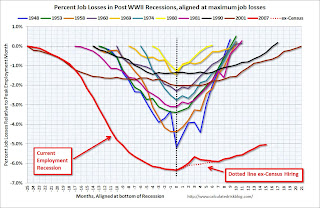

What is particularly concerning though it is the comparison of this recession and recovery with previous ones. Calculated Risk provides a chart.

Washington's Blog notes that the numbers for this recession are actually worse that the Great Depression.

The commonly-accepted unemployment figures for the Great Depression are overstated. Specifically, government workers were counted as unemployed by Stanley Lebergott (the BLS economist who put together the most widely used numbers) ... even though gainfully employed and receiving a pay check...

When the figures are adjusted this recession and recovery is far more serious than it is being made out to be in Washington. Paul Krugman warns that the US is facing a repeat of the double-dip of the Great Depression, when stimulus was removed prematurely in 1937. It took WWII for the US to recover fully — after two decades of underperformance.

With housing double-dipping and the ISM manufacturing index rolling over, things are not looking up. Meanwhile, politicians and pundits are occupied with the pseudo-problem of the deficit and debt and talking austerity as the remedy.

UPDATE: Michael Perelman thinks that a double-dip scenario is overly optimistic. He sees deeper problems resulting in long term malaise until fundamental problems are addressed.

7 comments:

What will happen if spending is materially cut, the economy then falls hard, tax revenues fall off tremendously, and the deficits grow dramatically? I am afraid with the vast majority of the public worrying about the national debt and thinking spending does not help the economy (the proverbial shouts of government spending does not create jobs), more cuts will be ordered.

When will it end? An how badly (with any American with a pulse able to get a gun, combined with military technology to counter that, streets could be red)?

Crake, Randy Wray has a satirical post about this. At least you can laugh about this while you are crying over it.

THE GREAT DEPRESSION AND THE REVOLUTION OF 2017 (May 24, 2010)

To make matters worse, while catching up on the Payrolls this morning, I saw the lead story on Bloomberg citing Ron Paul and making him out to be some sort of monetary oracle! O...M...G. This quack is being taken seriously? There can be no surer way to condemn the US economy. This is actually quite frightening.

What are ya'll talking about ?

Tax revenues will have to be made somewhere ...

where are they successful now ?

hmmmmm ....

price of oil & gasoline !

we'll raise the price of oil & gasoline and get tax revenue there while placating the southern deregulators !!

3 cheers for $8 / gallon gas

"we'll raise the price of oil & gasoline and get tax revenue there"

Nice theory but gasoline taxes aren't a percentage of sales but a flat 18 cents per gallon, Uncle Sam doesn't benefit from higher gas prices (and actually collects less if if price spike lowers volume).

http://www.gaspricewatch.com/usgastaxes.asp

you are wrong beowulf

localized tax components of gasoline are %

so all the more my pointlessness

googleheim,

On that site you cited, it shows the majority of states tax gasoline at cents-per-gallon not on a percentage. Some states have sales tax, as a percentage, but it seems just a handful do that.

Or am I missing something?

Post a Comment