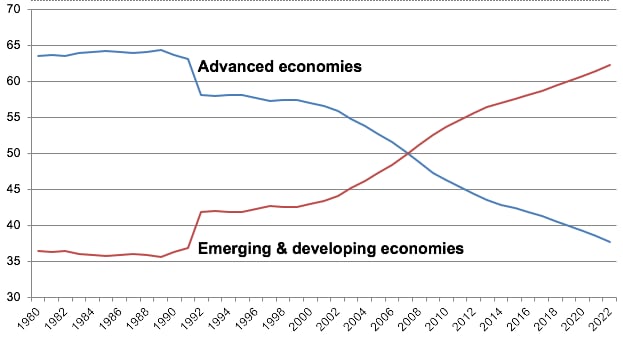

Emerging and Developing Economies for the First Time Account for a Larger Share of World GDP or Global Output Than Developed Economies; A Point Surpassed After the 2008 Financial Crisis That Has Continued Apace (See Figure 1)....

How has this been achieved? Possessing good institutions is what economists have come to focus on and the spread of such institutions seems to have been key, as the father of New Institutional Economics predicted. The seminal work in this area was by Douglass North who was frustrated by neoclassical economic models that focused on measurable factors like workers and investment, with attempts to measuring technological progress, even though they could not fully explain why some economies grow well and others do not.

So, North took economics out of its comfort zone, which consisted of examining more easily measured inputs like labour and capital, and instead brought in politics, psychology, and strategy, as well as history, in order to understand why some countries succeed and others fail. He stressed that there was no reason why countries could not learn from more successful economies to better their own institutions. That finally happened in the 1990s....

This sort of imitation of good institutions and effective economic policies was as outlined by institutional economists such as Douglass North. It took the fall of the Berlin Wall, the rescue of India by the IMF in 1991 as well as China’s re-orientation towards the global economy in 1992 for these economies to look to adopt a new course. By emulating ‘best practice’ in other economies as well as opening up, which meant learning from more successful foreign companies, these countries have made tremendous progress as North would have expected. He would have approved of these economies looking more widely than just on capital or labour or technology in fashioning their growth policies.The take-away from Douglass North's work is not so much that capitalism is the superior system in the sense that conventional economics treats it as that Western approaches to socio-economic and political organization proved superior to other approaches. The issues are more complicated than the simplified models of conventional economics, with their restrictive assumptions that are ideologically based — e.g., maximization and equilibrium. North recognized that broader scope was required.

North once remarked: “My pet peeve all through the last twenty years or thirty years has been the narrowness of economists, in fact of all social scientists, in not opening up whole new areas” (North et al. 2015: 9). And his ideas have brought us closer than ever before to answering the age-old question of how countries can become rich.

North adopted a different methodology that includes all factors he found to be relevant rather than seeking formal elegance but sacrificing empirical relevance. North was an institutional economist that specialized in development economics, and he worked in quantitative economic history (cliometrics), as well, which was needed for his empirical research.

World Economic Forum

Emerging economies are now richer than the West

In collaboration with VoxEU

1 comment:

For neoliberals the “economy” includes the financial economy, which consists of playing the markets, and which produces no physical goods or services.

For neoliberals the real economy and the financial economy (i.e. Wall Street and Main Street) are both the “economy.”

I say that the two economies are separate, and that the financial economy (including debt bondage and rent extraction) is a parasite on the real economy.

If we think like neoliberals, then the USA has the world’s biggest “economy.” However if we dismiss neoliberal lies, then the question of the “world’s biggest economy” becomes debatable.

“My pet peeve all through the last twenty years or thirty years has been the narrowness of economists, in fact of all social scientists, in not opening up whole new areas.” ~ Douglass North

Academicians are paid to justify the gigantic and ever-widening gap between the rich and the rest. Any variation from neoliberal lies is a career-ending error.

Thus, when Adam Smith, John Stuart Mill, and others extoled “free markets,” they meant markets not owned and controlled by oligarchs with their rent extraction and their debt bondage.

Today’s academicians, however, are paid to reverse this by claiming that Adam Smith was a neoliberal.

Post a Comment