Mike doing some projections this week on by how much or perhaps how fast the Fed can increase its policy rates while avoiding insolvency, ie a situation where their current interest income would be exceeded by their current interest payable:

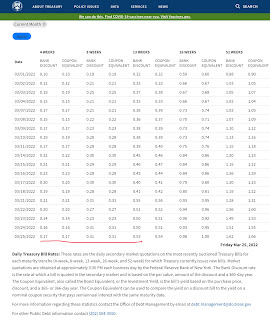

You can see here current UST yields are less than the Fed’s overnight rates (inverted) out to 8 weeks … no bueno:

To be safe they may want to somehow pivot from the current perhaps implied policy of an acceleration in the increase in their policy rates to a policy of acceleration in their rate of asset/liability reduction… keep an eye out for this pivot…

8 comments:

hi matt,

what you and mike are saying is that the UST rate here

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhDAJhNhPFzUz9bfW_dTWrp-wQvvpOeHPZvC9pGHdV2PE_JjKQrs6-gsMPV1Ao8OQdtoCNxiuiE81Y9tflKbGCn4pgIdJ9LgK8xjwT3b44AOc4j7xw-enhM0Bok1i7bvO7EBuqxKzm4Wevg7Kd07jsQbJs46GravwSr7EdFtdgIJzXr-C1vVndhPSvDoA/s1918/5B1BAE9A-E959-4F99-96AD-CC558050284C.jpeg

that you've highlighted is now lower than the fed overnight funding rate here

https://www.newyorkfed.org/markets/reference-rates/obfr

and if they continue to raise the funding rate the Fed will be in deficit? What does that mean as in they can't return money to the treasury? So they either stop with raising the overnight rate or they bump up QE and buy more treasuries to reduce reserve balance in the system so they have to pay out less on overnight reserves?

Yeah they have to balance their cash flows…

The higher their liability balance they owe interest on and the higher the rate they pay could exceed what they receive on their assets…

I don’t think they can issue a liability without taking possession of an asset so they just can’t “credit a bank account” to pay interest on reserves…. What would be the asset they receive? Accounting entries have to balance…

e.g. they have liability balance of 4T at depositories and 2T on RRP…. let’s say 6T total…

If they would raise rates right now to 5% to “tame inflation!” Then they would owe $300B annual and right now they only are receiving about 110B on their assets.., so they would become insolvent…

So as an extreme example there is NO WAY they could raise to 5%…

They have to examine all of their securities holdings and model the cash flows from them to make sure they will have enough to pay IOR… and MBS are redeemed early they call this “MBS prepayments “ and they are very difficult to model even by worlds best MBS portfolio managers …

So they can “jawbone” all they want about being aggressive on rate increases …but they are limited at what they can do with rate side of their monetary policy… They have to go very slowly…

https://www.investopedia.com/articles/mortgages-real-estate/08/weighted-average-mbs.asp

“ The prepayment assumption is crucial to mortgage pass-through securities. Investors know in advance that prepayment can and will occur, but do not know when and by how much. Those variables must be projected and assumed. ”

The MBS return component of their assets is tricky… this is probably why they’ve said they eventually want to get rid if their MBS and use exclusively USTs… USTs are not called before maturity.. their returns are dependable…

I assert that that guy Bullard at the Fed has no idea what Mike is talking about in this video..,

He is a flat out Art Degree monetarist moron who thinks they can raise rates anywhere they want at any time … to control their figurative “inflation!” …

His type is the type there that gets them in trouble..,

I guess

the issue is what happens when they are insolvent. Which becomes hard to predict. Seems they can either,

1. Ignore they rules and just remain insolvent.

2. Stop raising fed fund rates or drop back down.

3. Some other crazy things like getting congress or the white house to issue them more capital?

There is a law that congress passed that says the Fed’s residual cannot exceed 8b, … it may imply a positive residual but there is no minimum residual in that law…

I think it is customary in the administration of any bank central or otherwise to maintain a positive residual..,

Best thing they can do imo is to raise the rate very slowly and accelerate the reduction in their factors effecting reserve balances…

Post a Comment