% behind this. Check it out.

“We are going to do great things for the American people with Mick Mulvaney leading the Office of Management and Budget,” Trump said in a statement. “Right now we are nearly $20 trillion in debt, but Mick is a very high-energy leader with deep convictions for how to responsibly manage our nation’s finances and save our country from drowning in red ink.

Recession time, people. Recession time. I am shorting stocks.

Monday, July 11, 2016

It's not about the forking deficit.

Case closed.

This is the only place where the right ideas have been coming out.

We called everything to a tee, even when there was near, universal gloom, including among other MMT people.

Talk all day like a pretend academic or make money? Your choice.

It's the flows, stupid.

MMT Trader.

Tuesday, May 31, 2016

Deficit is too small? Consumer spending rose most in six years.

Consumer spending rose 1 percent last month after a flat reading in March, the Commerce Department reported Tuesday. Incomes were up a solid 0.4 percent, matching the March gain. Wages and salaries, the most important component of incomes, gained 0.5 percent.

Where are the "deficit is too small" people? When will they admit that they are wrong? Do you keep on saying, for years, that there's going to be a recession? How is that useful?

We have had it correct the entire time with our analysis of flows. I use flows almost exclusively in my MMT Trader report.

It's all about flows. You don't even know what the deficit is going to be until the government spends first. You don't even know how much total taxes will be paid.

It's flows.

Monday, April 11, 2016

What if the deficit grows (as it is doing) and then the economy tanks? What will the "deficit is too small crowd" say then?

Don't laugh. This could happen.

The deficit is growing again and flows (thankfully) are still strong, however, I am seeing some things that may suggest rising risk for the economy even though the deficit is now rising for the first time in six years.

What will the "deficit is too small crowd" say?

I'm pretty sure they'll say, "it's still too small," wihch woiuld be a total admission of the fact that they don't know what the hell is going on and are completely confused, but still trying to look smart.

It should also be the final proof that we are right at looking at flows.

If you want to see what "risk" to the economy I am talking about (and remeber, who told you BEFORE ANYONE that the deifici is growing--ME, right here at Mike Norman Economics where you get info you don't get anywhere else), then get my report MMT Trader for a free 30-day trial. Sign up today.

*New issue coming out today in a few hours! Get it!

The deficit is growing again and flows (thankfully) are still strong, however, I am seeing some things that may suggest rising risk for the economy even though the deficit is now rising for the first time in six years.

What will the "deficit is too small crowd" say?

I'm pretty sure they'll say, "it's still too small," wihch woiuld be a total admission of the fact that they don't know what the hell is going on and are completely confused, but still trying to look smart.

It should also be the final proof that we are right at looking at flows.

If you want to see what "risk" to the economy I am talking about (and remeber, who told you BEFORE ANYONE that the deifici is growing--ME, right here at Mike Norman Economics where you get info you don't get anywhere else), then get my report MMT Trader for a free 30-day trial. Sign up today.

*New issue coming out today in a few hours! Get it!

Wednesday, April 6, 2016

The deficit is now $73 billion larger than last year and growing.

The deficit for the fiscal year is now $535 billion. That is $73 billion above same time last year. (Figures compiled right from the Daily Treasury Statement.)

The deficit is rising, folks. What are all the "deficit is too small" people going to say when they find out? (Maybe send this to them, not that they will change their tune.)

You only get this info here and you know it.

The deficit is rising, folks. What are all the "deficit is too small" people going to say when they find out? (Maybe send this to them, not that they will change their tune.)

You only get this info here and you know it.

Saturday, April 2, 2016

Saturday, March 26, 2016

Federal deficit is going up again. Up $40 billion versus last year.

The Fedeal deficit is growing again. It's up $40 billion versus the same time last year.

I aleady predicted way back last October that the deficit was going to start expading again this year. You heard it hear on MNE first. Just remmber that when later on in the year the media will be reporting a growing deficit. It was here where you first learned about it.

What are the "deficit is too small crowd" going to say? Will they ever change their tune? Never, I predict. They have bee wrong all along with their recession call and we have been right all along.

By the way, all this information can be gleaned off the Daily Treasury Statement of which, I have become an expert at analyzing. There's simply nothing like it. It is by far the most prescient, up to date, leading data that exists and practically no one knows about it.

Get my video couse on Understanding the Daily Treasury Statement. It's only $99 bucks and well worth it.

Start out-forecasting everyone, today! (And making money.)

|

| Deficit $469b vs $427b in 2015 |

I aleady predicted way back last October that the deficit was going to start expading again this year. You heard it hear on MNE first. Just remmber that when later on in the year the media will be reporting a growing deficit. It was here where you first learned about it.

What are the "deficit is too small crowd" going to say? Will they ever change their tune? Never, I predict. They have bee wrong all along with their recession call and we have been right all along.

By the way, all this information can be gleaned off the Daily Treasury Statement of which, I have become an expert at analyzing. There's simply nothing like it. It is by far the most prescient, up to date, leading data that exists and practically no one knows about it.

Get my video couse on Understanding the Daily Treasury Statement. It's only $99 bucks and well worth it.

Start out-forecasting everyone, today! (And making money.)

Friday, March 18, 2016

We crushed it here at MNE! Sorry, no one even came close.

First I want to address a post I put up here the day of the conclusion of the Fed meeting when I said the stock rally (that day) wouldn't last and that we'd stall.

Well, that didn't happen, obviously.

However, that shouldn't diminish the fact that I said here, here, here, here and here (and probably a lot more places, but I am too lazy to look) where I said you gotta buy stocks and I gave you the reason: flows.

Two things: the flows are back and market sentiment is now shifting to very bullish.

The market is in a sweet spot now with sentiment aligned with direction (and fundamentals). It's going a lot higher and the only chance you'll have for a correction will be when the Fed raises rates. And it will. When that happens there will be some sort of bearish knee-jerk reaction and you'll have a chance to buy, however, by that time the stock market could be significantly higher.

By the way, remember all those people who were panicking and saying "sell" and there would be a catastrophe? Remember the RBS call? They were all completely and utterly wrong.

The "low hanging" fruit is probably gone. Maybe not. Depends on your definition of low hanging. I like really low hanging, like when people are selling like crazy. That's when I buy because it's like the idiots are just giving you their money. Take David Einhorn's money, remember?

There could be a "low hanging fruit" trade right now and that's shorting Treasuries. Even the idiots now think the Fed will never be able to raise. (After years of telling us how rates were going to skyrocket.) Short Treasuries. NO ONE is talking about that except, you guessed it, right here on MNE. Like, we always scoop everyone.

Which brings me to the economy. If you are thinking recession because the deficit is too small, forget it. No chance. The flows are big and this stock market rally, which will continue, will boost confidence and spending.

The people with the forecasts based on deficits for the last three years should just man up and throw in the towel.

Once again we got it all right here by looking at flows. It's all about flows or, mostly about flows anyway.

Oh yeah, how about the "oil bottom" call that I made back in January? Maybe a little early, but the market is 30% higher now. Not bad.

And what about the dollar going down? And gold rallying? Franco with metals prices bottoming, too. Jeez, I almost forgot those.

I swear, this site should have a million visitors a month. It's crazy that we don't.

Like I said, I must suck at marketing.

Well, that didn't happen, obviously.

However, that shouldn't diminish the fact that I said here, here, here, here and here (and probably a lot more places, but I am too lazy to look) where I said you gotta buy stocks and I gave you the reason: flows.

Two things: the flows are back and market sentiment is now shifting to very bullish.

The market is in a sweet spot now with sentiment aligned with direction (and fundamentals). It's going a lot higher and the only chance you'll have for a correction will be when the Fed raises rates. And it will. When that happens there will be some sort of bearish knee-jerk reaction and you'll have a chance to buy, however, by that time the stock market could be significantly higher.

By the way, remember all those people who were panicking and saying "sell" and there would be a catastrophe? Remember the RBS call? They were all completely and utterly wrong.

The "low hanging" fruit is probably gone. Maybe not. Depends on your definition of low hanging. I like really low hanging, like when people are selling like crazy. That's when I buy because it's like the idiots are just giving you their money. Take David Einhorn's money, remember?

There could be a "low hanging fruit" trade right now and that's shorting Treasuries. Even the idiots now think the Fed will never be able to raise. (After years of telling us how rates were going to skyrocket.) Short Treasuries. NO ONE is talking about that except, you guessed it, right here on MNE. Like, we always scoop everyone.

Which brings me to the economy. If you are thinking recession because the deficit is too small, forget it. No chance. The flows are big and this stock market rally, which will continue, will boost confidence and spending.

The people with the forecasts based on deficits for the last three years should just man up and throw in the towel.

Once again we got it all right here by looking at flows. It's all about flows or, mostly about flows anyway.

Oh yeah, how about the "oil bottom" call that I made back in January? Maybe a little early, but the market is 30% higher now. Not bad.

And what about the dollar going down? And gold rallying? Franco with metals prices bottoming, too. Jeez, I almost forgot those.

I swear, this site should have a million visitors a month. It's crazy that we don't.

Like I said, I must suck at marketing.

Labels:

David Einhorn,

deficit,

Fed,

flows,

MNE,

oil,

RBS,

stocks,

Treasuries

Monday, March 7, 2016

China says it is increasing deficit to support growth

"We are increasing the debt-to-GDP ratio to support achieving a medium- to high-speed rate of economic growth," said Lou. "Why do we do that? Because we don't want to see a decrease in economic growth and because we want to give strong support to structural reform." -Lou Jiwei

That's how you do it.

The "increasing the deficit" talk is really just about raising spending. That's what they're doing.

Still, it flies in the face of the moronic stuff we hear out of our politicians (including Obama) and all the mainstream ecoomists or, for that matter those in Europe, too, who continue to talk about balancing budgets and austerity.

Tuesday, March 1, 2016

I told you to buy the dips

You can listen to others who have been wrong for three years running, worried about the size of the deficit or, you can follow us here when we tell you about far more important flows.

I told you yesterday to buy the dips.

I told you there would be no recession.

I WILL TELL YOU when to get worried, but it's NOT NOW.

I told you yesterday to buy the dips.

I told you there would be no recession.

I WILL TELL YOU when to get worried, but it's NOT NOW.

Labels:

deficit,

flows,

recession,

stock market,

stocks

Monday, February 29, 2016

Keep buying the dips. Spending really accelerating now.

Federal Government spending is really accelerating now. We are $45 billion over last year and last year was the biggest increase in six years. There will NOT be a recession. You can look at the deficit all you want; you're wasting your time. The Fed will raise rates at least two more time this year.

The stock market is giving everyone easy opportunities to get in. There's been plenty of good, back and forth action. That won't always be the case. We'll go parabolic at some point.

Forex is also presenting great opportunities. If you don't trade forex, get my course.

The stock market is giving everyone easy opportunities to get in. There's been plenty of good, back and forth action. That won't always be the case. We'll go parabolic at some point.

Forex is also presenting great opportunities. If you don't trade forex, get my course.

Friday, February 26, 2016

No recession. Q4 GDP revised up. Flows tell it all, as we have been saying. Deficit based forecasts have been wrong, wrong, wrong.

How many times do we have to say it? Matt and I have been saying over and over and over that these deficit-based forecasts are stubborn and wrong and it's all about the flows. And we've been right.

With $4-trillion-plus and rising (year-over-year) there won't be recession. Slow growth, perhaps, and that's because of the drag from lower capex in the energy sector, however, it's being offset by higher consumption.

The deficit-based forecasters have been wrong for three years running. If, five years from now, the economy goes into recession because of some unrelated reason, are all of you going to say that the deficit-based forecasters "called" it?

Come on.

With $4-trillion-plus and rising (year-over-year) there won't be recession. Slow growth, perhaps, and that's because of the drag from lower capex in the energy sector, however, it's being offset by higher consumption.

The deficit-based forecasters have been wrong for three years running. If, five years from now, the economy goes into recession because of some unrelated reason, are all of you going to say that the deficit-based forecasters "called" it?

Come on.

Friday, February 19, 2016

Spending up YUGE! Starting to really accelerate. Here we go go go!!!

After that late, Jan-early Feb hiccup (IRS glitch, paperwork, whatever), Federal Gov't spending is now really starting to take off. Check it out:

We are nearly $40 billion over last year already and it's accelerating. This month alone, tax refunds have now caught up and surpassed last Feb. (Thanks to our tax accountant, MNE reader, John, for keeping me patient.)

Forecasts:

No recession

Stocks to rally sharply

Economy to show increasing strength

Fed will raise rates at least two more times

Bonds down

Dollar DOWN as foreign exporters regain some pricing power

Gold up.

If you're looking at the deficit (i.e. how "small" it has become) then, bye, bye. You are going to be left in the dust!

Much more detailed updates, analysis and forecasts in my Fiscal Trend Trader Report. Subscribe here.

We are nearly $40 billion over last year already and it's accelerating. This month alone, tax refunds have now caught up and surpassed last Feb. (Thanks to our tax accountant, MNE reader, John, for keeping me patient.)

Forecasts:

No recession

Stocks to rally sharply

Economy to show increasing strength

Fed will raise rates at least two more times

Bonds down

Dollar DOWN as foreign exporters regain some pricing power

Gold up.

If you're looking at the deficit (i.e. how "small" it has become) then, bye, bye. You are going to be left in the dust!

Much more detailed updates, analysis and forecasts in my Fiscal Trend Trader Report. Subscribe here.

Tuesday, January 19, 2016

CBO says deficit going to grow this year as I predicted. What are all those "deficit is too small folks" going to say now?

The Congressional Budget Office is out with its new deficit projections for 2016 and they are now saying that the deficit is going to grow substantially this year.

WASHINGTON, Jan 19 (Reuters) - The U.S. budget deficit will grow sharply to $544 billion in 2016 after six years of declines, largely because of permanent tax breaks that Congress passed late last year, the Congressional Budget Office said on Tuesday. Read more.

This is what I said several times and most recently, about a week ago here.

So the question is, what are all those "deficit is too small" folks/economists going to say now? They've been wrong for 5 years, looking at the shrinking deficit. They won't change their tune, I bet. They'll stick with their stubborn ideology and just keep saying it's "still too small."

We were right the entire time here at MNE. Matt Franko, myself, looking at flows, topline gov't spending, price setting currency markets by exporters etc, and none of this, getting harder to get nonsense.

This is the place to be. By the way, the budget projections were already in my new report, Fiscal Trend Trader. Front page. Even before the CBO released its report

Labels:

budget deficit,

CBO,

deficit,

Mosler

Friday, December 18, 2015

I'm in a debate with deficit terrorist, Maya McGuiness, on Twitter

She's all depressed over the budget deal, which she says will "blow a hole" i the deficit. By that way, that probably means it's going to be GREAT for the economy so do yourself a favor and buy stocks.

But anyway, she's all PROUD of being labeled a deficit TERRORIST. Look...

But anyway, she's all PROUD of being labeled a deficit TERRORIST. Look...

I think "deficit terrorist ideologue" is a compliment? https://t.co/esunZpuscn

— Maya MacGuineas (@MayaMacGuineas) December 18, 2015

Subscribe to:

Posts (Atom)