Tweet

When an unrestrained supply of bank credit is pumped in to relatively fixed supply of land, the result will always and everywhere be property price inflation. My new book, 'Why Can't you Afford a Home?'out today. politybooks.com/bookdetail/?is…

When an unrestrained supply of bank credit is pumped in to relatively fixed supply of land, the result will always and everywhere be property price inflation. My new book, 'Why Can't you Afford a Home?'out today. politybooks.com/bookdetail/?is…

Bank created credit is a force outside of market forces which distorts the markets. With an oversupply of money and a shortage of houses, the sky's the limit on house prices. The only thing holding back the cost of housing is the ability of people to work hard enough to service the loan on a property. Extra hours at work, two or three jobs, mini-cabbing in the evening, renting a room or two out, friends getting together to buy a hime, etc, but all this does was raise the price of homes even more.

The bankers made a fortune, and so did the landlords, while Britain was set to work. The One Percent turned Britain into a powerhouse work-house with everyone going 24/7. This is the protestant conservative work ethic where no one owes you a living. A neoliberal dream.

In the 1950's people thought machines and technology were going to bring about the leisure society where many of us would opt for doing some voluntary work for the benefit of society, but the opposite has happened. With the whole world going 24/7, and the planet's resources fast being used up, a few billionaires are on their way to becoming trillionaires. And one way they did it, was to set us to work by giving us easy bank credit and house price inflation.

But the people were fooled when they thought they were actually getting richer as their houses raised in value, because the quality of their lives were greatly diminished when life became all work.

Money creation, bank lending and house prices

When property prices rise faster than incomes, it becomes harder to buy a home. Mortgage loans bridge this gap, allowing households to access home ownership without having to save for many years. But there is a side-effect. Banks create new money in the act of lending. When a bank makes a loan, it creates both an asset (the loan) and a liability upon itself in the form of a new deposit in the bank account of the borrower. No money is borrowed from elsewhere in the economy. The main limit on bank money creation is the bank’s own confidence that the loan will be repaid.

If mortgage lending supports the building of new homes, this new money can be absorbed into the economy. However, in most cases mortgage finance enables people to buy existing property on existing land. As households, supported by banks, compete to purchase, the result is increasing land and house prices. Higher prices lead to more demand for mortgage credit, which further pumps up prices, and so on.

This feedback cycle runs against standard economic theory where an increase in the supply of goods, all else being equal, should eventually lead to a fall in prices. An ‘equilibrium’ price will be reached at the point when the quantity of goods supplied exactly matches the demand for them. But with bank credit and land, we have two phenomena that are quite unlike standard commodities. Bank credit is highly elastic and essentially infinite; in contrast land, as discussed in the preceding chapter, is inherently inelastic due to its scarcity.

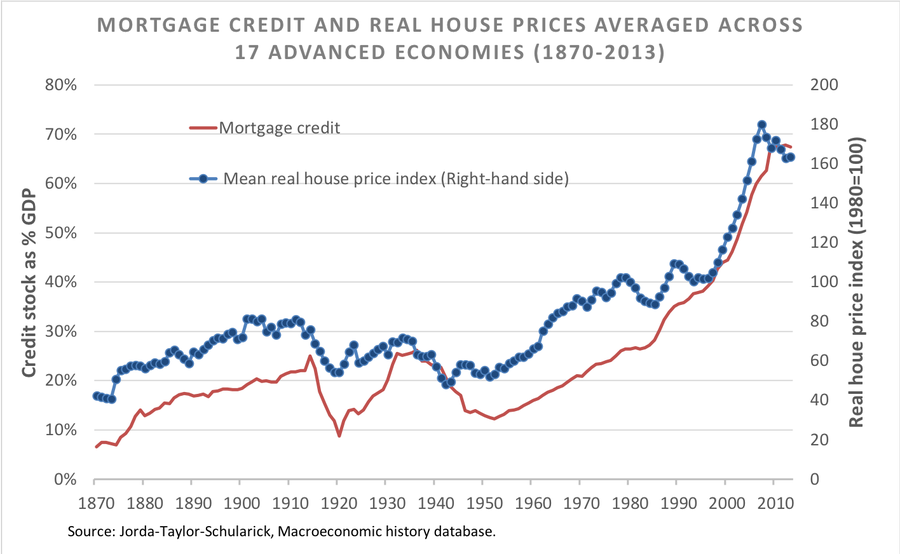

The chart below shows real house prices (adjusted for inflation) and mortgage credit as a proportion of GDP in advanced economies since 1870. Up until 1960, there was little change in house prices despite rising populations and incomes. Then, from the 1960s to the 1990s, house prices increased by around 65%, supported by the reduction in taxes on property and the withdrawal of state provision of affordable housing and gradual expansion of mortgage credit. But even more remarkable has been the change in the last 20 years, when real house prices have increased by 50%. During the same period, real average incomes have flatlined — but mortgage credit has risen exponentially. There is a clear correlation between the two variables since the 1990s.

Medium

24 comments:

And one way they did it, was to set us to work by giving us easy bank credit and house price inflation.

Via government privileges for the banks and other depository institutions - privileges that are largely supported by Progressives and the MMT folks too, to their shame.

And you know who you are.

“This is the protestant conservative work ethic where no one owes you a living.”

Unless you are rich, in which case everyone owes you a living, since everything is owned by you.

He who owns is owed.

Put another way, there’s no such thing as a free lunch, unless you are rich. And the richer you are, the more your lunch is free.

Neoliberals say that no one owes you a living. Instead, everyone owes neoliberals a living. I say that everyone owes each other a living.

“People were fooled when they thought they were actually getting richer as their houses raised in value, because the quality of their lives were greatly diminished when life became all work. “

And in the USA, the higher a houses rises in price, the more property tax the owner must pay, unless the owner is a bank or a finance company. The latter are legally required to pay property taxes, but they don’t, and county governments can’t make them, since the judges are owned by the banks.

Also, if the price of your house goes up, then so does the prices of all other houses. If you sell your house, your equity will be consumed in the purchase of a different house. So you are no further ahead.

The only party that wins in this game is the bank. Fortunately, the stupid peasants have been programmed to think that any alternative to the current nightmare would be evil communism. If you don’t like being impoverished by banks, then you are an evil communist.

When peasants see homeless people on the street, the peasants hate the homeless, not the banks that created the homeless. [Likewise when peasants see refugees, the peasants hate the refugees, not the governments that created refugees. The rich hate the poor, and the poor hate each other.]

In a sane society there would be no such thing as private for-profit banks.

Furthermore in the UK and USA, credit creation by private banks is the principle driver of price inflation in housing, and by extension the rest of the economy.

“There have has been major falls in the levels of home ownership since the turn of the century across all the major English-speaking economies.”

But at least we don’t have evil socialism.

In a sane society there would be no such thing as private for-profit banks. Konrad

Not quite. In a sane world, the banks would be 100% private with 100% voluntary depositors - something that has NEVER been tried since that would require that monetary sovereigns or their Central Banks provide free checking/debit accounts to all citizens up to reasonable limits on account size and transactions per month.

Why? Because citizens have an inherent RIGHT to use their Nation's fiat in all its forms including account form.

Even non-profit government-privileged banks would steal by the process of new purchasing power creation for the benefit of the more so-called "credit worthy" at the expense of the less so-called "credit worthy."

'Also, if the price of your house goes up, then so does the prices of all other houses. If you sell your house, your equity will be consumed in the purchase of a different house. So you are no further ahead'.

Yes, that's how they were conned, Konrad, but their children struggle to afford a home so is their family better off? The only way they are going to release the wealth is by selling and living in a tent, or by moving to a place no one wants to live. And as you get old, people find they don't want to move away from friends and relatives, or from where they have lived most if their lives.

And when they get old they may be made to sell their home to pay for their old aged care, where years ago the state provided old age care independent of your means to pay. They were conned when they voted for Tory privatization: They got a tax cut, a massive mortgage, and a heavy workload.

And their pensions are nowhere as good, and although the lucky older ones may still have a good pension, their retirement age is increasing. We are told that as we are living longer this needs to be done, but young people are denied good jobs as the older people hang onto them. But there's more:

When lots of people had good pensions in the UK, the pension funds put it into property boosting house prices which made good profits and therefore bonuses for the pension fund managers, but when house prices fell, they kept their bonuses. What many economists argued at the time was that the pension funds should be investing in industry, new companies, and start ups. This would have created good jobs for young people while being excellent investments for the pension funds yielding high quality pensions. Then maybe the retirement age could have been brought down instead.

The electorate have no idea how they have been ripped off by a few people in high finance and how the country has been let down. But many leading Tories do know, and don't care that Britain could have been as prosperous as Norway because they have done okay out of it. The Tories gave Britain's oil wealth away to a few elite who squirelled the profits off-shore.

Now we have austerity, poverty, and hardship, while most of the UK has the poorest regions in Northern Europe.

Well said, Kaivey.

This is the protestant conservative work ethic where no one owes you a living.

In contradiction to the Old Testament where the poor had rights such as the right to glean agricultural land and the right to share in a 3rd year tithe. And where Hebrews could not permanently lose their farms, vineyards, orchards, etc. (Leviticus 25).

But who reads the Old Testament?

My people perish for lack of knowledge ... Hosea 4:6 etc.

"In a sane world, the banks would be 100% private with 100% voluntary depositors - something that has NEVER been tried since that would require that monetary sovereigns or their Central Banks provide free checking/debit accounts to all citizens up to reasonable limits on account size and transactions per month." ~ Andrew Anderson

I thought deposits were voluntary. If I don't like one bank, I can voluntarily deposit my money in a different bank.

I don't understand what you are talking about, and I never have. Do you have a link to a blog or something that lays out your ideas so I could understand them?

Thanks for the comments, Andrew. I like your take I things.

I thought deposits were voluntary. If I don't like one bank, I can voluntarily deposit my money in a different bank. Konrad

Why can't you have a fiat account at the Central Bank like the banks do?

Why must you have an account at a member of the usury cartel instead?

Or else be limited to mere physical fiat, coins and bills?

No link, my thoughts are scattered on blog comments mostly here but also at Bill Mitchell's blog.

Andrew, You seem to be advocating full reserve banking or something close to it, which I agree with. That’s a system where the only form of totally safe money is in accounts at the central bank. In contrast, those making deposits at commercial banks (i.e. people who want their money loaned on) carry the risk if the bank fails. I.e. in effect, commercial banks become mutual funds. Those advocating that idea include:

Milton Friedman in 1948. See item No. 1 under the heading “The Proposal” here:

https://miltonfriedman.hoover.org/friedman_images/Collections/2016c21/AEA-AER_06_01_1948.pdf

See also his book, “A programme for monetary stability” 2nd half of Ch3. (First published 1960).

Positive Money and co authors here:

http://b.3cdn.net/nefoundation/3a4f0c195967cb202b_p2m6beqpy.pdf

Lawrence Kotlikoff:

http://www.kotlikoff.net/files/consequences_vickers.pdf

Matthew Klein: http://www.bloomberg.com/news/2013-03-27/the-best-way-to-save-banking-is-to-kill-it.html

What I advocate is VERY SIMPLE in principle:

1) Allow all citizens to have inherently risk-free accounts at the Central Bank ITSELF that are free for individual citizens up to reasonable limits on account size and transactions per month. This is no more than allowing citizens to use their Nation's fiat as they should be able to.

2) Then abolish, in a responsible, just manner, all privileges for the banks, etc. such as government provided deposit insurance, non-negative yields on the inherently risk-free debt of the monetary sovereign, and any fiat creation by the Central Bank except for its monetary sovereign.

Then we shall have 100% private banks with 100% voluntary depositors AND an additional payment system to the one that must work through banks.

In summary, let's have equal protection under the law wrt fiat and credit creation.

I should add that once banks are 100% private with 100% voluntary depositors then all regulations on them besides normal business regulations can be abolished since banks would then be not much more a threat to the economy than gambling casinos.

Andrew, Your proposals amount to full reserve far as I can see. In particular if deposit insurance is removed, then depositors are by definition bearing risk, which by definition means they are effectively shareholders, or put it another way, they've bought into a mutual fund.

Ryan-Collins over states his case. The UK household debt service ratio (interest payments divided by household incomes) was about 9% in 2000, 13% in 2008, then it fell back to about 9.5% in 2017. That’s according to this site (click on “Max” on the right):

https://www.ceicdata.com/en/indicator/united-kingdom/debt-service-ratio-households

House prices have doubled, as J-C rightly says in the last 20 years. But interest rates have approximately halved. So people are back where they started roughly speaking.

Your proposals amount to full reserve far as I can see. RM

No, since a bank should not be required for a citizen to use his/her Nation's fiat, only Central Bank branches and/or perhaps local Post Offices and the Internet.

And it defeats the purpose of an additional payment system if it must work, full reserve requirement or not, though a bank.

through a bank.

There is no shortage of housing. There is a serious shortage of affordable housing.

This is easily determined by comparing the population divided by household size with the total number of housing units.

The shortage of affordable housing is the result of massive and severe rent extraction by landlords, developers, speculators, and banks, as well as economic policy that rewards rentiers, speculators, and developers.

"The main limit on bank money creation is the bank’s own confidence that the loan will be repaid."

Kaivey, even the top MMT people know at some level that banks are capital constrained...

Why do you keep posting Monetarist drivel like this on this blog?

Andrew, I can't seem much wrong with "working through a bank". That's the arrangement advocated in the Positive Money work I linked to above, plus various other advocates of full reserve, e.g. Kotlikoff, advocate the same arrangement.

To get that system to work you just have a law which says all banks must offer customers special accounts where money deposited is deposited in turn by the bank at the end of each working day at the central bank. And as distinct from that, banks also offer customers accounts where customers' money is loaned on, but customers carry the loss if that goes wrong.

But the option you want, i.e. by-passing commercial banks and having citizens deal direct with the central bank would be perfectly feasible as well. As you doubtless know, several central banks are actively considering that idea right now.

Incidentally Josh Ryan-Collins was a co-author of the above Positive Money work.

People fall into the neoliberal trap of hating government and would rather trust private bakers or Wall Street over government.

yes, on some level the banks are capitol restrained. And it's a great idea that banks can create money out of nothing, then society well have sufficient cash to run its businesses. But using the fractions reserve system to create ponzi schemes is a tragic waste of this resource.

I changed my into from 'infinite' to 'oversupply'. But I have included a tweet by Josh Ryan-Collins.

And it's a great idea that banks can create money out of nothing, ... Kaivey

Why not have the monetary sovereign or its Central Bank create new fiat and distribute it equally to all citizens if interest rates are deemed to be too high?

Sure let banks create all the deposits/liabilities for fiat they dare but let their depositors have the option of transferring their deposits IMMEDIATELY to an account at the Central Bank. THAT and the abolition of all other privileges for the banks would KEEP THEM PRUDENT or else they would go bankrupt quickly.

Post a Comment